Regency View:

BUY eEnergy (EAAS)

A lightbulb moment in the go green revolution

Going green may be a necessity, but for most organisations it is neither cheap nor convenient…

Just to swap the lighting in a large secondary school from florescent to energy saving LED’s is estimated to cost of £200,000!

The large upfront costs, combined with the crimpling impact of the pandemic and the time-pressure of moving UK plc to net zero, has seen upswell in demand for services that can make going green more financially viable.

eEnergy (EAAS) help businesses and public sector organisations to unlock the long-term energy savings associated with going green, without the upfront costs.

The company posted a maiden profit in 2021 and is forecasting earnings per share (EPS) growth north of 133% over the next two years, making their modest forward PE ratio of 11.8 look attractive.

And with regulatory tailwinds blowing ever stronger, and a technology platform tailor made for expansion, eEnergy’s long-term prospects look highly compelling.

eLight’s organic revenue growth shining bright

eEnergy’s core business is eLight which provides Light as a Service (LAAS) to businesses and schools.

eLight enables its customers to transition to energy saving LED lighting for a fixed monthly fee.

The monthly fee usually knocks more than 30% off the customers lighting bill, and eLight handle all the upfront cost, installation, and maintenance. In return, eLight get a sticky 5-7 year contract which scales very nicely into a high-margin revenue stream.

This ‘win-win’ business model has proven very popular, and eLight has grown rapidly since the business launched five years ago…

So far, eLight has completed over 1,000 projects around 200 of which have been for schools.

Last year, eLight delivered organic revenue growth of 75% on sales of £7.9m (Full-Year 2021 to end June). The number of eLight projects increased by 69% to 211 during the same period with average revenue per project increasing by 52%.

There is significant scope for organic growth in both the public and private sector…

Some 80% of the UK’s 32,000 schools still rely on old lighting, representing a large untapped market.

And in the private sector, 80% of buildings are yet to convert to LED, and European legislation is forcing landlords to comply with energy efficiency targets.

A clear growth strategy

The Energy as a Service (EAAS) market is set to double over the next five years to be worth £25bn and eEnergy’s co-founder and CEO Harvey Sinclair is looking to take full advantage…

Having setup online recruiter Hotgroup in 2000, which he sold for £50m six years later, Mr Sinclair has ambitious plans to more than triple eEnergy’s £50m market cap…

Mr Sinclair’s long-term vision for eEnergy centres around providing customers with three inter-linking services:

- Energy savings – offering a transition to green energy with no upfront costs.

- Green energy management – switching customers to a green energy supply with accurate auditing processes.

- On-site power production and storage – utilising technology to allow customers to go off grid.

eEnergy plan to achieve this through organic and acquisitive growth…

In September, eEnergy acquired UtilityTeam, a top 20 energy consulting and procurement business whose services aim to reduce costs for clients whilst supporting their transition to Net Zero.

UtilityTeam has strong recurring revenues from its industrial and commercial customers, and the deal, worth £21m is expected to be “significantly earnings enhancing immediately”.

eEnergy also have the brand Beond, which combined with UtilityTeam forms eEnergy’s Energy Management division.

And eEnergy have also moved into the smart-metering space with an investment in MY ZeERO, a platform which gathers circuit level data ‘behind the meter’ which enables eEnergy to provide clients with granular visibility of their energy consumption and wastage.

Swing into profit signals the start of earnings momentum

eEnergy have successfully navigated the early ‘cash burn’ phase and the business moved into the black in 2021, posting a Full-Year 2021 operating profit of £0.249m.

Buying eEnergy at this stage means reduced risk without sacrificing earnings growth…

Revenues are forecast to nearly triple within the next two financial years and earnings are set to follow suit as margins improve.

eEnergy’s balance sheet is debt free with a modest £3.47m (Full-Year 2021) cash position.

This does mean that eEnergy’s ‘buy and build’ strategy is likely to be funded through share placings, as was the case with the UtilityTeam acquisition.

However, the use of a placings to fund earnings-enhancing acquisitions is very different to raising capital with a view to stabilising a balance sheet.

And over the long-term, we believe eEnergy’s shareholders are likely to reap the benefits as the business continues to build scale.

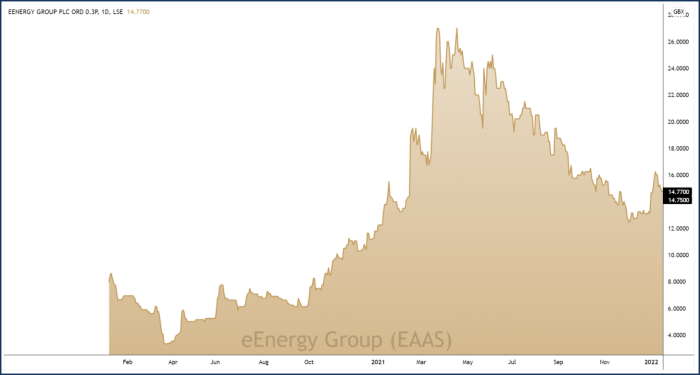

Shares snap downtrend after months of retracement

eEnergy’s share price surged higher from Oct 2020 – March 2021, with prices increasing six-fold as investors clamoured for green stocks.

Exponential moves of this nature are rarely sustainable, and eEnergy’s share price has spent the last nine months retracing those Q1 2021 gains. And the shares have now erased more than 70% of their ‘green stock bonanza’ bull run.

Importantly, eEnergy’s recent price action has seen the shares stabilise and snap the downtrend created by the retracement – breaking well above their descending trendline (see chart right).

We’ve been patiently waiting for short-term price momentum to realigned with the bigger picture, 3-year technical backdrop, and with this now in place, we are more than happy to add the stock to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.