14th Dec 2023. 8.58am

Regency View:

BUY LBG Media (LBG)

Regency View:

BUY LBG Media (LBG)

LBG Media’s digital domination and bold US expansion

The growth of digital advertising has been unrelenting during the last two decades. Digital ad spend topped $546bn in 2022 and digital now accounts for more than two thirds of all advertising spend.

Amidst this transformative landscape, the digitally fluent Gen Z emerges as a pivotal driving force, wielding considerable influence over consumer attention and expenditure. This burgeoning market presents an opportune and fertile ground for companies such as LBG Media (LBG) to not only navigate but flourish.

Engagement-driven revenue: LBG’s digital success story

LBG is a leading multi-brand digital youth publisher, prominently recognised for its engagement-focused approach. The cornerstone of their operations revolves around LADbible Group, targeting a predominantly youthful audience. Revenue generation is channelled through two key divisions: direct and indirect.

Their direct division involves activities such as forming branded partnerships, providing social agency services, and engaging in content licensing. On the indirect front, revenue is sourced from licensing content to third-party entities. These diverse revenue streams also encompass other services like social agency offerings and content licensing.

LBG’s revenue model pivots on various strategies, including branded partnerships, social agency services, content licensing, direct advertising, and consistent product innovation. This versatile approach allows them to capitalise on audience engagement, fostering continual revenue growth in the dynamic market of digital media.

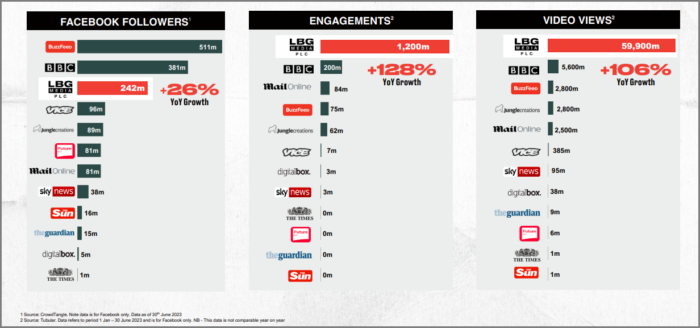

LBG’s engagement metrics tower over competitors. With 242 million Facebook followers, twice that of VICE, and 1,200 million digital engagements in six months, surpassing the BBC by six-fold, LBG’s digital traction is formidable. The 59.9 million video views during the same period far exceed their rivals, showcasing their digital prowess.

Social media mastery

A key driver behind LBG Media’s success has been its ability to strategically leverage various social media platforms. Here’s a brief overview of how they’ve utilised social media:

Platform diversity: Maintaining a robust presence across platforms like TikTok, Instagram, and Facebook broadens LBG’s demographic reach and engagement opportunities.

Video-centric approach: Heavy investments in short-form video content on TikTok and Instagram Reels have significantly boosted views and engagement.

Content tailoring: Customizing content formats for each platform maximizes engagement by resonating better with users’ preferences.

Strategic collaborations: Partnerships with influencers, content creators, and brands amplify LBG’s reach, tapping into new audiences and niches.

Data-driven insights: Utilising data analytics provides valuable insights into audience behaviour, optimising content strategies for maximum impact.

Betches acquisition marks bold US expansion

LBG’s recent acquisition of Betches marks a pivotal step in their growth strategy. Betches is a US-based media brand targeting millennial and Gen Z women. This complements LBG’s portfolio, bolstering their position in the vast US advertising market.

The deal, worth $24m plus add-ons, will allow LBG to leverage Betches’ engaged audience of approximately 32 million followers and amplifies LBG’s female audience and revenue potential.

LBG intends to keep Betches as a standalone entity, while seeking synergies between both brands to unlock cross-selling opportunities. By aligning with their overarching strategy and similar successful acquisitions, such as UNILAD in 2018, LBG solidifies its foothold in the US market, reinforcing relationships with American brands and agencies while expanding its global media presence.

Robust financials and compelling valuation

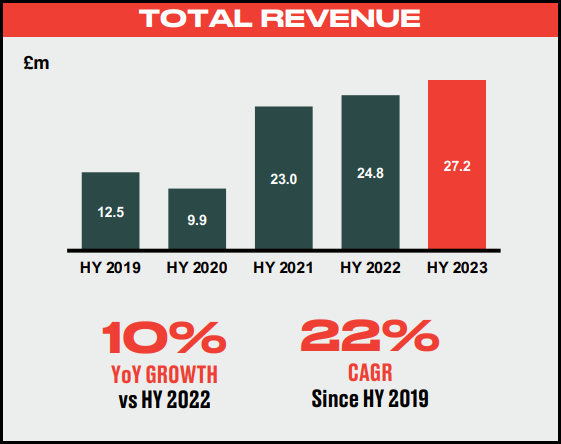

For a small-cap media stock, LBG has surprisingly high-quality financials. The business has an impressive track record of delivering profitable growth.

Revenues have grown at a compound annual rate of 22% since 2019. And consistently maintaining double-digit operating margins has propelled operating profits to grow at an impressive 18% CAGR during the same period, highlighting their operational efficiency.

This consistently profitable growth has created a sturdy financial structure. With a cash-rich, debt-free balance sheet, the company stands on a solid foundation, reducing the likelihood of shareholder dilution and fostering investor confidence in its stability and growth prospects.

In terms of valuation, LBG trade on a forward PE multiple of 11.4 which compares favourably to its sector peers. The stock also trades on a substantial 57% discount to its estimated fair value. Additionally, a forecasted EPS growth of 27.8% and a Price/Earnings-to-Growth (PEG) ratio of 0.5 further accentuate the stock’s appeal, indicating promising growth potential at a reasonable price.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.