18th Jan 2024. 8.59am

Regency View:

BUY Good Energy (GOOD)

Regency View:

BUY Good Energy (GOOD)

Good Energy: A beacon of profitability in the green revolution

The dire performance of green stocks during the last two years has led many investors to question their approach. A key reason for the underperformance has been the ‘jam tomorrow’ weak financial profiles that accompany many green stocks.

Green energy supplier, Good Energy (GOOD) is somewhat of a unicorn in this space. It has been consistently profitable during the last five years and is highly cash generative. The business has a cash-rich debt free balance sheet and a diverse service-led business model.

The stock trades on an attractive forward valuation relative to forecast earnings growth, and with prices pulling back to a cluster of key moving averages in recent weeks, we’re keen to snap up some shares.

Shaping a sustainable energy landscape

Good Energy operates as a green energy supplier with a distinct and diversified business model. Here are some of the key elements of that business model:

1. Renewable energy supplier: Good Energy is primarily known as a supplier of 100% renewable electricity. It sources its power from renewable generators in the UK, including wind and solar farms. The company has a focus on promoting clean and sustainable energy sources, contributing to the transition away from traditional fossil fuels.

2. Feed-in tariffs and small-scale generators: Good Energy has been instrumental in the development of feed-in tariffs, a system that pays customers for the electricity they generate, particularly from small-scale renewable installations like solar panels. This approach has helped the company build a loyal base of more than 2,000 small-scale generators, fostering a decentralized energy generation model.

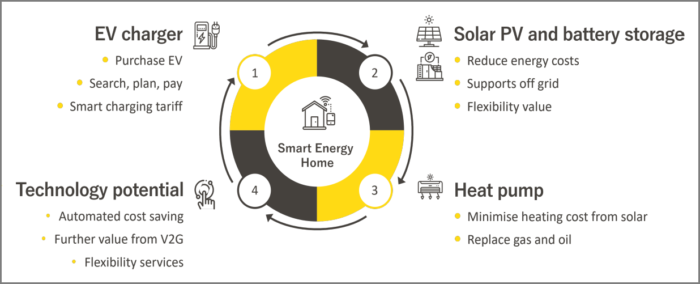

3. Transition to energy services: In recent years, Good Energy has undergone a strategic shift from being primarily an energy supplier to becoming an energy services provider. This shift involves expanding its offerings beyond supplying electricity to encompass a broader range of energy-related services.

4. Acquisitions in renewable services: As part of its transition, Good Energy has made strategic acquisitions, including the purchase of WessexECO, a solar panel installation business, and Igloo Works, a heat pump installation specialist. These acquisitions align with the company’s goal of diversifying its services and participating in the growing markets for solar and heat pump installations.

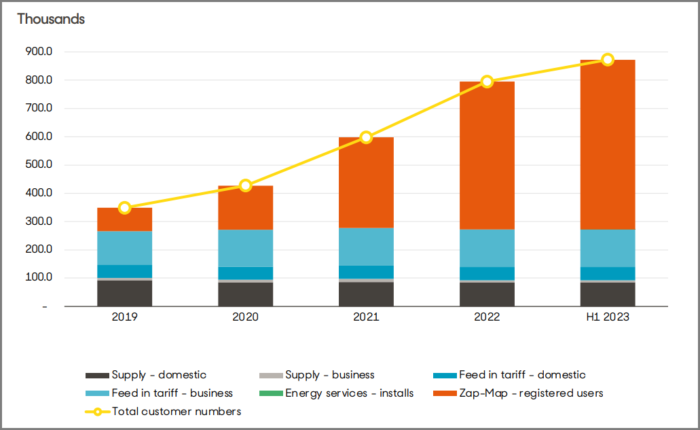

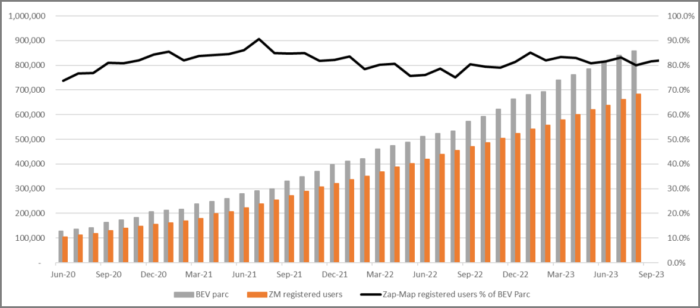

5. Zapmap EV Charging App: Good Energy is a part-owner of Zapmap, a UK-wide map of electric car charging points. By investing in Zapmap, Good Energy has positioned itself in the electric vehicle (EV) market, supporting the infrastructure for EV charging. This move aligns with the broader industry trend of promoting clean transportation.

6. Direct Power Purchase Agreements (PPAs): Instead of relying solely on its own renewable power portfolio, Good Energy has entered into direct power purchase agreements with major renewable generators like Ørsted. This approach ensures a stable and guaranteed supply of renewable electricity, even after the sale of its own 47.5MW renewable power portfolio.

Strong Interim Results followed by impressive trading update

In September, Good Energy reported a substantial 45.6% surge in half-year revenue to £156.1 million. This growth was propelled by the upward trajectory of wholesale energy prices during the period – creating a 168% jump in gross profit to 32.7 million.

The strong interims were backed up by a bullish trading update in November. The company continued to outperform expectations, anticipating earnings ahead of the Board’s projections for the full year, targeting a profit before tax of at least £4 million.

Weather conditions, notably a mild start to winter, played a favourable role, contributing to a reduction in the forecasted loss for H2 2023. Stable renewable generation was highlighted as a key factor, leading to lower gas consumption and mitigating short-term market price volatility.

Growth, momentum and quality at a reasonable price

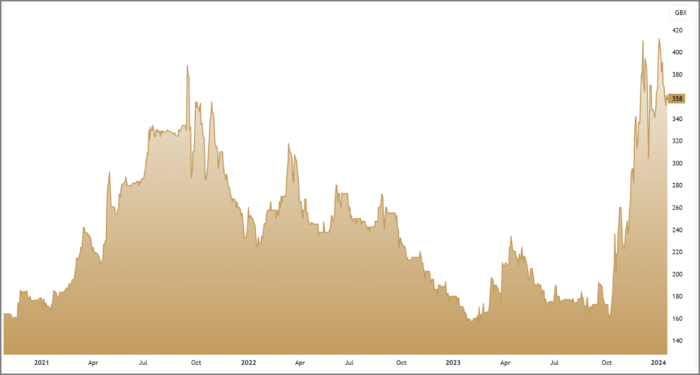

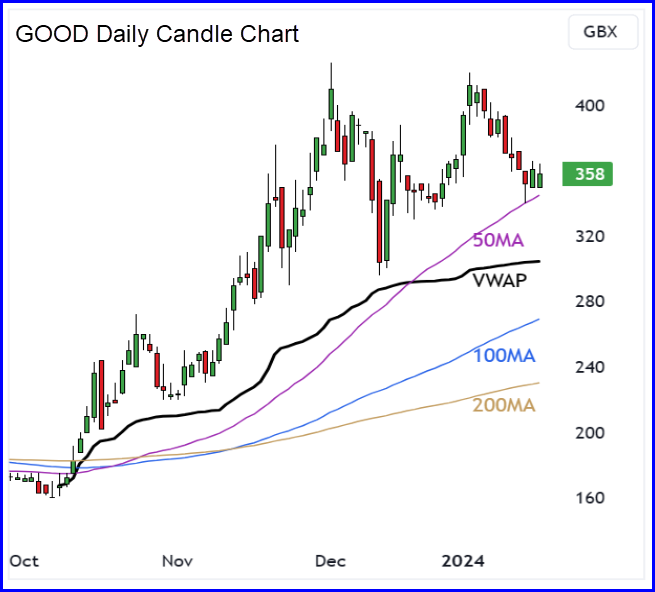

Good Energy’s share price has been trending higher since the autumn with prices carving a series of higher swing lows – above the 200 day, 100 day and 50 day moving averages (MA’s).

In recent week’s this uptrend has taken a pause and the shares have pulled back to the 50MA – an area that also coincides with the volume-weighted average price (VWAP) from the October lows. This is an attractive area to position ourselves within Good Energy’s uptrend.

In terms of valuation, the shares currently trade on a forward price-to-earnings (PE) ratio of 13.6. Whilst this makes Good Energy one of the pricier stocks in its peer group, we believe this is justified by the company’s strong financials and forecasted earnings per share (EPS) growth of 35.3%.

Looking across other metrics, Good Energy have a market-beating price-to-free cashflow of 2.9 – indicating that the stock offers growth and quality at a reasonable price. And the shares also trade at a 73% discount to estimated fair value which models future cashflows.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.