23rd Jun 2022. 9.00am

Regency View:

BUY Keywords Studios (KWS) – Second Tranche

Regency View:

BUY Keywords Studios (KWS) – Second Tranche

Keywords continue to look compelling

As an AIM stock, Keywords Studios (KWS) is something of a unicorn…

Keywords work with the biggest and best clients in gaming, yet investors don’t have to risk the hits and misses of your typical developer.

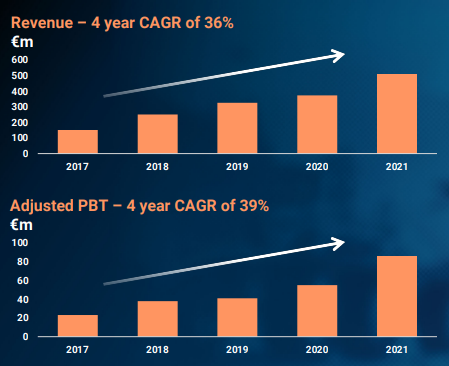

The business has an outstanding track record of profitable growth, a +€150m acquisition war chest and an ambitious new CEO at helm.

We first added Keywords to our AIM Investor portfolio in June last year and believe the time is right to snap up a second tranche…

New CEO outlines roadmap to €1bn revenue

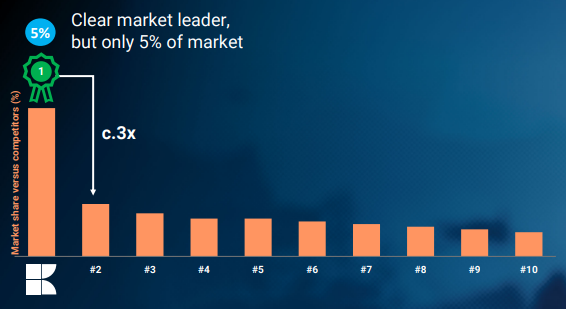

“We’re the only one with a full end-to-end offering” new CEO, Bertrand Bodson proclaimed as he addressed investors at Keywords recent capital markets day…

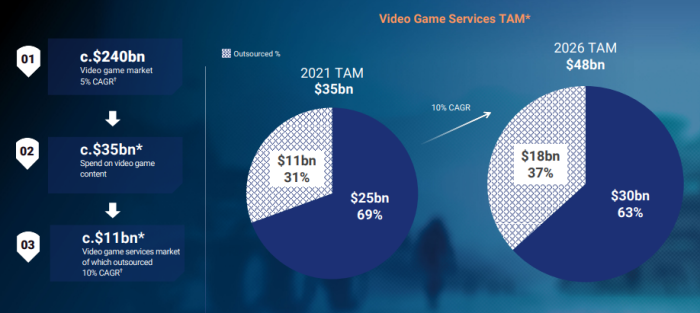

“We’re the clear market leader…but we’re still only 5% of the $11bn (gaming outsourcing market)…so you really get a sense of the runway that is ahead of us to really go and build and invest in the platform” he added.

Mr Bodson, who took the helm six months ago, set out a clear and compelling roadmap designed to double Keywords current +€500m revenues over the medium term.

And while affable CEO’s and slick investor day presentations are no reason to invest your hard-earned capital in a company, Keywords have the substance to back up the bold claims.

Keywords client list is a who’s who of the gaming industry. They work with 23 of the top 25 games companies by revenue and 10 of the top 10 mobile games publishers by revenue.

Group revenues are becoming increasingly ‘sticky’ as Keywords become more and more embedded into their customer systems…

They have seen a steady acceleration in the number of customers using three or more service lines and Keywords estimate that around 30%-40% of revenue is ‘evergreen’ which is very high for a gaming industry.

Demand for gaming content is being driven by new consoles, streaming platform developments, mobile growth and constantly evolving new platforms.

There is also increasing complexity in game development leading to higher costs and driving outsourcing demand. Budgets are skyrocketing growth in Games as a Service (GaaS) is driving more and more continuous content development.

Highly cash generative

We set a high bar when it comes to ‘doubling down’ on a position within the AIM Investor portfolio, but Keywords passed with flying colours…

Keywords have an impressive track record of revenue and profit growth, and the business is highly cash generative with a free cashflow conversion north of 80%.

Alongside a net cash position of €103m (end Dec 21), Keywords also have Revolving Credit Facility (RCF) of €150m expiring in 2025 with option to extend for 2 years and accordion feature to increase by €50m – so there is plenty of scope for acquisitive growth as Keywords continues to consolidate a fragmented market.

In terms of valuation, the shares trade on a punchy forward PE of 26.6, but this is to be expected given Keywords position as a global market leader and potential bid target.

And given the current levels of stock market uncertainty, we believe paying up for quality is a smart move.

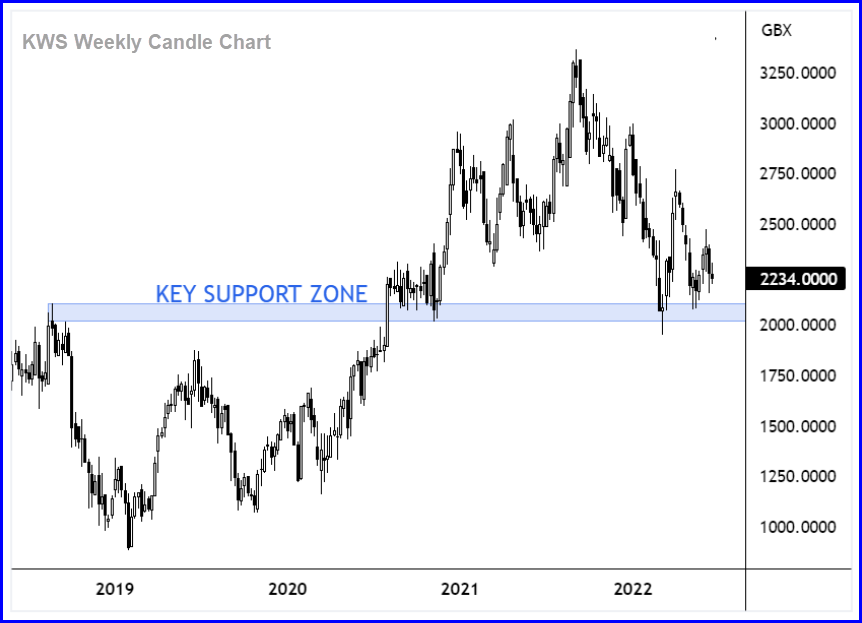

Keywords back at key support

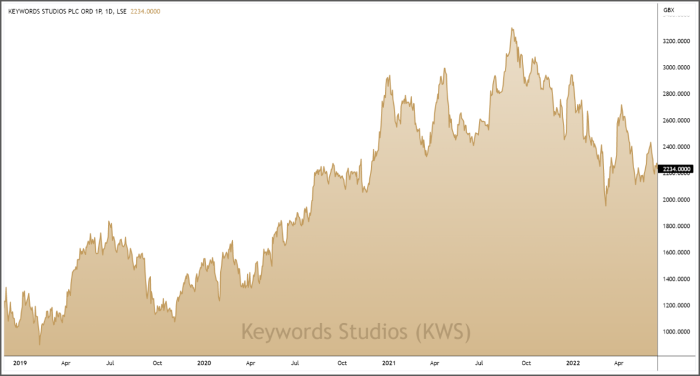

The first quarter of this year saw an indiscriminate sell-off in small tech stocks – dubbed the ‘tech wreck’ in the US…

Selling small, loss-making tech companies with weak balance sheets back sense against a backdrop of rising interest rates, but Keywords is a very different beast…

Their high-quality financials, rock solid balance sheet and strong revenue visibility saw investors step in and snap up Keywords in March – causing the shares to rally from a key area of support.

Weakness in the overall market has seen Keywords share price drift back to this zone of support. And with the old adage ‘markets have a memory’ ringing in our ears, we believe the technical timing looks compelling.

And given Keywords recent upbeat trading statement, we expect the shares to kick-on higher during the second half of the year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.