19th Oct 2023. 8.59am

Regency View:

BUY FRP Advisory (FRP)

Regency View:

BUY FRP Advisory (FRP)

Harnessing hostility: Why FRP Advisory thrives in the UK’s tough business environment

It’s tough out there; rising interest rates, soaring input costs, and economic uncertainties have converged to create a storm that has plunged more than 400,000 UK businesses into financial distress.

As more companies find themselves on the brink of administration, insolvency specialist FRP Advisory (FRP) is thriving amidst this turmoil.

FRP’s valuable services

FRP offers a range of crucial services which serve as a lifeline for businesses teetering on the edge, helping them steer clear of the insolvency abyss.

Their diverse range of advisory services includes:

Restructuring Advisory: Offering corporate financial advisory, formal insolvency appointments, informal restructuring advisory, personal insolvency, and general advice to all stakeholders.

Corporate Finance: Specialising in mergers and acquisitions (M&A), strategic advisory and valuations, financial due diligence, capital raising, special situations M&A, and partial exits.

Debt Advisory: Providing services in raising and refinancing debt, debt amendments and extensions, debt restructuring, asset-based lending, and corporate and leveraged debt advisory.

Forensic Services: Conducting forensic investigations, compliance and risk advisory, dispute services, and forensic technology.

Financial Advisory: Offering pensions advisory, valuation services, transaction services, lender services, board and c-suite advisory, and financial modelling.

Impressive growth journey

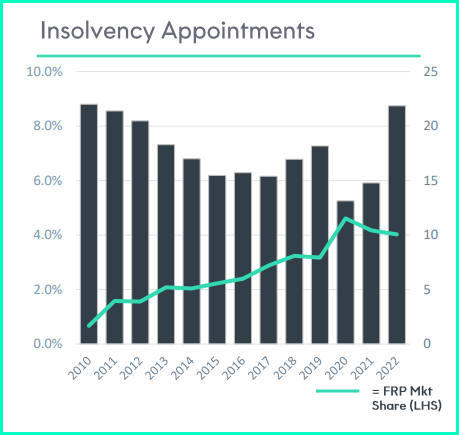

FRP has carved out an impressive growth journey over the past 12 years, marked by an ability to thrive when the broader business environment has posed challenges…

Over the last five years, the company has undergone a transformation. The number of partners has surged from 50 to an impressive 78. This expansion is a reflection of their commitment to not only growth but also to strengthening their capabilities and reach.

Their financial performance tells a compelling story. Revenue per partner has risen from £1.1 million to £1.3 million, showcasing their focus on optimising performance at every level. The company’s overall revenue has more than doubled, increasing from £54.3 million to £104 million.

Underlying earnings have followed a similar upward trajectory, surging from £14.1 million to £27 million. This impressive growth in profitability reflects not only the company’s efficient cost management but also their ability to identify and seize opportunities.

FRP’s recent trading update, issued on September 28, further underlined the compaany’s growth story…

If the current activity levels persist, FRP are confident of meeting the current full-year market expectations. These market expectations for the fiscal year 2024 anticipate substantial revenue of £111.8 million, up from £104m (FY23) and adjusted EBITDA of £26.7 million. It’s a promising outlook that reaffirms their trajectory of success.

Pullback creates buying opportunity

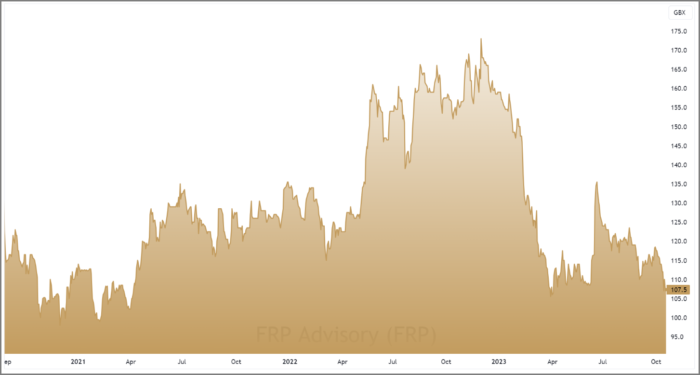

A glance at FRP’s price chart indeed reveals a conundrum. In a year where UK business conditions have been described as dire, their share price has experienced a decline exceeding 30%.

The paradox lies in the fact that the anticipated wave of large companies in distress, which would typically boost counter-cyclical plays like FRP, hasn’t materialized as expected. However, with a significant number of British businesses currently facing financial distress, the shadow of grimmer times looms, and this is precisely where we see opportunity.

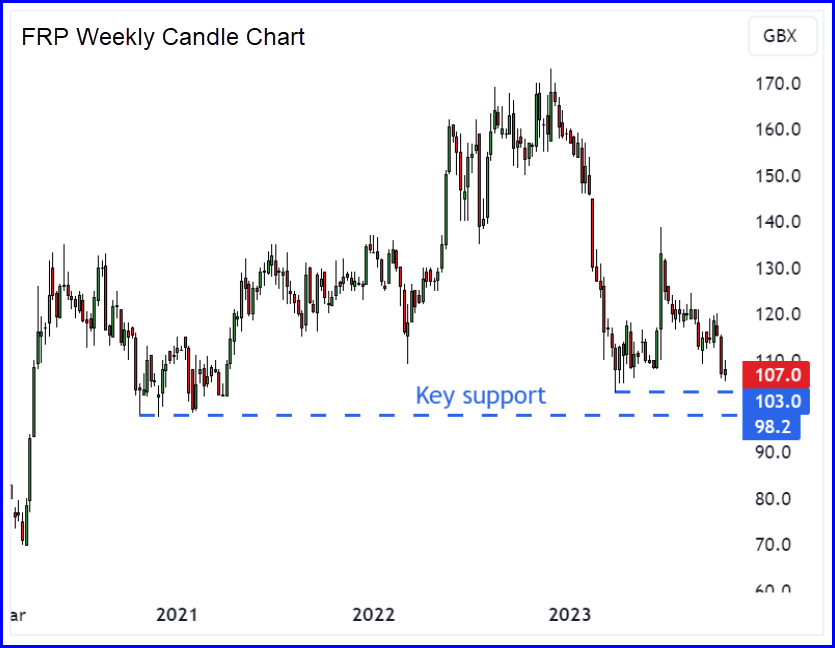

First and foremost, the shares have retraced to a pivotal support zone formed by the swing lows of March 2023 at 103p and the cluster of swing lows from 2020-2021 at 98p. This support zone signifies an area which is likely to attract buyers.

Secondly, from a fundamental perspective, the shares appear undervalued. They are currently trading at a 43% discount to their estimated Fair Value. And a forward price/earnings (PE) ratio of 13.4 compares favourably to forecasted earnings per share (EPS) growth of 23.6%.

Adding to their allure, FRP offers an attractive quarterly dividend, yielding 4.59% on a 1-year rolling basis. What’s more, the company maintains a robust balance sheet, boasting a net cash position of £27.7 million in the fiscal year 2023. While £3.1m of this cash was allocated to the recent acquisition of the Wilson Field Group, it leaves substantial room for future acquisitions.

In conclusion, the seemingly enigmatic downturn in FRP’s share price amid challenging business conditions conceals a compelling investment opportunity. Their alignment with key support levels, undervaluation, attractive dividend yield, and the potential for strategic growth through acquisitions position FRP as a standout choice for investors seeking quality and growth.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.