24th Jun 2021. 8.56am

Regency View:

BUY Keywords Studios (KWS)

Regency View:

BUY Keywords Studios (KWS)

The rise and rise of video gaming

Maturing millennials, digitisation of media content, superfast fibre and 5G…all key factors which have created the perfect backdrop for video gaming to flourish.

The headline ‘gaming is now bigger than music and movies combined’ used to seem sensational, now it seems like an understatement…

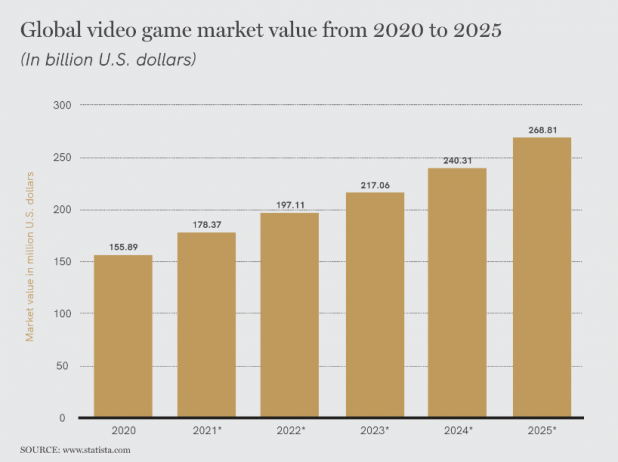

Video gaming is estimated to be worth 268.8 billion U.S. dollars annually in 2025, up from 178 billion U.S. dollars in 2021. With in-game purchases set to account for the more than 74 million U.S. dollars worldwide in 2025.

Gaming’s unrelenting growth is an investment theme we’ve enjoyed playing since launching our AIM Investor portfolio… holding Codemasters in 2019 and Frontier Developments across two tranches in 2020.

Now we have a new gaming play, one that we believe is well positioned to flourish in maturing market, Keywords Studios (KWS).

Low risk exposure to a high growth sector

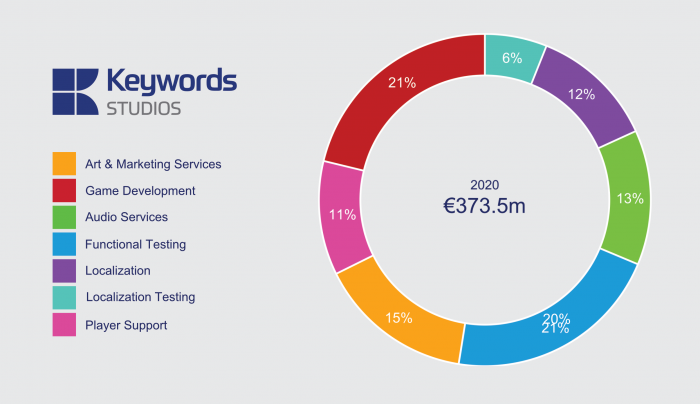

Keywords Studios provide a wide range of outsourcing services for the gaming and media industry including art services, game development, audio services and multi-language ‘localisation’.

The Group is comprised of many individual brands across more than 60 Studios, all leaders in their own fields of expertise, located across 4 continents and 21 countries.

Keywords client list is highly impressive, they work with 23 of the top 25 games companies by revenue and 10 of the top 10 mobile games publishers by revenue.

While the fortunes of most gaming stocks tend to be tied to their portfolio of game titles, Keywords being an outsourcing specialist do not suffer this same problem, they are highly diversified and offer lower risk exposure to this high growth sector.

And as the video gaming industry matures, supply chains become more structured and margins become squeezed, outsourcing will have an increasingly important role to play – making Keywords very well positioned to ride the next wave of the gaming boom.

Consistent revenue growth

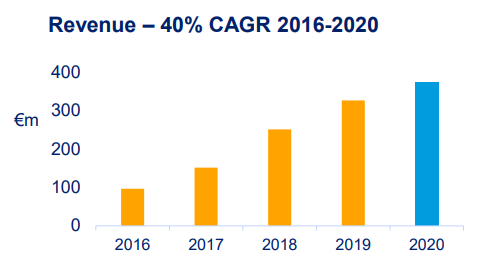

Keywords have used a growth-via-acquisition model to great effect in recent years…

They have made 52 acquisitions since their 2013 IPO totalling €203m which have returned over €400m in pro forma revenue to date.

The business boasts a 40% cumulative average growth rate (CAGR) for revenue over the last five years and 31% CAGR in earnings per share (EPS) over the same period.

And organic growth has consistently hit double digits as Keywords build scale in a highly fragmented market.

Gaming activity surged during global lockdowns and gaming publishers are set to ramp up development spend to keep the expanded market engaged with new content. Keywords are also benefiting from the launch of two major new gaming consoles in November 2020, Sony’s PlayStation 5 and Microsoft’s Xbox Series X and Series S.

Increasing profitability driving strong balance sheet

Whilst lockdown’s boosted gaming activity, the pandemic has actually been a net headwind to Keywords – restricting access to testing and audio facilities and disrupting the flow of content from clients to its localisation business.

Despite the headwind, Keywords profitability surged in 2020 with adjusted cash profits up 30% to €74m and margin expanding by 2.3 percentage points to 19.9%.

In May 2020, Keywords completed a €110m placing which it has partially used for eight acquisitions. The placing, along with €53m of free cash flow has taken Keywords balance sheet from an €18m of net debt in 2019, to a €103m of net cash position (FY 2020).

And whilst the shares are trading on a punchy forward PE multiple of 35.3 (about average for the Software & IT Services market), we believe Keywords forecast earnings per share (EPS) growth of 64.3%, it’s diversified business model and its rock-solid balance sheet, make it a worthy addition to our AIM Investor portfolio.

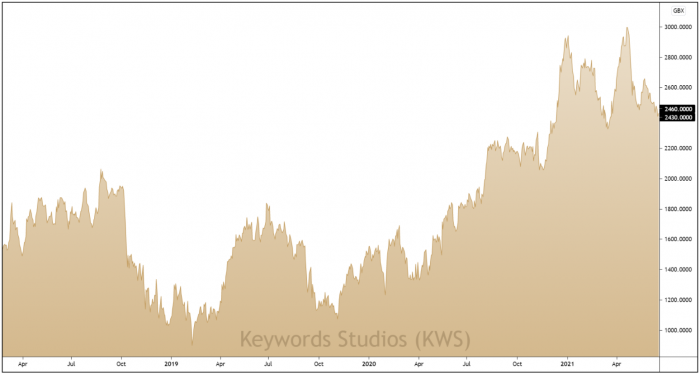

Prices pullback to long-term support levels

After hitting highs of £30 in April, Keywords have undergone a 20% pullback…

This pullback has taken prices back towards a key area of support at 2,310p, an area which the shares rallied more than 30% from in March.

There is also a secondary area of support at 2019, which adds a short-term technical safety net to our position.

Given the strength of Keywords long-term uptrend, we believe the recent pullback represents an attractive entry opportunity.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.