13th Feb 2025. 8.59am

Regency View:

BUY Franchise Brands (FRAN)

Regency View:

BUY Franchise Brands (FRAN)

A fresh start for Franchise Brands in 2025

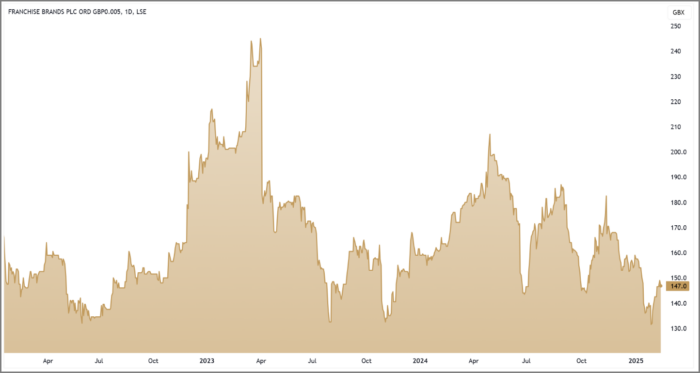

Franchise Brands’ (FRAN) share price has struggled over the past two years, sitting 60% below its 2023 highs. However, a strong underlying business, resilient demand for essential services, and a renewed strategic focus suggest that sentiment may be turning.

With the shares bouncing from key support at 130p, we believe now could be the time to reassess the opportunity.

A capital-light diversified business

Franchise Brands operates a portfolio of B2B van-based essential reactive services, spanning the UK, Europe, and North America. With seven market-leading franchise brands, the company benefits from highly diversified revenue streams and operates in large, fragmented markets where competition remains “manageable.”

A key strength of the business model is its capital-light structure. With over 625 franchisees driving growth, Franchise Brands enjoys strong cash generation, supporting deleveraging efforts and a progressive dividend policy.

2024 trading performance: Challenges, but resilient growth

Despite a challenging macroeconomic backdrop, Franchise Brands delivered record system sales across key divisions in 2024. While adjusted earnings (EBITDA) is expected to come in just below market expectations at £35.5m-£36m, the overall demand for essential reactive services remains strong.

- Pirtek (UK & Europe) saw system sales grow, with a 2% increase in the UK & Ireland and a 4% increase in Europe. However, demand for project work remained subdued, particularly in Germany, where the manufacturing sector struggled.

- Metro Rod and Metro Plumb achieved record sales growth of 6% and 16%, respectively, highlighting continued demand for water and waste services.

- Filta International (North America) saw system sales rise 12% in local currency, but lower used cooking oil prices weighed on overall revenue growth.

- The B2C division performed steadily, though franchisee recruitment and retention challenges persist.

Debt reduction remains a focus, with adjusted net debt falling to £65.1m from £74.7m a year prior. Management remains comfortable within banking covenants and expects further deleveraging through organic growth alone.

2025: A year of integration

A key theme for 2025 is “One Franchise Brands”, a strategic initiative designed to unify operations, enhance sales opportunities, and drive cost efficiencies. The aim is to create a leaner, more connected group that maximises cross-selling opportunities while benefiting from operational gearing.

With US operations seeing stronger macroeconomic tailwinds, the company remains cautiously optimistic about the year ahead. Interest rate reductions could also provide an earnings boost by accelerating debt reduction and enhancing shareholder returns.

Bouncing from a critical support zone

The technical picture suggests that the stock could be turning a corner. Franchise Brands has struggled over the past two years, but recent price action is encouraging…

The shares have consistently found support around the 130p level—a zone buyers have defended since May 2021. With short-term momentum improving, the current setup suggests an attractive risk/reward opportunity for investors eyeing a potential recovery.

Valuation: Undemanding multiples and upside potential

Franchise Brands’ valuation suggests room for upside, particularly given its strong forecasted earnings growth. The stock trades at a forward P/E of 14.1x, which looks reasonable considering expected EPS growth of 29.1% for 2025. The PEG ratio of 0.6 further reinforces the case for a company growing faster than its valuation might suggest.

The business generates healthy free cash flow, reflected in a price-to-free-cash-flow multiple of 11.2x. This supports a dividend yield of 1.94%, with strong dividend cover at 3.37x, indicating sustainability. Price-to-book sits at 1.3x, suggesting the shares are not expensive relative to their assets.

Despite recent share price weakness—down 21.5% over the past year—analysts remain optimistic, with a consensus price target of 323.33p, implying a potential upside of over 120% from current levels. With improving financials and a clear growth trajectory, the valuation appears undemanding for those willing to look past short-term volatility.

Catalysts for a re-rating

Several factors could drive a re-rating of Franchise Brands’ share price in 2025:

1. Successful execution of “One Franchise Brands”: If the integration strategy translates into tangible cost savings and operational synergies, margins should expand, boosting profitability.

2. Further debt reduction and interest rate tailwinds: With net debt already declining and the potential for interest rate cuts in 2025, lower financing costs could support higher EPS growth.

3. Continued growth in North America: The US business remains a bright spot, with system sales growing 12% despite pricing headwinds in used cooking oil. Sustained double-digit growth could shift investor sentiment.

4. Improving macroeconomic conditions: While demand for essential reactive services remains strong, a broader recovery in project-based and discretionary work could provide additional upside.

5. Institutional interest and Capital Markets Day update: Franchise Brands will host a Capital Markets Day in February 2025, offering a detailed strategic update. If management outlines a compelling growth trajectory, institutional buying interest could increase.

Final thoughts

Franchise Brands is navigating a tricky macro landscape but continues to demonstrate resilience through its essential services model. With an ambitious integration strategy, strong cash generation, and a share price sitting at key support, the pieces may be falling into place for a turnaround. The valuation appears undemanding, particularly if operational efficiencies and deleveraging efforts drive EPS growth in 2025.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.