10th Apr 2025. 8.59am

Regency View:

BUY Kitwave (KITW)

Regency View:

BUY Kitwave (KITW)

Kitwave’s quiet strength: A quality small cap defying the sell-off

It’s been a brutal few weeks for small caps, and let’s be honest — the combination of systemic selling and rising risk premiums has felt relentless. With global tariffs back on the table and investors rushing for cover, the instinct has been to ditch anything perceived as ‘risky’. But this is where the opportunity often lies.

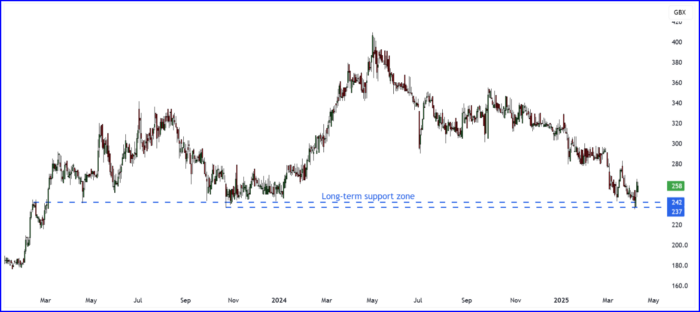

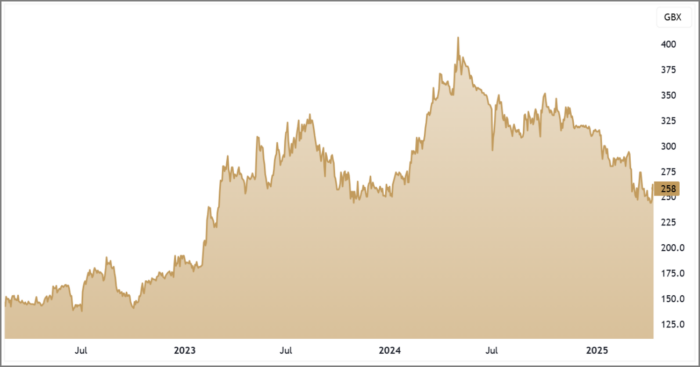

While many stocks are still sliding, Kitwave has shown signs of life — bouncing from long-term support and making gains in the past month, even as the wider small cap index capitulates. That’s the kind of relative strength we look for in the early stages of a recovery.

A boring business that’s getting better

Kitwave is a delivered wholesale group supplying over 40,000 customers across the UK. It serves independent retailers, leisure sites, pubs, cafes and foodservice outlets through a national depot and fleet network — distributing chilled, frozen and ambient products, with value-added logistics and delivery built in.

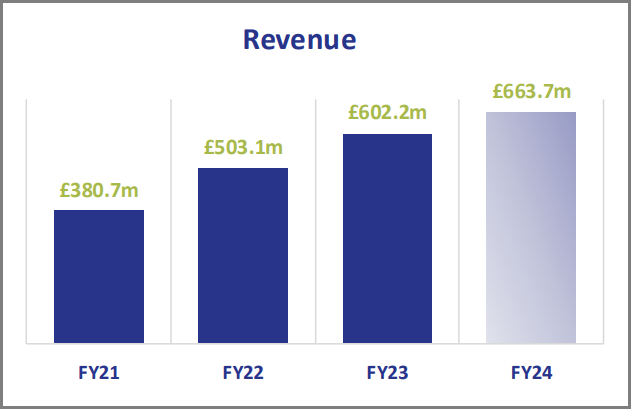

This is not a sexy business, and that’s exactly why we like it. It’s hard to disrupt, well diversified, and rooted in real-world demand. In FY24, Kitwave delivered 10.2% revenue growth to £663.7 million, alongside a 6% jump in adjusted profit before tax to £344 million. Strong operating cash flow, up £1.1m to £31.4 million, helped underpin a dividend of 11.30p ps.

All of this has been achieved without overreaching. There’s no stretch in the balance sheet, no pivot into fads, just the consistent rollout of a proven consolidation strategy — acquiring family-run regional wholesalers, integrating them into its logistics platform, and unlocking operational synergies. It’s unglamorous, but it’s working.

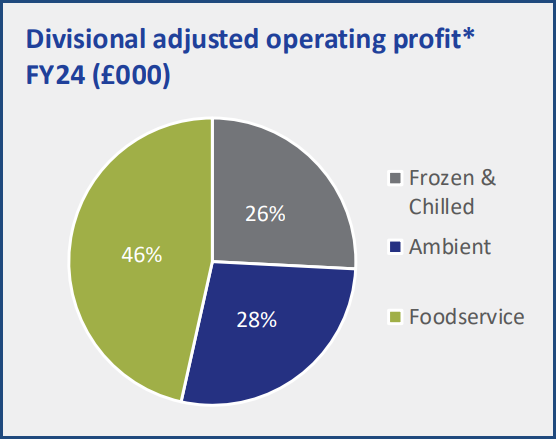

Foodservice driving growth

While Kitwave’s retail-facing divisions (Ambient and Frozen & Chilled) are mature, the Foodservice division has become the real growth engine. Revenue in this segment jumped to £223.6 million in FY24, up from £178.6 million a year earlier. That’s a 25% increase, driven by both organic momentum and three bolt-on acquisitions.

Creed, the largest of these, marks a major step forward. The deal — worth up to £70.7 million — adds significant scale, three large depots, and 600 deliveries a day across the South. It also bridges Kitwave’s geographic network, creating the foundations for a fully integrated national foodservice platform.

With capacity to grow in a fragmented market, this segment is now Kitwave’s biggest, and arguably most exciting. Gross margins here remain healthy at 29%, and we see further scope to scale through both acquisitions and operational leverage.

A compounding machine in the making

We often talk about small caps in terms of story or potential — but Kitwave is already delivering. Since the IPO in 2021, the group has completed six acquisitions, grown revenue by 49%, and increased adjusted earnings per share by 88%. Free cash flow has compounded at over 25% annually, and the dividend has doubled.

The company has done all of this while keeping debt levels well managed. Net debt including leases is £29.4 million, which equates to just 0.7x EBITDA — well within comfort zones given the cash generation profile.

This is what we like to see: a self-funding acquirer with strong execution and rising returns on capital. As the platform grows, so does the quality of earnings.

A national footprint that’s hard to replicate

The completion of a new 80,000 sq ft distribution hub in the South West — consolidating three previous sites into one — speaks to the long-term vision. It’s a high-spec, temperature-controlled facility designed to support growth in the region and improve delivery efficiency.

Across the UK, Kitwave now operates 37 depots, with solar PV installed at 12 of its largest sites, generating over 1.35m kWh of energy in FY24. The logistics backbone is increasingly sophisticated, backed by investments in voice-picking, robotic process automation, and a mobile-friendly e-commerce platform.

There’s real operational depth here — and it would be difficult for a new entrant to replicate the national reach, customer relationships, or delivery infrastructure Kitwave has built.

Relative strength in a bear market

While much of the small cap index has broken down to new lows, Kitwave has held long-term support and bounced strongly from the 240p zone. The shares are now up more than 7% in the last month, decisively outperforming the wider market.

This relative strength is important. It tells us there are still buyers in the name — likely institutional holders adding on dips — and it suggests the stock is building a base from which to trend higher again.

There’s a clear upside trigger around the 350p zone, which acted as resistance last autumn. A close above that would likely bring momentum buyers back into the picture. In the meantime, valuation remains attractive, with the shares trading on just 7.9x forward earnings, well below the sector average, and offering a 4.71% dividend yield that’s twice covered by earnings.

Looking ahead

The UK wholesale market remains ripe for consolidation. Many regional players still operate as family-run businesses, lacking the scale or digital capability to compete nationally. Kitwave’s model — buy, integrate, improve — has proved highly effective, and there’s no shortage of future targets.

And crucially, in a world where macro risk feels like it’s rising by the day, Kitwave is relatively sheltered from the storm. Trump’s sweeping tariff proposals may have rattled global markets, but they’re unlikely to hit Kitwave directly. The business is firmly UK-focused, with minimal exposure to international trade or complex cross-border supply chains. Most of its products are sourced domestically, through established UK wholesalers and suppliers. That’s a rare kind of insulation in today’s market — and it gives the company room to keep executing, regardless of the geopolitical noise.

The recent decision to join the Country Range Group further boosts its buying power and customer offering in foodservice. Combined with internal tech investments and rising service levels (now above 98%), it’s clear that Kitwave is not just buying growth — it’s building a better business.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.