23rd May 2024. 9.02am

Regency View:

BUY Gaming Realms (GMR)

Regency View:

BUY Gaming Realms (GMR)

Unlocking the Jackpot: Gaming Realms’ Path to Success in the US

With the expansion of online gambling in the United States, companies are positioning themselves to capitalise on this burgeoning market. Among these contenders is Gaming Realms (GMR), a mobile-focused gaming content developer and licensor.

Who is Gaming Realms?

Gaming Realms is best known for its expertise in developing and licensing captivating gaming content.

At the heart of their portfolio lies the Slingo series of games, a unique fusion of slots and bingo that has garnered widespread acclaim for its innovative gameplay. This distinctive gaming experience has propelled Gaming Realms to the forefront of the industry, attracting partnerships with major operators worldwide.

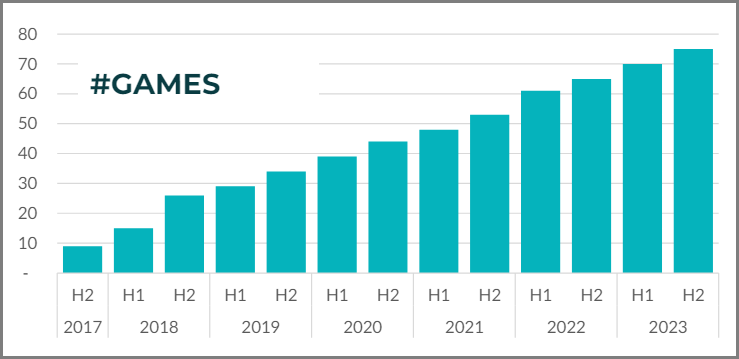

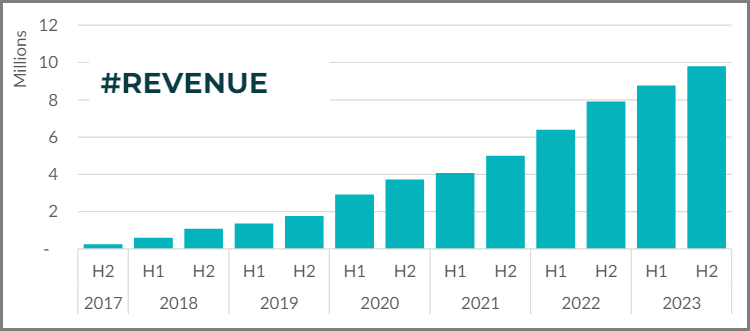

Gaming Realms strategic emphasis on content licensing has consistently delivered high margins and significant revenue growth. In 2023, the company achieved a 26% increase in revenue, reaching £23.4 million and licensing revenue surged by 33%.

Key areas for growth: Expanding horizons

Gaming Realms’ growth strategy encompasses several key areas poised to drive expansion and solidify their position as a leader in the online gaming industry.

1. Global market penetration: Gaming Realms is aggressively pursuing expansion into new markets worldwide. By securing iGaming Supplier Licenses in lucrative regions like West Virginia, Sweden, and Greece, the company is laying the groundwork for future growth.

2. Strategic partnerships and licensing deals: The company’s success hinges on its ability to form strategic partnerships and secure licensing agreements. Collaborations with industry giants such as Tetris and Relax Gaming bolster Gaming Realms’ portfolio and enhance its market appeal. By continually expanding its network of partners, Gaming Realms can access new audiences and drive revenue growth.

3. Product innovation and portfolio expansion: Gaming Realms’ commitment to product innovation fuels its competitive edge in the market. The company continuously develops new games and variants, leveraging its proprietary technology. By diversifying its portfolio and introducing captivating titles like Slingo Space Invaders and Tetris Slingo, Gaming Realms increases engagement.

4. Optimising distribution channels: Gaming Realms is keen on optimising its distribution channels to maximise reach. A recent distribution agreement with Playtech signifies a strategic move to enhance distribution capabilities and facilitate market expansion. By leveraging Playtech’s extensive network, Gaming Realms gains access to new markets and accelerates game launches, amplifying its market presence and revenue potential.

5. Focus on player acquisition and retention: Central to Gaming Realms’ growth strategy is its emphasis on player acquisition and retention. The launch of new Slingo games, coupled with partnerships with operators like Livescore and DAZN, have significantly enhanced the company’s ability to acquire and retain customers.

Promising outlook for 2024

In their Annual Report for 2023, Gaming Realms painted a promising outlook for the future. They anticipated continued growth fuelled by a strong pipeline of upcoming games and operator partnerships.

CEO Mark Segal echoed this sentiment, stating, “With a record year behind us and a robust start to 2024, we were well-positioned to capitalise on the growing demand for online gaming content.”

The company is optimistic about its expansion into new markets, with launches planned in territories like West Virginia and Greece. This proactive approach to growth has set the stage for further success in the year ahead.

Financial perspective: Growth at a reasonable price

Financially, Gaming Realms has impressive performance metrics that underline its potential for sustained growth.

Their revenue has experienced a compound annual growth rate (CAGR) of 30.6% over the past few years, reflecting the company’s successful expansion and increased market penetration. In addition to revenue growth, Gaming Realms has seen a significant surge in net profit, boasting a CAGR of 44.3% over the same period. This profitability underscores the company’s ability to convert top-line growth into substantial bottom-line improvements.

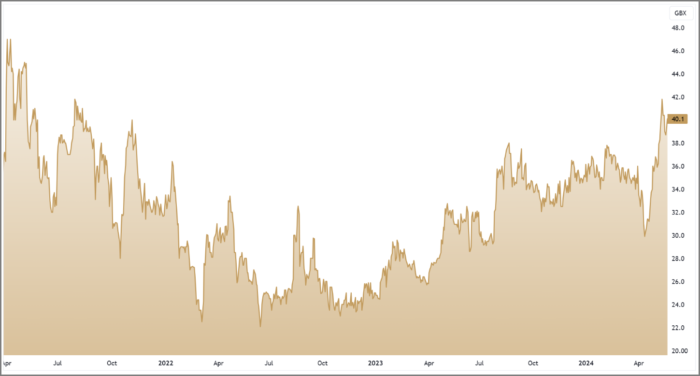

Despite these strong growth figures, we believe the shares offer considerable value. The company’s price-to-earnings (PE) ratio stands at a relatively low 13.5, suggesting that the stock is not overvalued compared to its earnings. And a price/earnings-to-growth (PEG) ratio of 0.6 further highlights this point. A PEG ratio below 1 typically indicates that a stock is undervalued relative to its growth prospects.

In addition to these metrics, Gaming Realms’ financial health is evidenced by its debt-free status and a year-end cash balance of £7.5 million. This solid position provides the company with the financial flexibility to invest in new opportunities and weather the current turbulence in the gaming market. The company’s return on equity (ROE) of 28.0% and return on capital employed (ROCE) of 20.6% are both indicative of the company’s quality.

Gaming Realms has also demonstrated operational efficiency, with an operating margin of 21.8%, which is an improvement from previous years. This margin reflects the company’s ability to maintain cost control while scaling its operations.

In summary, with a proven track record of revenue growth, a strategic focus on content licensing, and a robust outlook for the future, Gaming Realms offers investors a compelling foothold in the fast-growing online gambling market.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.