15th Feb 2024. 9.00am

Regency View:

BUY Eleco (ELCO)

Regency View:

BUY Eleco (ELCO)

Eleco: Orchestrating growth through SaaS

Momentum investing thrives when the mood music in the market aligns with opportunity…

In the case of Eleco (ELCO), a specialist software provider for the construction industry, the harmonious blend of positive market sentiment fuelled by a rebound in tech stocks and strong-recent trading update has orchestrated a compelling investment opportunity.

Global business model

Eleco’s strategic focus is on digital transformation, providing software solutions to support various stages of the building lifecycle. Eleco has evolved into a high recurring revenue, Software as a Service (SaaS) driven business, leveraging technology to meet the evolving demands of the construction sector.

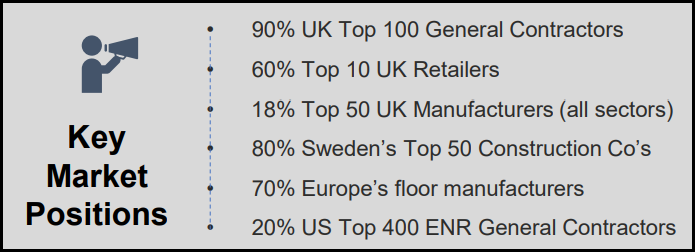

Eleco is a global business due to its strategic presence in key international markets, including the UK, Scandinavia, Germany, the Netherlands, and the USA. Through its diverse portfolio of software solutions, Eleco has successfully expanded its footprint, making it a significant player on the global stage.

Key products and brands:

Eleco’s key product portfolio caters to specific aspects of the building lifecycle:

Elecosoft: Eleco’s a primary brand, provides integrated software solutions featuring products like Bidcon for project management and estimation, IconSystem for project visualisation and management, Asta Powerproject for project planning and control.

Veeuze: Specialises in personalised product visualisation for marketing purposes. Solutions include ConfiMerce for enhanced customer experiences, InteriorStudio for interior design visualisation, and MarketingManager for marketing visual management.

Staircon: Focuses on stair design and production.

BestOutcome: A recent acquisition which enhances Eleco’s capabilities in Project Portfolio Management (PPM) software.

Revenue generation:

Eleco generates revenue through a combination of software sales, subscription licenses, contract values of annual support and maintenance, and SaaS contracts. The transition to a SaaS model has contributed to the company’s record growth in recurring revenue. Key revenue streams include:

- Software sales: Revenue generated from the sale of software licenses to clients in the construction and built environment sector.

- Subscription licenses: Recurring revenue from ongoing subscriptions for the use of Eleco’s software products.

- Support and maintenance contracts: Revenue derived from contracts providing ongoing support and maintenance services for the software.

- SaaS contracts: Revenue from SaaS contracts, where clients pay a recurring fee for accessing and using Eleco’s software solutions over the cloud.

Growth strategy

Eleco are taking a three-pronged approach to growth under their new SaaS model:

Higher margin products: Eleco are focussing on higher-margin core products, streamlining its portfolio to include essential solutions for the building lifecycle. This targeted approach maximizes profitability and underscores Eleco’s commitment to delivering high-value offerings to its clients.

US expansion: International expansion is a key component of Eleco’s growth strategy, with a specific focus on the United States. The company has introduced a direct sales approach and invested in sales and marketing – successfully acquiring over 40 new direct customers in the US already.

Product innovation: Yes, product innovation is one of those bland terms which are banded around by every tech company, but Eleco’s commitment to innovation is evident through its numerous awards. For example, the consistent recognition of Asta Powerproject as ‘Project Management Software of the Year’ at the UK Construction Computing Awards for ten consecutive years underlines Eleco’s dedication to delivering cutting-edge and award-winning solutions.

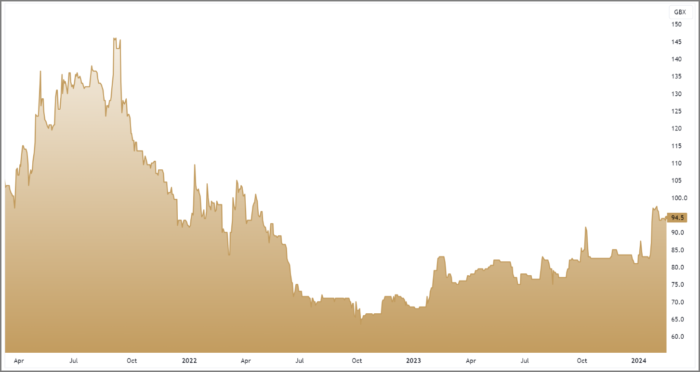

Bull flag follows ‘gap and go’ Trading Update

In Eleco’s recent Trading Update for the year ending December 2023, the company reported record growth in Annualised Recurring Revenue (ARR) and Total Recurring Revenue (TRR), reflecting progress on its growth strategy.

ARR was approximately £22.6m, marking a 24% increase from the previous year, while TRR increased to approximately £20.7m, up by 22%. Anticipated revenues for 2023 were estimated to be £28.0m, ahead by 11% in underlying and constant currency terms compared to the prior year.

The reported revenues exceeded expectations causing the share to ‘gap and go’ higher. Price action following the initial burst of momentum has seen the shares consolidate within a small ‘bull flag’ pattern – creating a short-term catalyst for timing our entry.

In terms of long-term valuation, the shares score higher for quality than they do for value and this reflects out approach to small cap investing.

We believe that quality, as defined by a strong balance sheet, stable revenue streams and consistent profitability will allow small-cap investors to reap the highest rewards without fear of dilution.

Eleco, fall into this category and we’re excited to add this stock to our list of AIM Investor open positions.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.