15th Apr 2021. 8.57am

Regency View:

BUY Eckoh (ECK) – Second Tranche

Regency View:

BUY Eckoh (ECK) – Second Tranche

Eckoh’s key contract wins kick-start new leg higher

We originally added secure payments company Echok (ECK) to our AIM investor portfolio back in January 2020 – not ideal timing in hindsight!

However, high-quality stocks like Eckoh have proven their resilience during the last year, and with recent news of US sales momentum, we’re looking to add a second tranche to our portfolio…

To recap, Eckoh provide secure payment products and customer contact solutions, helping businesses take payments securely across multiple channels.

Its patented payment products, including CallGuard and EckohPAY can be hosted in the Cloud or deployed on a client’s website.

The products are designed to remove sensitive payment data from contact centres and IT environments, offering a low-touch way for businesses to reduce the risk of fraud, secure sensitive data and comply with key regulation such as the Payments Card Industry Data Security Standards (PCI DSS).

Key US contract wins

In our original recommendation, we highlighted the importance of the US market to Eckoh’s growth story…

A backdrop of tightening payment regulation and a series of high-profile ‘mega fines’ for non-compliance has created a growing sense of urgency around payment security which has only heightened during the pandemic.

At the end of March, Eckoh announced $11.6m of new contracts in US Secure Payments – comfortably exceeding their Full-Year 2020 total of $10.7m.

The number of individual contracts won in the year is also the highest since Eckoh entered the US market.

Commenting on Eckoh’s momentum in the US, CEO Nik Philpot said:

“The excellent performance of Eckoh’s US Secure Payments business has been very satisfying, as it was one of the hardest hit in the first few months of the pandemic. Despite those challenges, with record numbers of contracts signed and new contract value beating last year’s total, this clearly illustrates Eckoh’s momentum in the attractive Secure Payments market.”

Cloud delivery a crucial advantage

Since the pandemic, Eckoh has noted a significant increase in demand for their Cloud platforms.

“Where possible, organisations have fast-tracked their plans to deploy in the Cloud, a trend accelerated by the circumstances of the pandemic” read their latest update.

More than half the contract value Eckoh has won, and more than 80% of the number of contracts, have been for Cloud delivery.

It is Eckoh’s proven ability to successfully deliver solutions both on premise and in the Cloud which has been a crucial advantage that has seen Eckoh take a market leading position in the US.

Paying up for quality

Just like when buying a new suit, you typically get what you pay for…

Eckoh trades on a punchy forecast earnings multiple of 38.7, but this is a small stock with a foothold in a giant market. The payment security industry has significant long-term growth drivers which show no signs of slowing.

It’s also worth noting that Eckoh have an exceedingly low customer churn rate – creating levels of recurring revenue north of 70%.

Gap and go

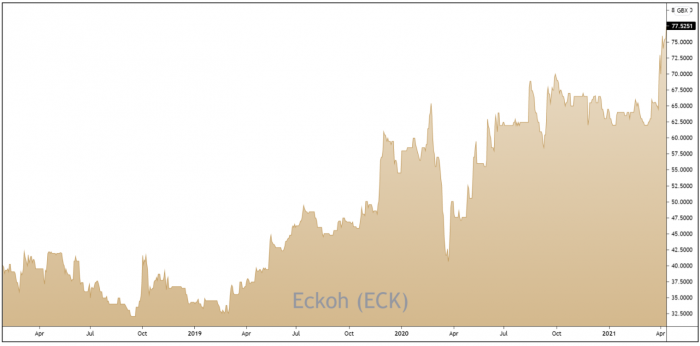

Eckoh’s share price gapped higher on the back the US contract win news at the end of March.

This burst of bullish momentum has seen the shares break through a key resistance zone created by the summer 2020 highs.

Prior to the breakout, the shares had spent months chopping sideways within a narrow range – creating plenty of stored potential for the current directional push higher to run for a considerable length of time.

With momentum building on both the price chart and in Eckoh’s US sales numbers, we feel adding a second tranche is more than justified.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.