16th Jan 2020. 8.58am

Regency View:

BUY Eckoh (ECK)

Regency View:

BUY Eckoh (ECK)

Eckoh making all the right noises

Data security and payment protection is a space that interests us greatly for several reasons:

Our ever-digitised lives have seen a rapid expansion in remote payment technology, an expansion which is increasing our digital footprint faster than businesses can protect it.

Payment fraud is growing year-on-year and organisations are under significant pressure from regulators to make sure customer transactions are secure.

We believe we’ve found another gem in this space which, alongside GB Group, will fit perfectly into our AIM Investor portfolio.

Meet Eckoh (ECK)…

Eckoh provide secure payment products and customer contact solutions, helping businesses take payments securely across multiple channels.

Its patented payment products, including CallGuard and EckohPAY can be hosted in the Cloud or deployed on a client’s website. The products are designed to remove sensitive payment data from contact centres and IT environments, offering a low-touch way for businesses to reduce the risk of fraud, secure sensitive data and comply with key regulation such as the Payments Card Industry Data Security Standards (PCI DSS).

Regulatory Tailwinds Propel US Growth

A background of tightening payment regulation and a series of high-profile ‘mega fines’ for non-compliance has created a growing sense of urgency around payment security which is proving extremely advantageous for Eckoh, especially in the US.

A new version of PCI DSS comes into effect this year along with the US version of the General Data Protection Regulation (GDPR) which is state-lead and has just been approved in California.

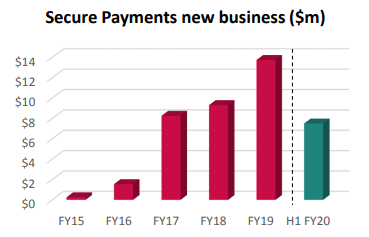

Eckoh’s US secure payments business surged 103% in the first half of 2020 and according to CEO Nik Philpot, this growth is being driven by the increased regulation – “if they were on the fence before about working with us they’re coming off the fence now”… “firms want to reduce their cost of compliance, make themselves more secure and work with somebody like Eckoh”…

He continued…“we’re winning more deals, the sales cycle is coming down and the value of those deals are going up”.

Eckoh’s US business now accounts for 42% (H1 2020) of revenue, up considerably from 28% in H1 2019 and US revenue is expected to overtake UK within the next two years. Indeed, the US market is 7-8 times the size of the UK and its actually less competitive, “we still don’t have a domestic competitor in the US and now that we’re deploying these massive US corporations we’ve got fantastic reference sites so it’s looking increasingly unlikely that a big new entrant from the US will enter the market” comments Nik.

In the UK, Eckoh have used high profile partners including BT, Capita and Teleperformance to drive growth.

‘Digital Transformations’, where large businesses seek to manage the challenge of multiple engagement channels is seen as a key growth factor in the UK market. Through Eckoh’s self-hosted Experience Portal, customers can add solutions very easily – making it easy to cross sell. During the first half of Eckoh’s financial year, over 40% of new UK business came from existing customers – underlining Eckoh’s cross-selling capabilities.

Eckoh’s premium valuation is justified

Eckoh trades on a forecast earnings multiple of 34 so it can’t be considered cheap. However, with a near perfect client retention rate, forecast earnings per share (EPS) growth of 45% and high visibility over future earnings, we believe Eckoh’s premium valuation is justified.

The firm have a rock-solid balance sheet and over £11m in cash. Given the significant opportunity for organic growth in the US market, it’s likely that Eckoh’s cash pile will be used to reward investor loyalty rather than fund acquisitions.

Shares Break Key Resistance

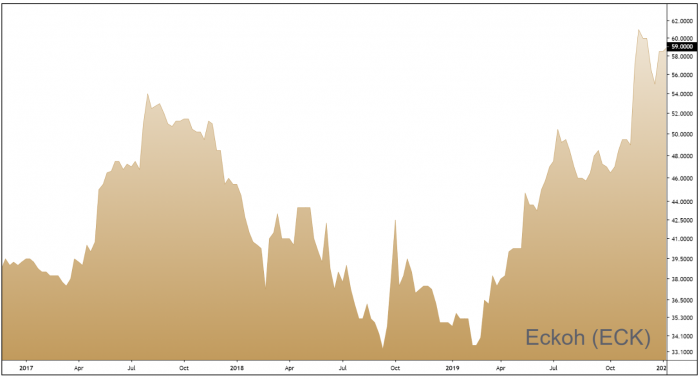

It is said that ‘markets have a memory’ and this is true of even small cap AIM-listed stocks like Eckoh…

For the last four years, every time Eckoh’s share price hit 54p, sellers stepped in to drive prices lower. These ‘psychological price points’ become almost self-fulfilling in nature, that is until they are eventually broken. Eckoh’s impressive November HY numbers saw the shares burst through the 54p barrier and we are now seeing evidence that 54p will be used as a platform of support going forward.

We believe the ‘break and retest’ of such a key technical level opens the door for more substantial push higher.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.