28th Mar 2024. 8.54am

Regency View:

BUY Knights Group (KGH)

Regency View:

BUY Knights Group (KGH)

Knights Group: Leading the charge in legal ingenuity

The UK legal services market, valued at a whopping £43.7 billion, is undergoing a transformative shift.

Clients increasingly seek more efficient and cost-effective legal services, prompting firms to adopt innovative approaches to meet these needs. Law firm, Knights Group (KGH), has a unique corporate structure and agile business model, allowing it to benefit from this shift.

In today’s report we outline why Knights is perfectly positioned for growth, we highlight the company’s strategic advantages, the stocks lowly valuation, and explain why the recent pullback has presented an attractive point of entry.

Competitive edge in a consolidating market

Unlike traditional law firms, Knights operates under a centralised management system while allowing for decentralised fee generation. This setup enables Knights to respond rapidly to changing client needs and market conditions, giving it a competitive edge.

Knights has a focus on regional markets outside of London and this aligns well with the changing preferences of clients. In addition to its structural advantages, Knights’ emphasis on technology and innovation further strengthens its position in the market. By leveraging technology solutions and digital platforms, Knights managed to streamline processes, enhance efficiency, and deliver value-added services to clients, setting itself apart from competitors.

Furthermore, the ongoing consolidation trend within the legal sector presents opportunities for Knights to expand its market share through strategic acquisitions. As smaller firms face increasing pressure to compete, Knights can capitalise on these opportunities to strengthen its presence in key regions and sectors, driving further growth and profitability.

Financial fortitude: Knights robust performance and debt management

Knights has demonstrated impressive financial performance over the past five years, with a Compound Annual Growth Rate (CAGR) of 32.4%, reflecting its strong market position and effective growth strategy.

Despite some fluctuations, the company has maintained a stable operating margin of around 10-12%, showcasing operational efficiency. Additionally, the return on equity (ROE) has been steadily increasing, reaching 10.4%, indicating the company’s ability to generate profits from shareholders’ investments.

Even during challenging times, Knights has shown resilience in its earnings per share (EPS), rebounding from setbacks in 2022 to achieve significant growth.

While Knights’ balance sheet may initially appear tilted towards debt rather than cash reserves, a closer look reveals a robust financial position. The company’s strong operating cash flow generation, disciplined debt management, and solid revenue/profitability growth collectively position it to comfortably service its debt obligations.

Notably, Knights achieved a significant 25% growth in underlying earnings (EBITDA) to £18.2 million in Half Year 2023. This growth underscores the company’s adeptness in generating cash from its fundamental business operations. And with a cash conversion rate of 69%, Knights efficiently translates underlying EBITDA into operating cash flow, ensuring effective debt repayment.

+70% discount to fair value

In terms of valuation, Knights appears undervalued relative to its earnings potential. Over the last two years, Knights price-to-earnings (P/E) ratio has declined from north of 9 to just above 5 -indicating the stock is becoming cheaper compared to its earnings, putting value investors on high alert.

Notably, the current share price trades at a staggering 71.2% below its estimated fair value, offering a substantial discount for prospective investors.

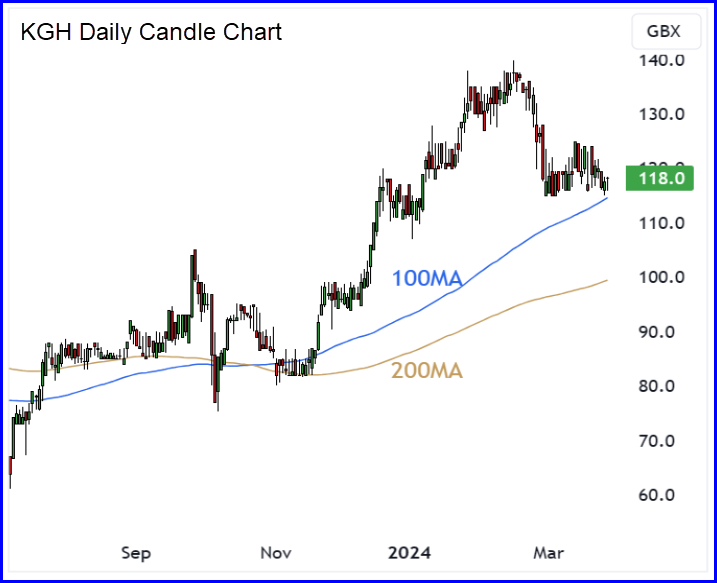

On the price chart, the shares have formed a strong uptrend since last summer, reflecting positive market sentiment and confidence in the company’s future prospects.

The shares currently stand above both the 100-day and 200-day moving averages, underscoring the stock’s bullish momentum and sustained upward trajectory.

However, a recent pullback has created an timely entry point, with prices retracing to the 100-day moving average. This dip presents an attractive buying opportunity, especially considering the company’s robust financial position, promising growth trajectory, and favourable valuation metrics.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.