27th Feb 2025. 8.56am

Regency View:

BUY Knights Group (KGH) Second Tranche

Regency View:

BUY Knights Group (KGH) Second Tranche

Knights Group riding renewed momentum

It’s almost a year to the day since we first recommended Knights Group to our AIM Investor subscribers.

While the 12% gain so far may seem modest, we believe there’s more to come. With a strong set of half-year results under their belt, a highly attractive valuation, and momentum building on their price chart, we believe the time is right to add a second tranche.

A quick recap

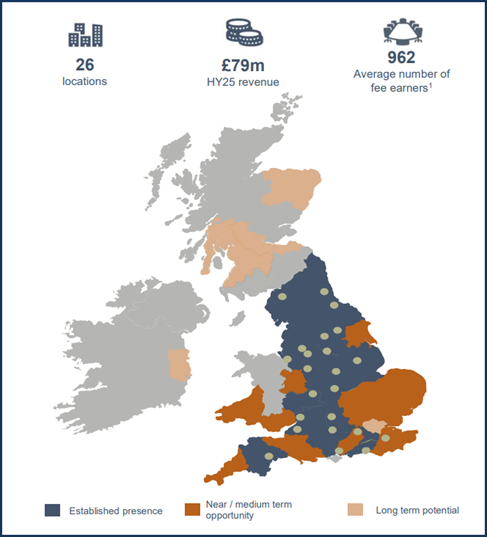

Knights Group is a UK-based legal services provider that has consistently demonstrated a strong growth track record. The company has carved out a niche serving the mid-market, balancing organic expansion with strategic acquisitions to build a business that is both resilient and scalable.

Operating across key sectors such as healthcare, real estate, and financial services, Knights provides a comprehensive range of legal services. Their growth strategy revolves around acquiring complementary businesses and seamlessly integrating them, expanding their market share while maintaining high-quality service standards.

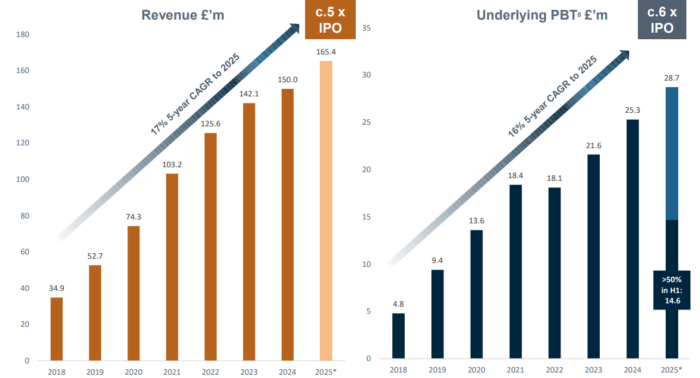

What initially attracted us to Knights Group was their consistent delivery of solid growth, driven by this acquisition strategy and their ability to integrate new businesses smoothly. With this ongoing momentum and a solid foundation for future expansion, we expect their growth trajectory to continue.

Strong half-year results

Knights Group’s half-year results offer an impressive snapshot of a business firing on all cylinders. The firm reported a 14% increase in revenue, reaching £84.4 million, compared to £74.1 million for the same period last year. This solid growth was primarily driven by the firm’s expanding client base and strong performance in key sectors like real estate and healthcare.

What stands out in the results is the growth in operating profit. At £15.2 million, up 12% from the £13.6 million reported last year, Knights has successfully translated top-line growth into increased profitability.

Even more encouraging is the robust cash flow generated by the business. Cash flow from operations reached £5.1 million, bringing the company’s total cash reserves to £26.3 million. This cash-rich position puts Knights Group in a strong financial position, enabling them to pursue strategic acquisitions or invest in growth opportunities without relying on debt.

Not only does this cash position provide flexibility, but it also reflects the company’s strong financial discipline. The firm’s conservative approach to capital management ensures they maintain financial stability, even in challenging market conditions.

On the debt front, Knights Group remains conservatively geared, with a net debt-to-EBITDA ratio of 1.1x. This provides further comfort for investors, as it indicates the company is not over-leveraged and has the capacity to fund further expansion without taking on excessive risk. This approach has positioned the company well for future growth, ensuring that they can continue to expand while protecting shareholder value.

Finally, it’s worth noting that Knights has maintained a healthy dividend yield of 3.81%, a key feature that makes the company attractive to income-focused investors. With solid cash flow, low debt, and a commitment to returning capital to shareholders, the dividend yield adds an additional layer of appeal to the stock, especially for those looking for both growth and income.

Growth at a discount

Knights Group’s valuation continues to stand out as highly attractive, especially compared to industry peers and the broader market. The forward P/E ratio of 5.4 suggests that the company may be undervalued given its growth potential. This is further supported by a PEG ratio of 0.6, which signals that Knights is expected to grow at a pace that outpaces its current valuation.

The firm is forecasted to achieve 10% EPS growth over the next 12 months, while offering a solid dividend yield of 3.81%. In terms of price-to-book value, Knights stands at 1.09, and their price-to-sales ratio is 0.74, indicating the stock is priced attractively in relation to its industry.

On the quality side, Knights boasts a return on capital of 10.6% and return on equity of 11.4%, both of which highlight their ability to generate returns on investments efficiently. Furthermore, with an operating margin of 14.4%, Knights is demonstrating a solid ability to manage costs and generate healthy profits.

Taken together, these metrics suggest Knights Group is priced at a discount to its intrinsic value. With solid growth prospects ahead, the stock offers a blend of value and upside potential.

Timing for a second tranche

Knights Group’s share price has had a strong start to 2025. After breaking above a descending trendline that had formed during the second half of 2024, the shares paused before gaining momentum again, bolstered by the impressive half-year results.

The shares are now trading above the 200-day moving average, which signals renewed bullish momentum. Given the solid set of results and the technical momentum, the shares look well-positioned to revisit their May 2024 highs, some 18% above current levels.

Knights Group continues to execute its growth strategy effectively, with solid performance across both financial and operational metrics. The strong half-year results, attractive valuation, and improving technical setup all point to a promising outlook.

As Knights continues to leverage its acquisition strategy and expand its market presence, we expect the company to deliver ongoing growth for shareholders.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.