Regency View:

BUY Gattaca (GATC)

Profiting from the UK’s hiring frenzy

This week’s UK Labour market data revealed that more than a million jobs stood open in the UK in the three months to August…

According to the Office of National Statistics (ONS), payrolled employment rose by almost a quarter of a million last month and more people re-joined the labour market as employers rushed to hire.

The ‘hiring frenzy’ hasn’t been isolated to the UK, in the US job openings rose to a record high for the fifth consecutive month in July as demand for workers still outpaced hiring, and a similar trend is being seen throughout euro zone countries.

Today’s addition to our AIM Investor portfolio, Gattaca (GATC) is a global recruitment group focused on the engineering and technology industries.

They are benefiting from a swift recovery in key markets and the stock has several high-quality characteristics including a substantial net-cash balance sheet, triple-digit forecast earnings per share (EPS) growth and plenty of medium-term momentum on the price chart.

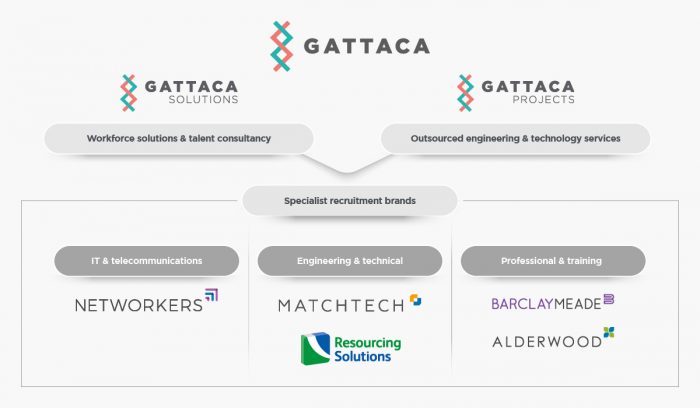

Gattaca consists of several specialist recruitment brands and has more than 500 staff around the world.

In terms of geographic revenue split, Gattaca have a major weighting to the UK – generating roughly 80% of group revenues, with 10% coming from the Americas and EMEA respectively.

Matchtech is a market leader in the UK engineering recruitment sector. It has a market share of around 5%, and this is something Gattaca are looking to replicate internationally…

Gattaca recently completed the migration of its entire group to its global technology platform, and this will enable the business to have a consistent view of activity and performance across all operating units globally.

Commenting on the migration, CEO Kevin Freeguard said:

“Our new global technology platform will increase our ability to collaborate and drive performance across the business”.

Exposure to long-term growth themes

Gattaca have a core focus on engineering and technology – covering high-growth sectors such as Infrastructure, Defence, Energy and new Mobility.

This also gives Gattaca exposure to several long-term growth themes:

HS2

High Speed Two (HS2) is the biggest rail project in UK history and will serve 1 in 5 of the UK population with phase one set to complete in 2026, and phase two in 2033.

HS2 will support over 100,000 jobs and Gattaca’s Matchtech is one of the leading recruiters in this area.

UK Fibre and 5G investment

The UK Government has ambitious plans to bring “gigabit-capable” broadband to every home and business by the end of 2025.

From cabling technicians to quantity surveyors, fibre planners to field engineers the UK fibre rollout will create tens of thousands of jobs.

Cyber Security

The cost of cybercrime is estimated to reach $6 trillion globally this year, meaning that we require an ever-growing number of cyber security professionals to deal with threats and defend our online security.

The New York Times recently reported that there would be 3.5 million open cyber security jobs this year, and Gattaca’s Networkers brand has a strong foothold in this growing market.

Offshore 2025

As set out in the Prime Minister’s Ten Point Plan for a Green Industrial Revolution, the offshore wind sector could support up to 60,000 jobs by 2030.

The government has pledged £200 million to support offshore wind projects in a bid to help meet the manifesto commitment to ensure the UK has 40GW of capacity by 2030. And Gattaca’s Resource Solutions subsidiary, a specialist in infrastructure recruitment looks well positioned to take advantage of this long-term theme.

Performing above market expectations

Gattaca’s financials have undergone a sharp turnaround in recent years…

Having had net debt of £40.9m as recently as 2018, leverage has been reduced significantly and Gattaca now have an Adjusted Net Cash position of £20m.

And whilst the pandemic had a severe impact in 2020, Gattaca’s recent trading update indicates the recruitment industry is entering the “next phase of recovery”.

The market recovery has been led by permanent recruitment both in contingent and solutions products, and Gattaca believe the next bounce of the ball will be in contracting…

“There is further improvement to come on the contract front including in our core infrastructure unit, which will benefit from strong demand driven by major initiatives such as UK Fibre investment, HS2 and Offshore 2025, which we are seeing already positively impacting hiring” read the upbeat trading statement.

Gattaca upped its guidance in May, and they had to do so again in their August update…

Net Fee Income (NFI) was 7% higher than in the first half of Gattaca’s 2021 financial year and they now expect full year NFI to be £42.5m.

The shares currently trade on a mid-market forward Price Earnings multiple (PE) of 16.9, and this look very attractive relative to forecast growth in earnings per share (EPS) of 106.6%.

Gattaca also score highly across a number of value metrics including Price to Book Value (1.77), Price to Free Cashflow (2.6) and Price to Sales (0.16).

Bullish wedge taking shape

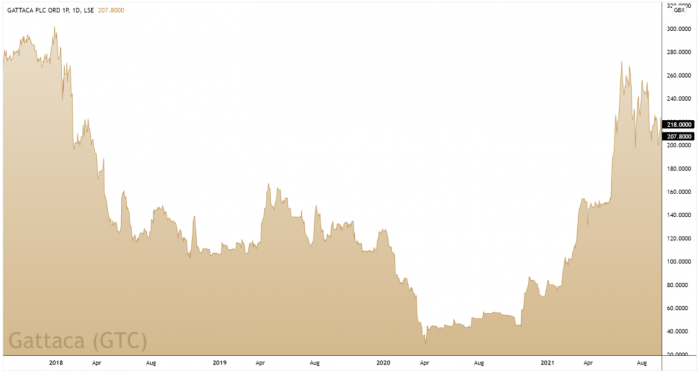

The positive vaccine news in November 2020 kick-started a powerful uptrend – taking Gattaca’s share price to three-year highs in June.

Since then, prices have undergone a much-needed period of mean reversion. The shares have been consolidating within a ‘bullish wedge’ or ‘bull flag’ formation, characterised by a converging series of lower swing highs and higher swing lows.

Consolidation patterns of this nature have a statistical tendency to resolve themselves in higher prices. And we are going to use this powerful pattern as a technical catalyst for entry – positioning ourselves within the wedge in order to optimise our risk/reward.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.