Regency View:

BUY Gamma Communications (GAMA)

Gamma’s European growth potential remains highly attractive

Of the many factors we look at when selecting our stocks, recurring revenue sits very high on the list, and its not hard to see why…

Firms with plenty of repeat business don’t have to try so hard just to stand still. In addition, recurring revenues tend to be earned in a less competitive fashion than new business, so they often have good profit margins attached to them.

Digital telecoms provider, Gamma Communications (GAMA) boast recurring revenues of 89% and is a text-book example of how repeat business can be leveraged to achieve high levels of growth.

At AIM Investor, we’re no strangers to Gamma’s growth story…

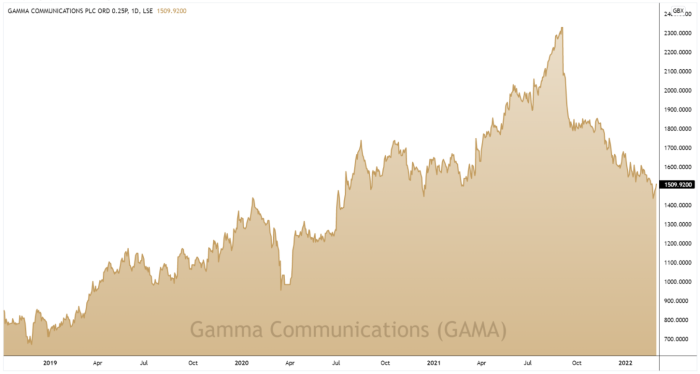

We snapped up the shares in March 2019 and enjoyed an unrelenting run higher over the following two-years – taking profits in May 2021.

And after a significant pullback from its September 2021 highs, a period in which Gamma’s newsflow has been uniformly positive throughout, we believe this high-quality growth stock looks attractive once again…

European growth story

When we first became aware of Gamma, they were making waves in the UK internet telephony or VoIP (Voice Over Internet Protocol) market, and Gamma had swiftly established itself as the UK’s largest ‘SIP trunking’ provider (SIP trunking being the ability to connect multiple different channels directly to a business’s private telephone exchange).

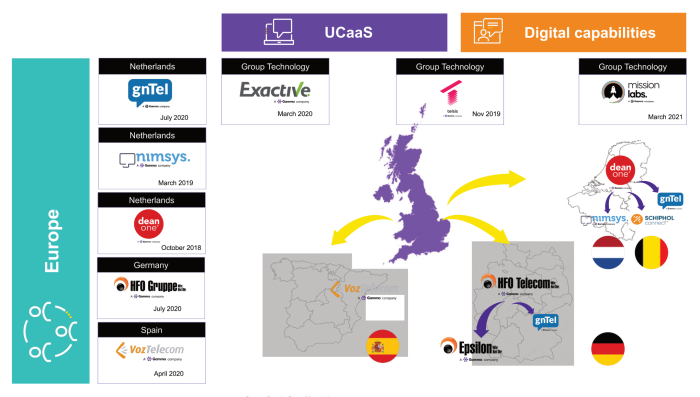

Through a series of smart acquisitions, Gamma is now a major European player in the broader cloud-based ‘Unified Communications as a Service’ (UCaaS) market…

Alongside its domestic brands, Mission Labs, Unified Comms and Exactive, Gamma also own a number of key European brands including:

- HFO – one Germany’s leading SIP Trunk and emerging Cloud PBX (Private Branch Exchange) providers.

- VozTelecom – a Spanish cloud communications service provider focused on the SME market.

- Gamma Communications Nederland (formerly Dean One and gnTel) – a telecom operator and Internet provider supplying hosted VoIP solutions, mobile and broadband services via 900+ channel partners to SMEs in the Benelux region.

Gamma’s ‘land and expand’ European growth strategy is at the core of the Group’s long-term objectives, and as we’ll outline in more detail below, there is huge potential for further growth as the transitionary ‘waves’ of new technology continue to sweep across Europe…

Gamma waves getting closer

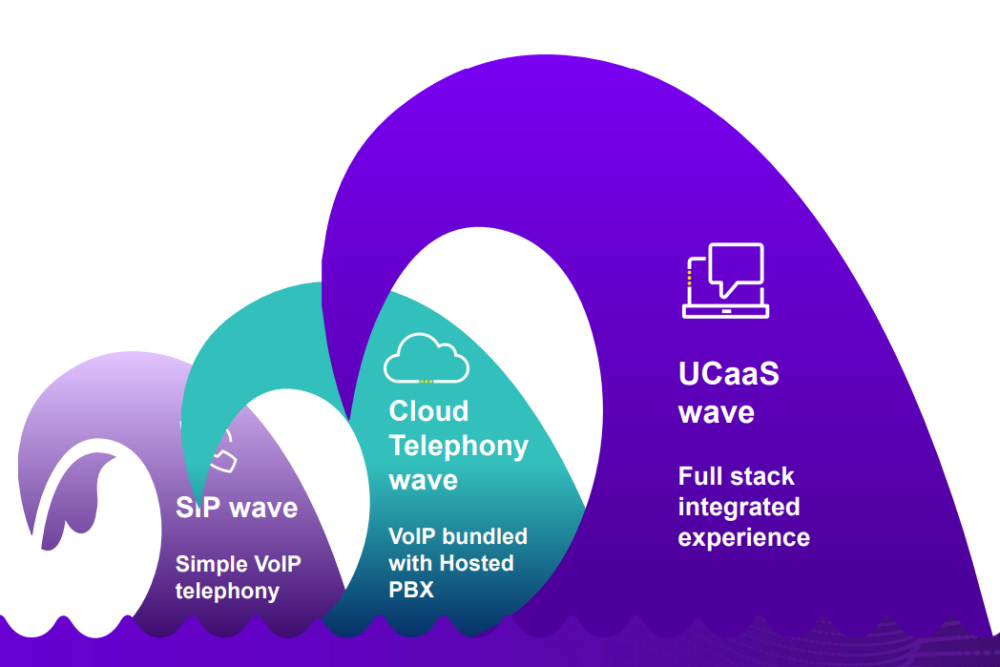

The adoption of new technology is rarely linear, and this is especially true in the office communications market…

When Gamma first outlined their European expansion plans in 2018, they believed it would take 3-5 years for European businesses to adopt simple VoIP telephony dubbed the ‘SIP wave’ in Gamma’s capital markets day presentation.

And for European businesses to fully adopt integrated UCaaS bundles, Gamma had forecast this could take more than eight years.

However, the pandemic has turned this timeframe on its head as businesses suddenly found they needed to rapidly move away from their locally-installed systems towards flexible cloud-based solutions.

The waves of technological change are now stacked much closer together and this has fast-tracked Gamma’s European growth projections.

There is also a key domestic growth catalyst working in Gamma’s favour…

Openreach will be switching off their Public (PSTN) and Integrated (ISDN) telephone networks in 2025. As of 2020, only 29% of UK businesses had moved to cloud services – creating a clear catalyst for Gamma’s domestic growth.

Buying ahead of FY 2021 Results

Gamma have a strong, five-year plus track record for delivering double-digit growth in both revenue (15.5% CAGR/Avg) and operating profit (27.5% CAGR/Avg).

Gamma also have a Return on Capital Employed (ROCE) of 30.8%, one of the best in its sector and clear evidence that management can grow the business effectively.

The business generates plenty of cash, of which more than 77% flows through to Free Cashflow. And this has created a rock-solid, debt free balance sheet which has £30.8m cash (TTM) to fund further acquisitive growth.

On the price chart, the shares have undergone a deep retracement from its September 2021 highs – taking prices down into a long-term area of support. And given the strength of Gamma’s long-term 5-year uptrend, we believe this support level represents an attractive long-term entry point.

In terms of valuation, Gamma’s status as a high-quality growth stock means that even after a 38% drop in its share price during the last six months, the shares remain on a rather punchy forward PE ratio of 21.

However, Gamma reaffirmed in January that it remains on-track to meet expectations that it raised twice in 2021. That implies adjusted earnings (EBITDA) of £90.5m-£96m on revenue in the region of £444.5m-£445.6m. This puts adjusted earnings per share (EPS) at 57.6p-64p.

And, if Gamma’s track record of under-promising and over-delivering is anything to by, we believe the risk / reward favours the upside ahead of the release their Full-Year 2021 results later this month (Tues 22nd March).

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.