Regency View:

BUY iEnergizer (IBPO)

Bullet-proof BPO

BPO or ‘business process outsourcing’ is one of the world’s fastest growing and resilient markets…

The global BPO market was valued at $245.9 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 9.1% from 2022 to 2030.

Think call centres, technical support and back-office services, BPO is essential and labour-intensive services that can save companies millions through outsourcing to countries where labour costs are lower.

In India, BPO is the fastest growing segment of the ITES (Information Technology Enabled Services) industry.

Cheap labour costs, time zone advantages and a huge talent pool of skilled, English-speaking professionals has made India the world’s favoured market for BPO companies and a standout among them is iEnergizer (IBPO)…

iEnergizer is a highly profitable business, generating $200m revenue last year and netting $49m in profit on industry leading operating margins.

The stock looks attractively priced with one of the cheapest forward price / earnings (PE) ratios in its peer group and a chunky dividend yield.

Diverse client base

Founded in 2000 by CEO and controlling shareholder, Anil Aggarwal iEnergizer have grown rapidly and now has more than 17,000 staff across 9 delivery centres in India.

iEnergizer’s services are divided into two segments:

BPO – this is iEnergizer’s largest segment, generating more than two thirds of revenue. iEnergizer’s BPO client base is highly diverse spanning healthcare, banking, insurance and gaming.

Content delivery – this segment includes outsourced provision of eLearning and digitisation services and contributed 37% towards the Group’s FY21 revenue.

Highly profitable growing business

When it comes to selecting quality stocks, a consistent track record for delivering profitable growth is essential…

iEnergizer has a 5-year Return on Capital Employed (ROCE) of 25.8% – indicating that the business can grow very profitably.

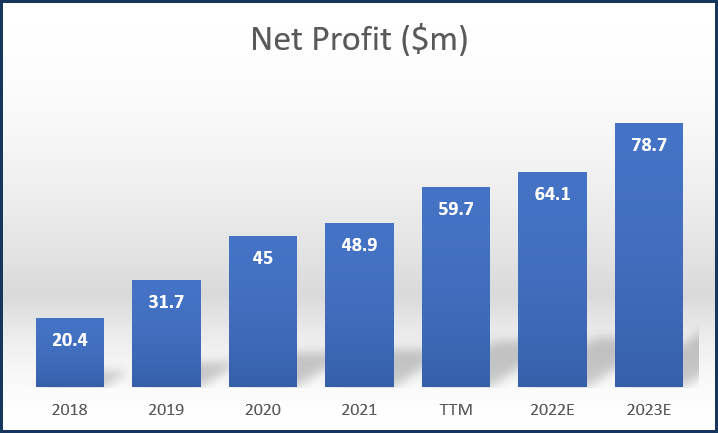

This is also reflected in iEnergizer’s net profit graphic (right) which indicates that growth in profitability is forecast to continue.

Operating cash flow is very healthy a $40m (TTM), of which more than $38m converts to free cash flow.

And iEnegizer’s free cashflow has historically tracked ahead of its earnings – another sign of a high-quality company.

Income & Growth at a reasonable price

In February, iEnergizer released a bullish trading statement in which it said:

“The Company expects to announce another record year significantly above last year’s numbers.”

This statement triggered a material upgrade from iEnergizer’s house broker which suggest earnings growth of 30% in FY22 and 20% in FY23.

Based on these forecasts, the shares currently trade on a forward PE multiple of 11.3 – one of the cheapest in the Professional & Commercial Services sector.

The PE also looks attractive relative to forecast earnings per share (EPS) growth of 20.6%, and a forward dividend yield of 6.69%.

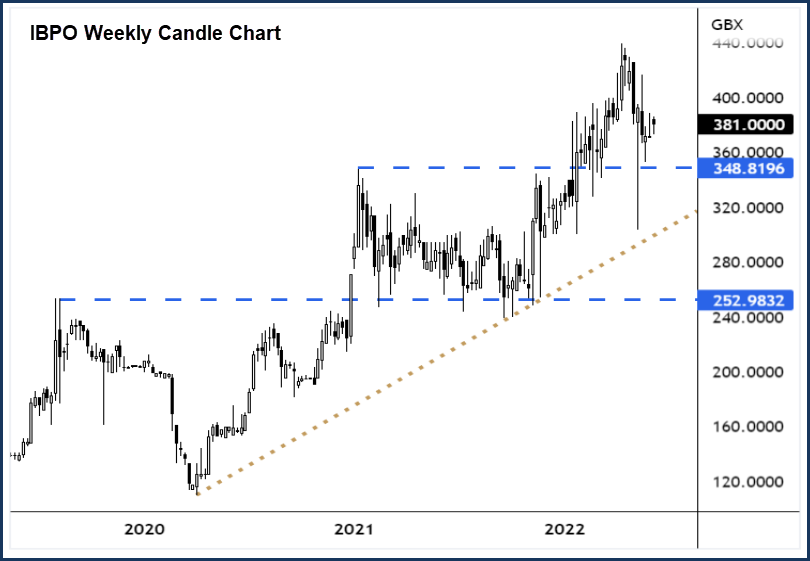

And with the shares currently trading back at February levels, we wouldn’t be surprised if iEnergizer’s Full Year 2022 numbers, scheduled for release later this month, trigger another positive reaction from the market.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.