7th Jul 2022. 8.58am

Regency View:

BUY Equals Group (EQLS)

Regency View:

BUY Equals Group (EQLS)

The fast-growing fintech with ‘inflation resistant’ revenues

Finding a small cap that’s growing fast is easy.

Finding a small cap that’s growing fast, has a strong balance sheet and remains reasonably priced, that’s not so easy.

Meet Equals Group (EQLS)…

Equals is a UK fintech operating in the payment processing sector. Revenues are growing at a compound annual growth rate (CAGR) north of 30%, the balance sheet is debt free, and the stock looks cheap relative to forecast earnings growth.

A stellar trading update this week has created a clear catalyst for entry, and we believe Equals make for another strong addition to our AIM Investor portfolio.

Focus on B2B a game-changer

Most small businesses take time to truly find their lane before growth rates accelerate, and this has been the case with Equals…

Having originally listed on AIM in 2014 under the name FairFX – a B2C travel money and FX dealing business, Equals repositioned itself towards B2B payments in 2017 – focusing on SME customers.

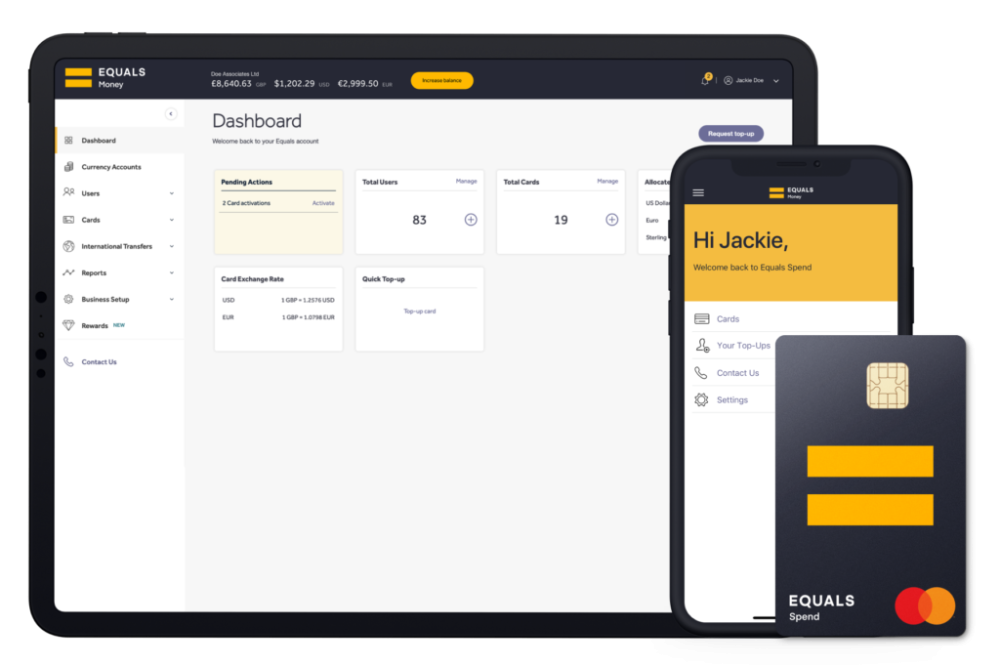

And through a series of smart acquisitions, Equals Money, its core B2B brand offers one unified platform, combining account transfers, card payments, foreign exchange and current account functionality.

The Equals Money platform facilitates payments either direct to bank accounts or at 35 million merchants and over 1 million ATM’s in more than 35 countries via mobile apps, the internet, wire transfer and Mastercard debit and credit cards.

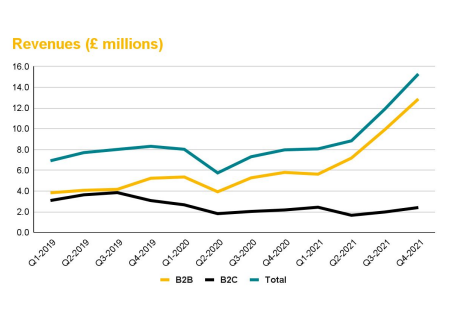

Pivoting the business to B2B has been a game-changer for Equals…

While B2C revenues from FairFX have flatlined, B2C revenues from Equals Money have more than quadrupled since 2019. Total transaction volumes have increased by a similar amount during the same period.

And given the current cost pressures on SME’s, Equals’ competitive pricing model with market leading foreign exchange rates makes them well positioned to capture further market share.

Superior service capability equals competitive edge

Last year, Equals enhanced their technology platform to offer SME’s ‘own-name multi-currency International Bank Account Number (IBAN)’ accounts.

This enables business customers to pay and receive into a single account in their own name which can process all currencies automatically.

Having one IBAN for all currencies enables SME’s to provide one single account identifier to all its customers and suppliers, helping to simplifying both sales and procurement processes.

Other recent developments include a new customer interface for the Equals Money platform and the launch of Equals Exchange – the Group’s internal dealing platform.

Equals ability to quickly onboard complex B2B customers, provide them with multiple own-name IBAN accounts and sub-accounts, and implement complex authorisation protocols is a clear competitive advantage, that bigger, slower banks struggle to compete with.

Accelerating momentum

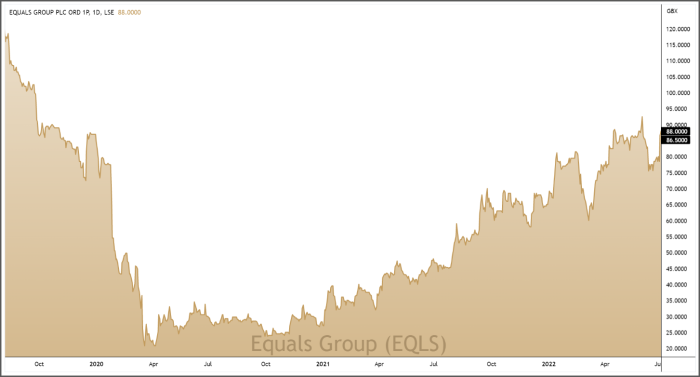

Equals have undeniable momentum across every aspect of its business and on its price chart…

On Tuesday, Equals delivered a stellar trading update which saw First-Half revenues surge 84% to £31.3m, a new record for the Group.

Equals CEO, Ian Strafford-Taylor said all segments of the business were “performing exceptionally well” and that Group revenues are “highly inflation-resistant”.

Gross profits for H1 2022 are estimated to be £15m, up 47% on the same period last year. And Full-Year 2022 adjusted earnings are forecast to come in “ahead of current market expectations”.

Indeed, the market certainly liked what Equals had to say, and the shares jumped 11% on Tuesday – creating a burst of bullish momentum on the price chart which should continue to reverberate for weeks to come.

Despite Tuesday’s rally, we believe Equals remain attractively priced…

The shares currently trade on a forward PE of 16 which looks very modest compared to forecast earnings per share (EPS) growth of 172%. This gives Equals one of the most attractive Price to Earnings Growth (PEG) ratios on AIM at 0.3 (anything less than one is eye catching).

Alongside its strong growth metrics, Equals also meet our quality requirements – operating a debt free balance sheet which has net cash of £15m and positive Free Cashflow.

With Tuesday’s trading update blowing wind in their sails, we believe the time is right to add Equals to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.