18th Feb 2021. 8.58am

Regency View:

BUY Inspecs (SPEC)

Regency View:

BUY Inspecs (SPEC)

Click here for printer friendly version

Focused on growth

For a small business to grow fast you typically need two things, a large market, preferably comprised of other small businesses which can be strategically acquired, you also need a competitive advantage.

Today’s stock Inspecs (SPEC) has both of these prerequisites for growth…

Inspecs design, manufacture and distribute eyewear frames for mid-tier fashion brands like Superdry, O’ Neill and Radley. They also deliver OEM (original equipment manufacture) services for top retailers and opticians such as WalMart, ASOS and Specsavers.

For an AIM-listed stock, Inspecs are highly diversified in terms of geographical footprint. They’re headquartered in Bath but have offices in Hong Kong, USA, Scandinavia, Portugal and Italy, along with factories in Vietnam, China, London and Italy.

Inspecs distribution network spans 80 countries across 30,000 points of sale, with roughly 25% of revenues generated from the UK and 75% internationally.

Access to a large market

In 2020, the global eyewear market size was valued at $148 billion. It is expected to expand at a compound annual growth rate (CAGR) of 8.5% from 2021 to 2028 – according to industry analysts at Grand View Research.

There are a number of long-term growth drivers at play…

The rising popularity of fast fashion among millennials – this is encouraging eyewear manufacturers to design affordable and attractive eyewear.

Increasing prosperity in emerging markets – a rising middle class in China has been a driver for the fashion industry during the last decade and it shows no sign of slowing.

Aging populations – levels of myopia (short-sightedness) and presbyopia (long-sightedness) are forecast to double during the next thirty years as populations in developed economies age.

The pandemic has of course hit the retail sector incredibly hard and opticians were among the first businesses to be shuttered during lockdowns. However, most indications suggest that as the global vaccine rollout takes effect, the demand for eyewear will recover quickly. After all, vision correction isn’t considered a luxury in much of the developed world.

Inspects tend to focus on mid-tier affordable eyewear, and this lower-end market positioning should serve as some protection in the COVID-recovery era.

Competitive advantage strengthens through key acquisitions

Inspecs offer in-house design, global manufacturing, marketing, and sales capabilities. This ‘one-stop-shop’, vertically integrated business model is rare within the sector and highly appealing to big retail distributors and mid-market brands.

The vertical integration model allows them to keep final costs highly competitive and this will allow them to gain market share quickly as the global economy recovers.

Inspecs vertical integration advantage has been increased in recent months through a number of key acquisitions…

Last summer Inspecs snapped up part of The Norville Group from administrators for £2.4m.

Norville is a long-established spectacle manufacturer and is considered to have the most advanced portfolio of spectacle lenses in the UK.

The deal included Norville’s manufacturing site in Gloucester as well as smaller facilities in Bolton, Seaham and Livingston.

The Norville acquisition was followed by a much larger deal for German rival Eschenbach Optik worth €95m (£84.7m).

Eschenbach has a presence in the US and continental Europe, particularly in Germany and France, alongside a portfolio of more than 15 in-house and licensed brands.

The deal supercharges Inspecs growth plans, and once fully integrated will make Inspecs a dominant player in the in the fragmented global eyewear market.

January update strikes a bullish tone

Inspecs recent trading update indicated the acquisitions of Norville and Eschenbach were bedding in well, with the businesses already contributing revenue of $4.2m and $3.1m respectively.

Overall trading performance for the year was in line with management’s expectations, delivering Group revenue of $46.2m versus $61.2m the year prior.

Inspecs CEO and founder, Robin Totterman (right) commented:

“Although the global pandemic continues, the Group is in a strong position to capitalise on the compelling structural opportunities that exist in the fragmented global eyewear market.”

Inspecs is debt free with a cash pile of £28.6m, and the business was highly cash generative prior to the pandemic. A forward price / earnings ratio of 26 may seem a little steep, but when you consider the significant rebound in earnings growth which is being forecast for 2022 and beyond, we believe this valuation is justified.

Bullish consolidation

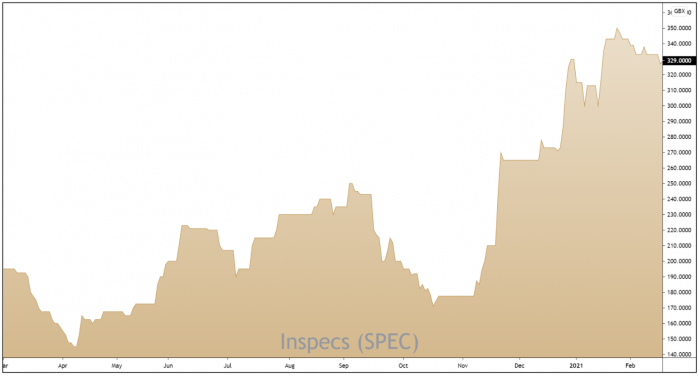

Inspecs share price has performed very well considering they IPO’d at the very start of the pandemic in February 2020 for 195p.

The shares have formed a powerful trend structure, characterised by strong momentum drives higher in November and December.

Recent price action has seen Inspecs consolidate within a tight descending channel and this form of compression is indicative of trend continuation.

Hence, we are more than happy to position ourselves within the current consolidation phase with a view to Inspecs uptrend kicking back into gear within the coming weeks.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.