9th Mar 2023. 8.59am

Regency View:

BUY hVIVO (HVO)

Regency View:

BUY hVIVO (HVO)

hVIVO’s human challenge trials pass the test

Human challenge trials.

It sounds like something you’d see on Channel 4 hosted by former SAS operatives, but human challenge trials are in fact, a faster and cheaper way of developing vaccines.

Typically, around 100 volunteers are recruited to a challenge trial, inoculated with the challenge agent (virus) and placed in quarantine for a couple of weeks.

Using humans over lab rats generates superior data in a short period of time – saving large biopharma companies tens of millions.

hVIVO (HVO) is the world leader in testing infectious and respiratory disease vaccines and theraputics using human challenge trials.

Demand for hVIVO’s services is growing fast with the business winning a steady stream of contracts over the last year.

And with a rock-solid balance sheet, high earnings visibility and a pullback on the price chart, we believe hVIVO is a leading candidate in the biotech sector.

Smart investments

Formerly known as Open Orphan, the stock shot to fame during the pandemic when it partnered with UK Government to conduct the world’s first COVID-19 challenge trial.

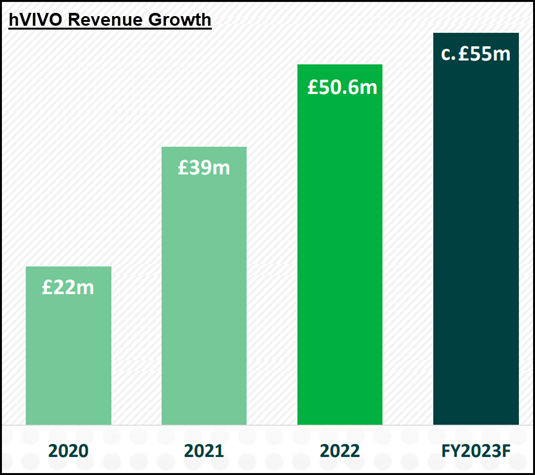

The pandemic was transformative for the business, sending revenues surging from £3.37m in FY 2019 to £20.6m in 2020.

Fast forward three years and hVIVO boasts four of the world’s top 10 biopharma giants as active clients, FY 2022 revenue is set to top £50m and the acquisition of Venn Life Sciences, a drug development consultancy, has significantly expanded the group’s offering.

Alongside its Whitechapel quarantine clinic, hVIVO now has a state-of-the-art QMB clinic with a highly specialised on-site virology and immunology laboratory, and a newly opened clinic in Plumbers Row.

hVIVO also has volunteer screening facilities in London and Manchester which have access to more than 250,000 volunteers.

hVIVO’s smart, post-pandemic investments have expanded the scope of the business to enable Phase I and Phase II vaccine field trials, pharmacokinetic studies, bridging studies, and patient trials as part of large international multi-centre studies.

Strong contract momentum

The pandemic has kickstarted a material increase in pharma R&D activity in infectious diseases and hVIVO are taking full advantage.

Increasing demand for hVIVO’s human challenge services is clearly evidenced by the growing number and size of the contracts it is winning…

In 2022, hVIVO won eight significant challenge study contracts, worth a combined value of £74m.

Only three years ago, the average contract award was worth £3m-£4m, this has increased considerably with three contracts in 2022 worth more than £10m in revenue:

- £14.7m (Influenza) – manufacture, characterisation and challenge study for top 5 global pharma client

- £13.6m (RSV) – challenge trial with US-based biopharmaceutical client

- £10.4m (Influenza) – manufacture and challenge trial for top 5 global pharma client

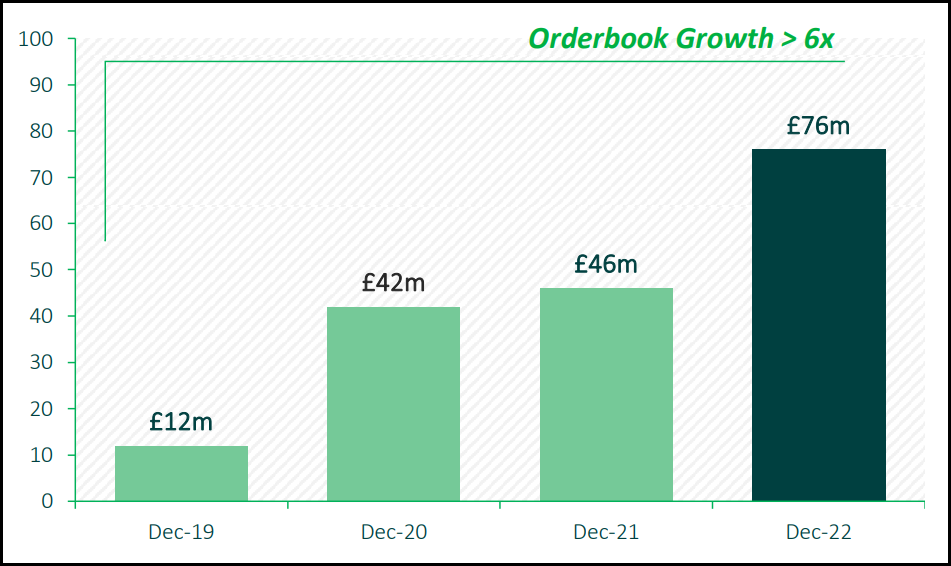

Needless to say, hVIVO’s order book has a very healthy glow!

As of December 2022, forward orders stood at £76m, a more than six-fold increase on 2019.

60% of the orderbook is attributable to repeat business and more than 40% of hVIVO’s orderbook is Big Pharma clients.

And hVIVO has started 2023 the same way it ended last year…

On January 4th hVIVO announced that it had won a £5.2m RSV human challenge study contract with global biotechnology company in the Asia Pacific region (APAC).

This was followed by a €3.2m contract win with global pharma client for the provision of drug testing services at the end of Jan. And a further £6.6m contract win with a second APAC pharma company – building on the business development work it has done in the region.

The APAC clinical trial market is rapidly growing, with almost 8,000 clinical trials started in the region in 2021, and hVIVO expect approx. 20% of new contract wins to come from APAC this year.

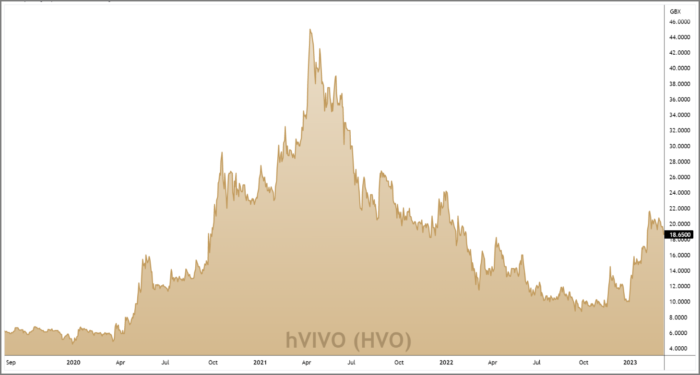

New Year rally poised to resume

hVIVO’s recent flurry of contract wins sent its share price into overdrive.

Three bullish price gaps in less than two months took the shares from 10p at the turn of the year to 20p in early-Feb.

When prices are going through exponential runs of this nature it’s important not to chase the market. Instead, we prefer to be patient and wait for prices to revert to a short-term mean.

On the chart (right) we’ve used the 20 day and 50 day exponential moving averages (EMA’s) as a broad guide for where hVIVO’s pullback should settle.

Recent price action has seen the shares consolidate sideways within a bull flag formation, taking prices into the 20-50 EMA zone.

This represents a reasonable level in which the short-term momentum created by the New Year rally can now resume.

Not your average micro-cap biotech

For a micro-cap biotech, hVIVO has reassuringly strong financials.

hVIVO’s balance sheet is debt-free, with just shy of £28.4m net cash (TTM) and post-pandemic revenue growth has been impressively averaging more than 30% year-on-year.

Full-year 2023 revenue is currently forecast at £55m, but this looks very conservative given “95% of 2023 revenue” has already been contracted.

Importantly, hVIVO are cashflow positive and the business will deliver a maiden net profit of £5.05m this year (FY22).

hVIVO’s high level of earnings visibility and contract momentum has given the stock a valuation to match with investors having to pay more that 20 times forward earnings.

However, this valuation looks reasonable given earnings are forecast to grow 52% next year and hVIVO’s strong financials reduce the risk of dilution – the enemy of the long-term investor.

Shareholders can look forward to a maiden dividend this year, and should hVIVO’s profitability accelerate as forecast, we expect its investors to be well rewarded.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.