Regency View:

BUY Ebiquity (EBQ)

Ebiquity drive marketing efficiency

“Marketing budgets are investments to be protected, not costs to be cut”.

The words of Ebiquity (EBQ) CEO, Nick Waters when addressing analyst concerns that a global recession will equate to slashed marketing budgets.

Mr Waters’ is hardly an unbiased opinion, but based on Ebiquity’s current strong performance, he has a very valid argument…

Ebiquity is an independent media investment analysis house. They help advertisers to understand if they’re spending their marketing budgets wisely.

The global advertising market is vast with a total annual spend of $750bn, but even if you just take Ebiquity’s primary target customer, the world’s 100 largest advertisers who spend more than $100bn every year buying media, there is significant scope for Ebiquity to add value.

Ebiquity’s half year results, released last week, saw revenue climb 16% to £37.2m and underlying operating profit jump 117% to £5m in the six months to end June 2022.

And whilst a global slowdown in economic growth is never a good thing for advertising budgets, it’s unlikely to dampen demand for Ebiquity’s insights which aim to help advertisers get a bigger bang for their buck in terms of value for money and efficient ‘channel mixes’ of media.

Small stock with a big, blue-chip client base

Those of you who follow our AIM Investor research closely will know that we like to find small companies that have big, blue chip client bases…

A blue-chip client base brings revenue stability, geographical diversification, and powerful growth potential.

Ebiquity is a great example of this. They have a small market cap of just under £60m, but they count 70 of the world’s top 100 advertisers as clients.

Operating from 21 offices globally, Ebiquity have over 450 media specialists – analysing $55bn of media spend in over 75 markets. Ebiquity’s Contract Compliance department, called FirmDecisions analyses over $40bn worth of contracts annually.

Through a combination of organic and acquisitive growth, Ebiquity has increased its presence in the world’s two largest media markets: North America and China…

Acquisitions of MMi in the US and Forde & Semple in Canada have seen Ebiquity’s North American revenues surge 90% in the first half of the year. And the increased scale has already seen costs drop by 11% and operating margins rise to 16%.

Asia Pacific is Ebiquity’s fastest growing region with organic revenue up 38% and half year revenue in China alone grew 27% on an organic basis.

Ebiquity also saw a “strong performance” in the more mature region of Continental Europe with organic revenue up 13% in the first half of the year.

80% discount to Fair Value

Ebiquity’s strong position in the global advertising market is in contrast to its current valuation…

Investors are being asked to pay 7.5 times forward earnings, which looks very reasonable given a forecast earnings per share (EPS) growth of 47.5%.

Ebiquity has a Price to Sales ratio of just 0.96 which compares favourably to its peer group. And when viewing the stock’s valuation in the context of discounted future cashflows, Ebiquity has an estimated Fair Value of £3.60p per share – putting the current share price at an 80% discount.

On the balance sheet, which isn’t as shiny and cash-rich as we typically look for, net debt is £10.7m.

However, this is largely explained by the key North American acquisitions made last year, and we expect the increased cash flow and efficiencies created by the deals to boost the balance sheet for year end.

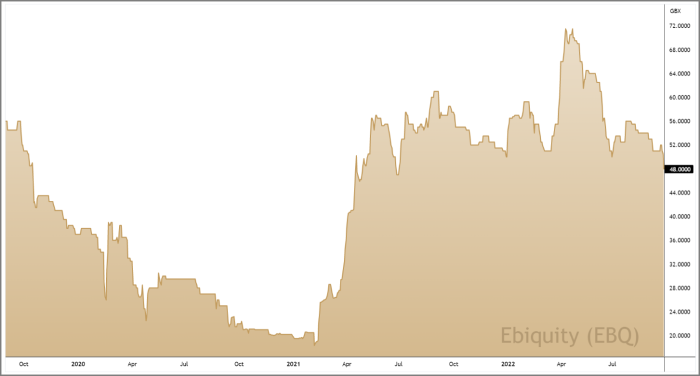

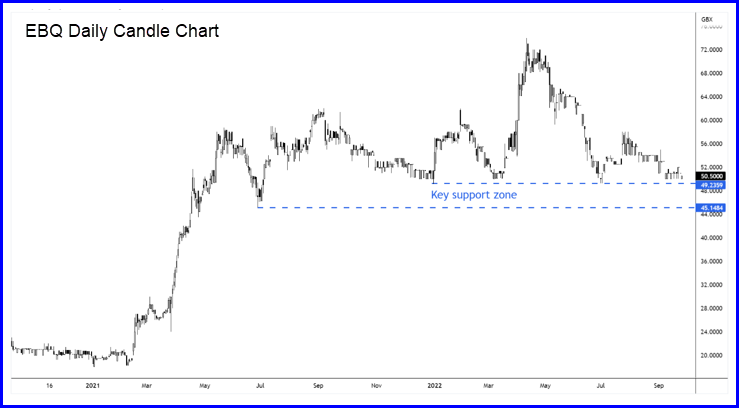

On the price chart, Ebiquity’s share price has pulled back to a key ‘zone’ of support created by the cluster of swing lows which formed this year at 49p and the June 2021 swing low at 45p.

In summary, Ebiquity offer attractively priced exposure to the global advertising market, and their focus on driving efficiency for their blue-chip clients should see revenues remain resilient.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.