12th Sep 2024. 9.04am

Regency View:

BUY Filtronic (FTC)

Regency View:

BUY Filtronic (FTC)

Filtronic: Powering growth with SpaceX and beyond

SpaceX’s Starlink project, which started with a handful of satellites, has exploded into a constellation of nearly 6,000 satellites, offering high-speed internet to millions of users across the globe.

As this revolutionary project continues to evolve, it’s clear that SpaceX is not the only entity benefiting from its success. Filtronic (FTC), a rapidly growing British tech company, is also riding this wave of innovation and opportunity with impressive momentum and solid financial performance.

Filtronic’s ascendancy

Filtronic is at the cutting edge of communication technology, specialising in advanced millimeter-wave (mmWave) technology. This niche expertise places them at the forefront of innovation in aerospace, defence, and telecommunications.

Filtronic’s product portfolio includes high-power amplifiers, sophisticated filters, and customised solutions designed for the most demanding applications in modern communication infrastructure. Their mmWave technology is integral to the development of next-generation satellite and communication systems, providing the high-speed, low-latency performance required for today’s advanced networks.

State-of-the-art facilities and expanding capabilities

In early 2025, Filtronic will transition to a new, purpose-built facility at NetPark in Sedgefield, significantly expanding their operational footprint. This move will effectively double their space, allowing for greater manufacturing capacity and enhanced capabilities. The new facility will feature cutting-edge cleanroom areas, advanced engineering laboratories, and state-of-the-art testing facilities, all designed to support Filtronic’s ambitious growth plans and commitment to innovation.

This expansion is more than just a physical relocation; it represents a strategic investment in Filtronic’s future. The new premises will enable the company to scale their operations efficiently, meet the increasing demand for their products, and reinforce their position as a leader in high-performance mmWave technologies. The facility’s advanced infrastructure will also facilitate the development and production of next-generation communication products, further driving Filtronic’s growth and success.

Deepening relationship with SpaceX: A series of lucrative wins

Filtronic’s partnership with SpaceX has been a game-changer for the company. Their role in supporting the Starlink project has been underscored by a series of significant contract wins. Most notably, Filtronic secured an $8.4 million contract to supply E-band solid-state power amplifiers (SSPAs) for the Starlink constellation. This contract is a testament to Filtronic’s pivotal role in enhancing SpaceX’s global internet network.

This contract follows a $9 million deal awarded earlier in the year, further cementing Filtronic’s critical contribution to the expansion of the Starlink network. These contracts not only highlight the strategic importance of Filtronic’s products but also reflect the growing trust and reliance that SpaceX places on their technology. Filtronic’s continued involvement in such high-profile projects showcases their capability and reliability as a key player in the satellite communications sector.

Impressive financial performance

Filtronic’s financial performance for the year ending May 31, 2024, has been truly impressive. The company’s revenue surged to £25.4 million, a significant jump from £16.3 million the year before. This impressive growth shows how well Filtronic is expanding its market presence and effectively executing its strategies.

Adjusted earnings (EBITDA) surged to £4.9 million, a big improvement from £1.3 million in the previous year. Operating profit and net income also saw significant gains, with the company recording £3.6 million and £3.1 million, respectively. These impressive financial metrics are supported by a robust cash position, with £7.2 million in cash at bank and a net cash balance of £4.2 million. This strong financial foundation provides Filtronic with the flexibility to invest in growth opportunities and continue driving innovation.

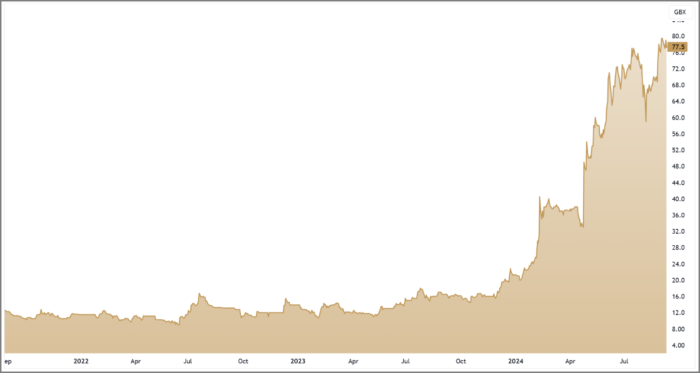

Growth at a reasonable price

While Filtronic’s stock is not the cheapest, trading at a forward PE of 25.1, it represents a compelling growth opportunity. The company’s balance sheet is debt-free, a rare and valuable trait among small-cap companies. This strong financial position, coupled with a low Price-to-Earnings Growth (PEG) ratio of 0.7, highlights that Filtronic offers growth at a reasonable price.

The stock’s performance has been impressive, reflecting its high quality and momentum. Filtronic’s share price has been trading above its 50-day moving average and comfortably above its upward-sloping 200-day moving average. This positive trend underscores the strength of the stock’s momentum and investor confidence.

Filtronic is a prime example of a small-cap company making significant strides in the technology sector. Their strategic partnership with SpaceX’s Starlink project, combined with the move to new, state-of-the-art facilities, positions them for accelerated growth. Filtronic’s solid profitability metrics and strong market performance make it one of AIM’s standout stocks this year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.