Regency View:

BUY Inland Homes (INL)

Inland’s eye-catching valuation is built on strong foundations

Everyone loves a bargain in January, and we believe today’s stock offers investors plenty of value…

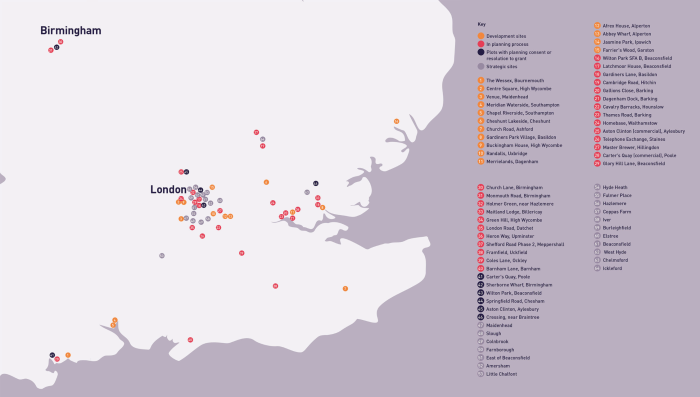

Inland Homes (INL) is a brownfield site developer and housebuilder focused on the South and South-East of England.

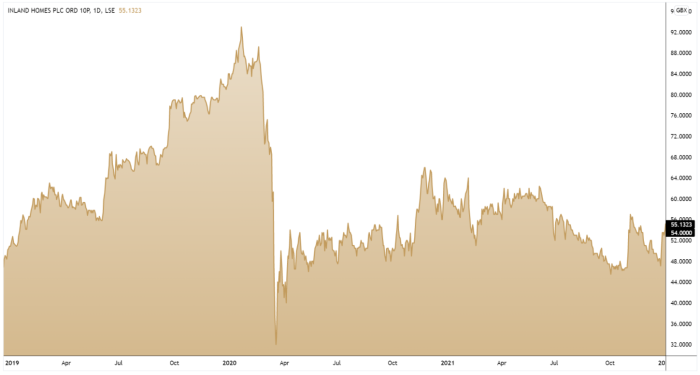

The shares look materially undervalued, trading on a market cap of just £121m versus net assets of £222m (EPRA NAV) and a land bank worth more than £3bn (gross development value).

Inland are using their cash generative partnerships and asset management portfolio to deleverage their balance sheet, and as the stocks financial risk reduces, we expect Inland’s share price to receive a re-rating by the market in 2022.

Large and balanced land bank

Inland has built a balanced land portfolio or ‘land bank’ that has a gross development value north of £3bn.

The portfolio consists of 10,055 plots, of which 3,736 are defined as ‘longer-term opportunities’ held by way of discount to market value options.

More than 3,600 plots within their land portfolio have planning consent. And during the current financial year, Inland achieved planning consent on 1,592 plots and sold 111 plots.

Highlights of the portfolio include Inland’s flagship development at Wilton Park in Beaconsfield which is initially set to provide 304 new homes, and a 54-acre site at Gardiners Park Village in Basildon which is subject to the signing of a Section 106 agreement.

The Gardiners Park Village site has an estimated gross development value of more than £200m, and will enable the delivery of up to 700 new homes, together with 25,000 square metres of commercial space, a new school and community facilities.

Capital light asset management division gaining traction

Alongside their land bank, Inland have done a good job of building out their Asset Management division…

This division leverages Inland’s significant experience in identifying and securing viable development sites for external investors.

The capital light nature of this model, together with the management fees earned at various milestones of the project (including the successful gaining of planning permission), enable Inland to generate attractive cashflow.

Inland currently has six active projects within its asset management division with the potential to deliver more than 3,000 new homes.

The most notable project being one of London’s largest brownfield sites, the Cavalry Barracks in Hounslow. The 36-acre site has an estimated gross development value of £600m and planning permission is currently expected in early 2022.

Partnerships order book more than £200m

Inland specialise in building affordable housing at brownfield sites, and the demand from housing associations and ‘build-to-rent’ operators for these ‘turnkey’ projects has never been higher…

Inland’s forward order book for partnership housing has almost doubled this year to £200m, up from £105.8m the year prior.

The partnerships business is going from strength to strength and in November, Inland announced the forward sale of 161 new homes at Carters Quay in Poole to Bournemouth Council.

The contract is for a total consideration of £43.5m over the next 36 months, with monthly stage payments being made as the project progresses.

Eye-catching valuation

Inland’s substantial cashflows from its Partnerships and Asset Management divisions has allowed the business to deleverage its balance sheet.

Net debt declined 10% to £133m in the half-year and Inland have indicated in recent updates that the debt pile will fall below to £100m when their full-year numbers are confirmed early next month.

The shares trade on Price to Free Cashflow of 10.1, which is one of the most attractive in the Real Estate Operations sector. And Inland’s Price to Book Value of just 0.73 also puts the shares firmly into bargain basement territory.

Pre-tax profits are expected to recover sharply in full-year 2021 (end Sep) on total revenue north of £190m – giving Inland forecast earnings per share (EPS) growth of 53.3%, making their forward PE multiple of 7.8 look very reasonable.

Our AIM Investor portfolio has minimal exposure to UK real estate, and the portfolio also has a natural bias towards growth over value. With this in mind, we believe Inland adds some welcome sector diversification and value to our portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.