2nd Jan 2020. 9.00am

Regency View:

BUY Learning Technologies Group (LTG)

Regency View:

BUY Learning Technologies Group (LTG)

The e-Learning Stock Making Smart Acquisitions

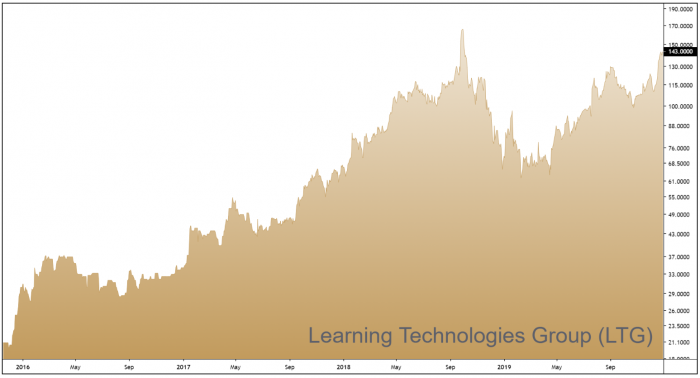

Access to a fast-growing global market is a characteristic that we look for in most new additions to our AIM Investor portfolio and this week’s stock more than meets the brief…

Learning Technologies Group (LTG) is a specialist in workplace digital learning or ‘e-Learning’, a market that is forecast to be worth $325bn by 2025.

More than 80% of US companies now use some form of e-Learning. A major driver behind this uptake is its proven ability to slash employee training time and boost productivity. A recent survey by research group Brandon Hall found that e-Learning could reduce employee training time by as much as 60%. And tech giant IBM have found that for every dollar they spend on e-Learning, they make back $30 dollars in productivity gains!

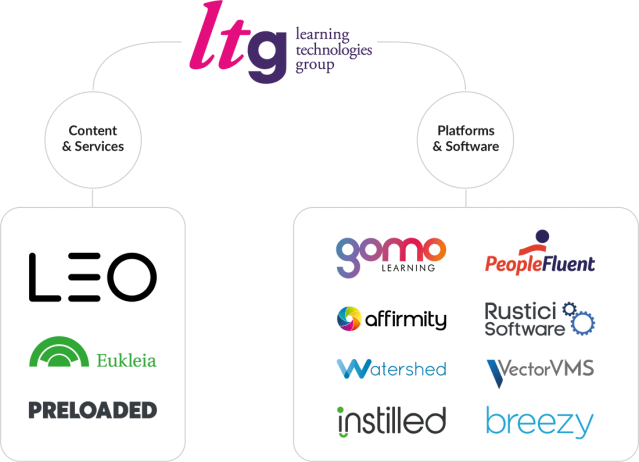

LTG is focused on the outsourced segment of the e-Learning market, a market segment which is highly fragmented, comprising a multitude of small operators with each offering a limited range of services.

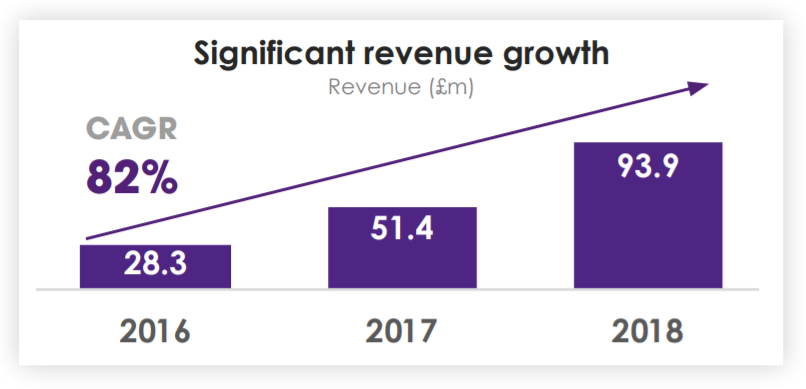

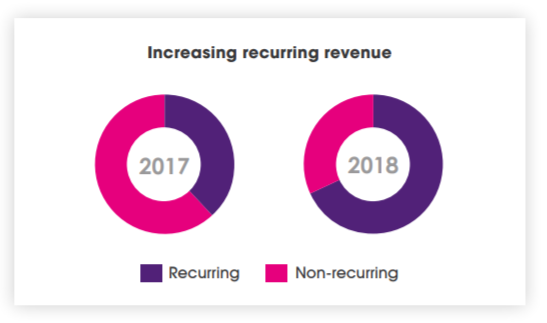

Under the stewardship of CEO Jonathan Satchell, who has been there from the very beginning, LTG have successfully used a ‘buy and build’ strategy to grow their business. LTG now employ around 750 people in 17 locations across Europe, the United States, Asia-Pacific and South America, generating £93.9m in revenue of which over two-thirds are recurring in nature.

Transformational Acquisition

In May 2018 LTG bought US-headquartered PeopleFluent for $150m. PeopleFluent is a cloud-based platform for ‘talent-management’ (i.e. recruitment and training) and its purchase has been somewhat of a game-changer for LTG…

It has enabled LTG to transcend the digital corporate learning space and enter a complementary market, talent management software, estimated to be worth $6bn and growing at an annual rate of 9%. It has also enabled LTG to make a “fundamental transition” towards a software-led, licence model delivering high-margin recurring revenue.

Prior to its acquisition, PeopleFluent had endured many years of declining sales but under LTG’s ownership, the business is now hitting its targets and is poised to return to growth in 2020 – ahead of expectations.

Improving Profit Margins

LTG’s half-year numbers, released in September, came in well ahead of market consensus and gives management flexibility and freedom to choose how they wish to invest in the business going forward.

Stripping out the impact of the PeopleFluent (which helped first half revenues jump 85%), the business is performing very well. LTG’s Platforms & Software division enjoyed a 7% uptick in organic revenues, offsetting a 3% contraction from the smaller Content & Services business. That said, the latter still represented progress against the 8% decline reported over 2018 and management expects Content & Services to deliver an organic improvement of around 8% for 2019, helped by product cross-selling.

Profit margins are very robust, with adjusted EBIT margin rising from to 24.5% in H1 2018 to 31.1% in H1 2019. Margins are improving for a couple of reasons; revenue is bang on budget and LTG continue to refine their model by finding further operating efficiencies across several areas.

Cash generation is high and net debt is declining, with CEO Jonathan Satchell stating that “subject to us not needing to use debt to make further acquisitions”, LTG is “trending towards having very little debt by the end of the year”.

Overall, we believe LTG look very well positioned to beat market consensus for operating profit which currently sits at £38.3m and £42.2m respectively in 2019 and 2020, according to data from Refinitv.

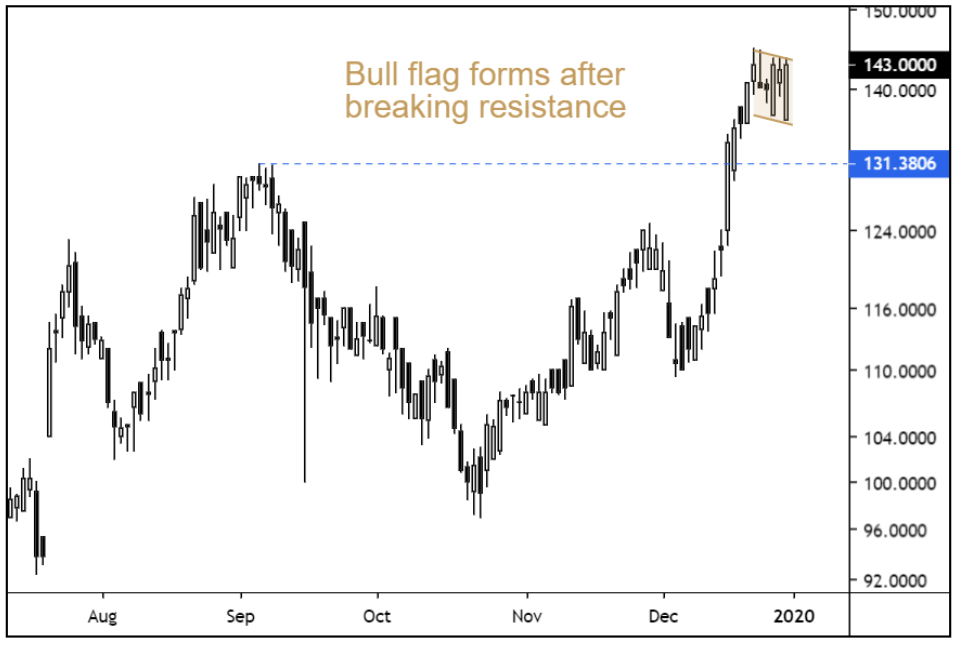

Buying the Bull Flag

Whilst LTG have been on our radar since the summer, we’ve not seen the shares print the technical catalyst required for us to enter, that is until now…

The shares broke through resistance at 130p in December – helped by the market-wide post-election pop. Since then, we’ve seen the shares consolidate near their highs in a small ‘bull flag’ formation.

With short-term momentum now realigned with LTG’s long-term uptrend, we’re going to use this pattern as a technical catalyst for timing our entry.