22nd Mar 2023. 3.10pm

Regency View:

BUY GlobalData (DATA)

Regency View:

BUY GlobalData (DATA)

GlobalData has proven pricing power

Pricing power, the ability of a business to raise prices without dampening demand.

In this inflationary environment, pricing power has become one of the key factors we look for when selecting long-term investments, and GlobalData (DATA) has plenty of it…

GlobalData provide industry intelligence reports to a global customer base via a subscription model.

Industry intelligence and market insights become more valuable during times of uncertainty, and this is reflected in GlobalData’s pricing power which has seen it hike prices in 2022 only for revenue and margins to increase.

The business has high levels of earnings visibility, and we believe the stock offers growth at a reasonable price.

One scalable platform

GlobalData have built a global expert community of 3,500 employees across 25 countries worldwide to turn “raw data into trusted intelligence”.

This community includes 800 Expert Analysts & 1,200 Researchers, 250 Data Scientists, and 100 Editorial & Data Journalists.

GlobalData’s intelligence reports cover more than twenty of the world’s largest industries and are used by financial institutions, large corporations, legal professionals and government.

Alongside industry content, they offer ‘add-on’ content such as macroeconomic indictors, thematic research and expert panels.

GlobalData’s content is delivered via one platform – making the business highly scalable. They use a tiered pricing subscription model, with free access to basic level content and higher pricing for higher value and customisable solutions.

Revenue is highly geographically diversified, with around two thirds of revenue being generated from the America and EMA regions in roughly equal measure.

In 2022, GlobalData had a retention rate of 84% for customers worth more than £20k, creating a strong platform for growth. And their products have proven to be very ‘sticky’ with 75% of GlobalData’s largest clients being with the company for more than three-years.

‘Significant scope’ for further price hikes

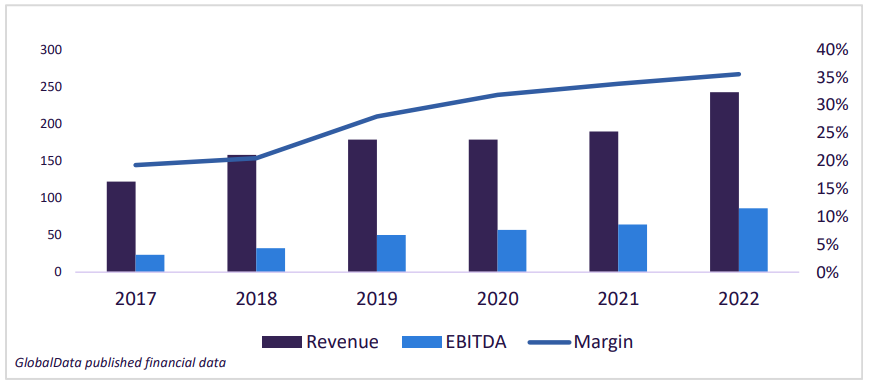

In February, GlobalData released an impressive set of Full-Year 2022 numbers.

Underlying revenue increased by 10% to £243.2m, while price rises helped push up the adjusted operating margin by 2 percentage points to 36%.

“Our strong performance in 2022 has brought forward our Adjusted EBITDA earnings expectations by a year” said CEO Mike Danson.

“We enter 2023 in a position of strength with visibility on more than 80% of our FY23 revenue guidance, giving us the confidence for both growth and margin expansion into 2023 and beyond” he added.

Mr Danson indicated that there was “significant scope” for further price rises and he expects operating margin to hit 40% next year.

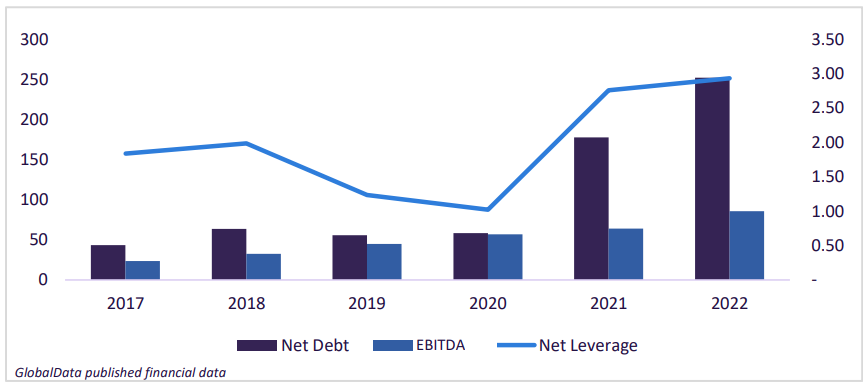

However, before you start thinking this stock is too good to be true, there is a £250m elephant in the room…

GlobalData like to finance acquisitions via debt, and the purchase of Media Business Insight and TS Lombard last year has seen net debt jump from £178m to £250m. And rising interest rates have caused finance costs to increase from £5.6m to £17.6m – creating a profit headwind.

Whilst we typically avoid stocks that have highly geared balance sheets, we believe GlobalData’s pricing power and earnings visibility make it a notable exception.

Operating cashflow jumped 26% to £53.1m and GlobalData’s high margin digital model ensures that more than 90% of that cash flows through into free the bottom line.

A Slater and O’Neil worthy stock

GlobalData’s valuation metrics would gain the approval of two legendary investors, Jim Slater and William O’Neil…

Slater’s ‘Zulu principle’ championed the method of comparing forecast rolling price to earnings (PE) ratio against forecast earnings per share (EPS) growth rates to generate a PEG ratio.

A PEG ratio of less than one indicates that you’re buying a growth stock at a reasonable price and GlobalData has a Jim Slater PEG ratio of just 0.4.

US Growth investor, William O’Neil’s ‘CANSLIM’ method focuses on earnings and management, but also includes momentum components such as selecting leaders over laggards in a sector and the share price relative to its 52-week highs.

GlobalData has seen operating profit grow at a compound annual rate of 144% over the last five years and EPS has increased four-fold over the same five-year period.

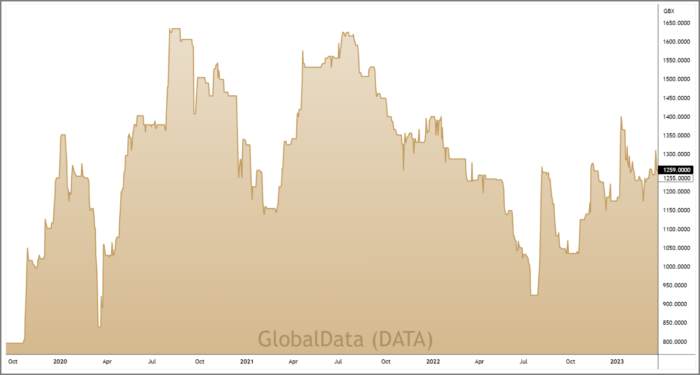

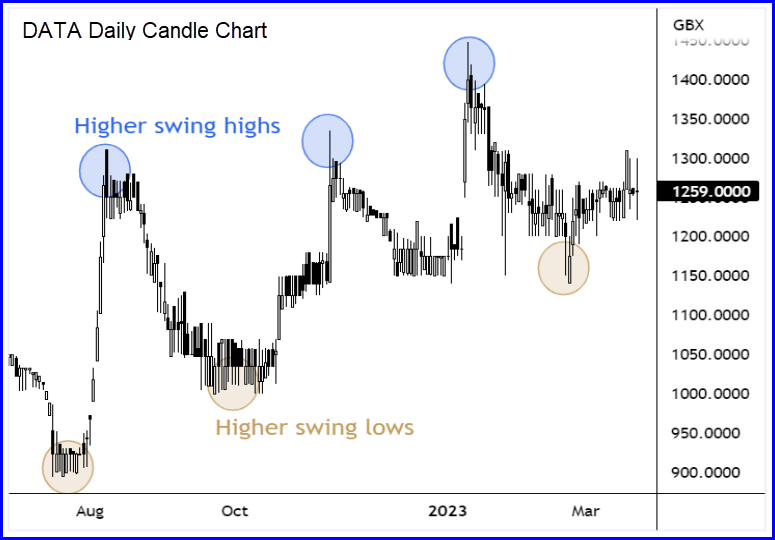

On the price chart, the shares have recently been carving out a bullish series of higher swing highs and higher swing lows. The shares remain within 20% of their 52-week highs and have displayed high levels of strength relative to their peer group and the wider market.

GlobalData’s strong and stable earnings trajectory combined with the relative strength of its share price mean that the stock comfortably meets O’Neil’s criteria.

And with demand for GlobalData’s insights remaining strong during times of uncertainty, the stock offers unique defensive growth qualities to our stable of AIM Investor stocks.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.