Regency View:

BUY EQTEC (EQT)

Turning our trash into fuel

In June we released a free report looking into the waste-to-energy sector.

Waste-to-energy facilities generate renewable energy from non-recyclable and non-compostable waste that would otherwise be landfilled.

Modern waste-to-energy processes represent a highly compelling cog in the ‘go-green’ machine, reducing our plastic waste accumulation while simultaneously addressing the need for an alternative fuel source.

The global waste-to-energy market is estimated to be worth $17.9 billion and is expected to reach 2.9 billion by 2026.

In our report we compared two stocks within the sector, EQTEC (EQT) and Powerhouse Energy (PHE) with EQTEC comprehensively coming out on top due to its superior technology, commercialisation and financials.

We mentioned in the report that we were looking for technical catalyst, and as we’ll later explain, with this in place we’re happy to add them to our AIM Investor portfolio.

Patented Technology

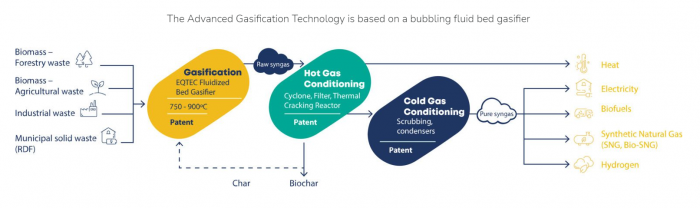

EQTEC’s patented Advanced Gasification technology converts a wide range of waste products such as biomass, industrial waste, and plastics into synthesis gas or ‘syngas’.

The process uses something called a ‘bubbling fluid bed gasifier’ to generate raw syngas from the waste.

The raw gas is then cleaned through a series of hot and cold gas conditioning processes.

The cleaned syngas is then used as fuel to generate electricity and heat, or as a commodity, to produce transportation fuels, Synthetic Natural Gas (SNG) and green hydrogen.

What makes EQTEC’s Advanced Gasification technology unique is that it produces high purity syngas without the use of combustion – giving it a much cleaner emissions profile than other waste-to-energy processes.

Operations

EQTEC have made significant progress in commercialising their Advanced Gasification technology, and several key global partnerships have been signed over the last 18-months including:

Phoenix Energy partnership: EQTEC has signed a Framework Agreement with US Power company, Pheonix Energy to jointly develop biomass gasification power projects in the US, generally between 2 to 3MW in size, with an estimated project value between $15 and US$20 million.

It’s first project, currently under construction is a forestry waste plant called North Fork in California.

World’s first olive pomace waste to energy plant: Spain produces approximately four million tonnes of olive pomace waste annually. Because it contains high concentrations of polyphenols, lipids and organic acids, if olive wet pomace is not properly dried and disposed of, it seeps into the ground, changing the acidity and polluting soil and water. In 2011, EQTEC built a gasification plant in Spain to help solve this problem.

EwerGy joint agreement: Early last year, EQTEC signed a Collaboration Framework Agreement with German Engineering, procurement, and construction (EPC) company ewerGy for the development of a portfolio of projects in Greece and the Balkan Region.

UK RDF Plants: EQTEC have signed three different agreements to build Refuse Derived Fuel (RDF) plants throughout the UK in Billingham, Mersyside and North Wales.

Technical catalyst now in place

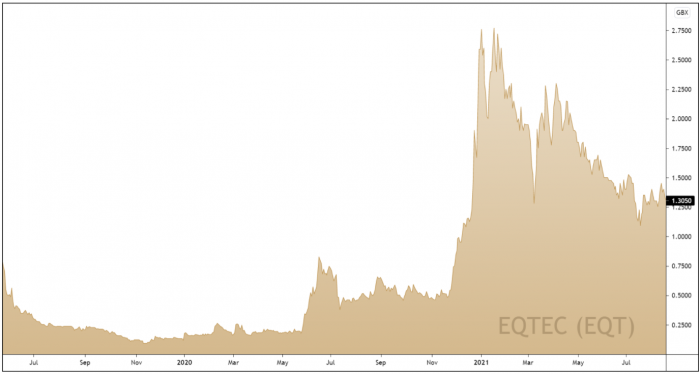

We highlighted in our waste-to-energy report that whilst we liked EQTEC, it lacked a technical catalysts for entry as the shares retraced the 500% rally which took place between Nov-Jan…

In recent weeks we have seen EQTEC’s share price respond to the long-term support zone created by the March swing lows at 1.22p and the broken June 2020 highs at 0.88p.

We have also seen prices break and retest the descending retracement line (gold dotted line) – indicating that EQTEC is ready to resume its long-term uptrend.

Profits forecast to more than double in 2022

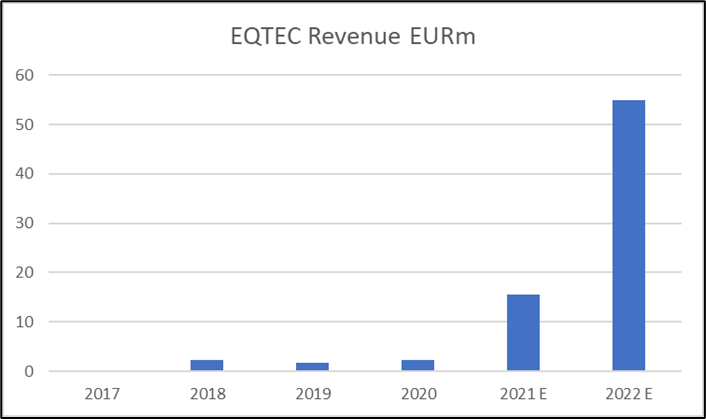

EQTEC’s sales growth is starting to accelerate with forecasts projecting an exponential rise in revenue over the next three-years.

According to EQTEC’s last trading update, the Company added non-contracted tender opportunities worth a total potential of €316 million for a total potential pipeline value of €657 million (for the period July 2020 and February 2021). Over the same period the Company sent full commercial offers worth a total of €246 million.

This steepening sales growth is set to see EQTEC post a maiden profit of in 2021 with profits forecast to more than double in 2022.

EQTEC also have a solid debt-free balance sheet with net cash of £6.39m (FY 2020). The balance sheet was enhanced in May with a £15m capital raise via an offer of 200m new ordinary shares.

With a technical catalyst now in place, and EQTEC’s profitability set to accelerate, we believe they represent a good long-term addition to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.