Regency View:

BUY Ixico (IXI)

Investing in an ageing population

“Ageing is a privilege not a predicament” – this quote from British artist Martin Firrell has perhaps never had more weight given the impact COVID-19 has had on older generations.

Nonetheless, the world’s population is undeniably ageing, and this brings with it huge challenges…

According to a report by the United Nations Department for Economic and Social Affairs, the number of people aged 65 or over is expected to more than double by 2050.

Alongside a rapidly ageing population comes an equally rapid growth in age-related neurological diseases such as Alzheimer’s, Parkinson’s, Huntington’s and MS.

These are diseases which were discovered over 100 years ago for which there are many FDA approved treatments, but none of these treatments are curative. There is large and growing demand for better drugs to tackle these diseases with a long-term drive from pharmaceutical R&D companies to fill their pipelines with new assets.

One company who is helping to meet this significant clinical need is Ixico (IXI).

Ixico provide neurological clinical trials services to pharmaceutical companies. Ixico has an impressive track record at achieving double-digit revenue growth, a debt-free balance sheet and an order book which is recovering rapidly from the impact of the pandemic.

All in the mind

Neuroimaging through MRI and PET scanning has created the ability to visualise extraordinary information about the structural and biochemical characteristics of the human brain.

This has led to huge breakthroughs in the field of Central Nervous System (CNS) clinical research and Ixico have been at the forefront of this progress for over a decade…

IXICO’s TrialTracker® platform and Artificial Intelligence (AI) software algorithms are used to collate and interpret brain scan data – producing specialist analytics which measure unique biomarkers during clinical research programmes.

To ensure it stays at the cutting edge, Ixico have recently made a ‘significant capital investment’ in its platform and AI technology – underpinned by a partnership with a small tech company called Microsoft!

The partnership will enhance Ixico’s large-scale data processing capabilities and it will help to ‘future-proof’ it’s core AI technology.

Rapid rebound in trials as pandemic abates

The world-wide shift in scientific resources required to produce a COVID-19 vaccine has hit the clinical trial sector hard, but given the essential nature of CNS clinical trials, Ixico believe the impact is temporary…

“The short-term impact means there’s been less trials started, but it’s important to emphasize that these are not lost or cancelled, they’re simply delayed” commented Ixico CEO, Giulio Cerroni in a recent interview.

“We’ve been consistently indicating that we expect to see a rapid rebound in demand as the pandemic abates” he added.

There is evidence of this ‘rapid rebound’ in Ixico’s strong Half-Year numbers…

Ixico’s order book currently stands at £19m (31 March 2021), up 24% on H1 2020 with 8% organic revenue growth and strong gross margins of 67.6%.

“The increase in pace in new contracts combined with the top-line growth indicates a very healthy book-to-bill ratio which is a lead indicator” commented Mr Cerroni.

“We’re seeing a resilient operating model combined with ongoing demand for our services in a market that is starting to pick up at a bigger pace than we’ve seen in the previous twelve months” he continued.

Exciting new contract wins

Along with the rebound in delayed clinical trials, Ixico have recently won several new contracts covering the following areas:

Alzheimer’s Disease – an expansion contract by a current biopharmaceutical client to support the company’s Phase II Alzheimer’s disease clinical trial worth an additional £1m.

Neuroinflammatory Disorder – neuroimaging services for a Phase III neuroinflammatory disorder clinical trial worth in excess of £0.5m over 4 years.

Acute ischemic stroke – neuroimaging services for a new clinical trial for acute ischemic stroke. This contract reflects a further broadening of IXICO’s neurological footprint into a new therapeutic area trial. The trial will be conducted across 50 sites in North America and Europe and is worth in excess of US$0.5m over 35 months.

Market over-reaction creates buying opportunity

It goes without saying that developing disease-modifying treatments is far from straightforward and setbacks are inevitable with many trials failing.

In March, Ixico’s largest customer was forced to stop dosing participants in a phase III trial and open-label extension studies in Huntington’s disease.

The decision followed an independent committee review of the potential benefit/risk profile for study participants – prompting a 40% one-day drop in Ixico’s share price.

Those of you who follow our research will know that we’re not in the business of catching falling knifes, and we’ve waited patiently for the dust to settle and for Ixico to provide further clarity…

CEO Giulio Cerroni commented:

“The impact (of the cancelled trial) that we can articulate now is significantly lower than the maximum potential impacts that we outlined back in March”.

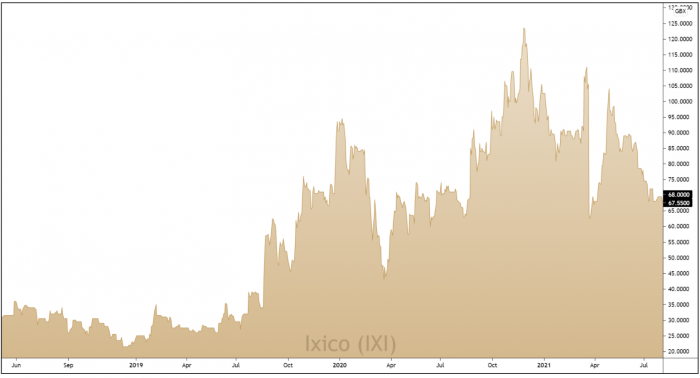

Despite re-calibrating the market’s expectations as to the reduced impact of the trial closure, the shares are still trading at a significant discount – 40% below their 2021 highs.

In fact, the shares have recently drifted back towards their March spike lows and near the bottom of a long-term ‘wedge’ consolidation pattern (see chart above).

And whilst the shares remain on a mid-market PE ratio of 25.9 (trailing 12-month), this is more than offset by a market-beating earnings per share (EPS) growth rate of 83.8% (trailing 12-month) and a top-quartile return on equity (ROE) of 13.9%.

When you combine Ixico’s discounted share price with a rapidly recovering order book and solid financials, we believe Ixico are deserving of a place in our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.