15th Jun 2023. 8.58am

Regency View:

BUY Duke Royalty (DUKE)

Regency View:

BUY Duke Royalty (DUKE)

Duke Royalty reigns with income and value

Ever heard of royalty finance? We hadn’t either until Duke Royalty (DUKE) caught our attention on our stock screens.

Royalty finance is a fascinating hybrid that sits between private credit and private equity, catering to owner-operators who value maintaining control of their business.

In North America alone, the royalty finance sector is worth £50bn, and now Duke Royalty is pioneering the use of this innovative “corporate mortgage” model in the UK and Europe, with tremendous success.

The business is firing on all cylinders, generating robust levels of recurring revenue from its increasingly diversified portfolio and delivering substantial income for its shareholders.

A Unique Model: Silent Partnership for Profitable Returns

Duke Royalty provide capital to other companies in exchange for a share of their revenues, known as royalties. It’s like being a silent partner who gets a piece of the pie without getting involved in the day-to-day operations.

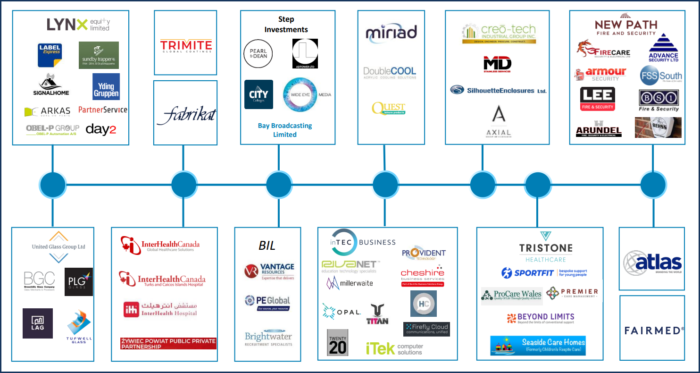

What’s appealing about Duke Royalty is that they have a diversified portfolio of 57 operating companies across 14 royalty partners. They invest in various sectors and geographies, spreading their risk. This means that even if one industry or region faces challenges, they have other investments to balance it out. It’s like having a mix of stocks in your investment portfolio, reducing the impact of any single investment.

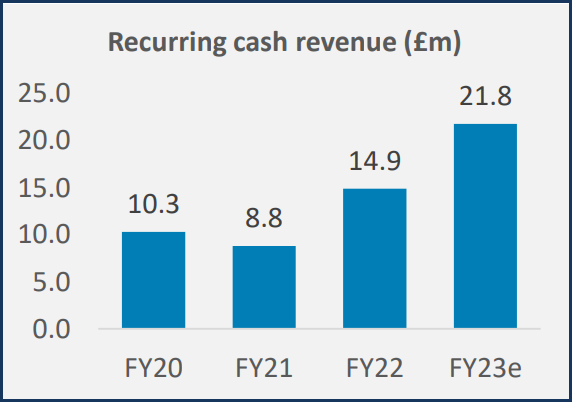

One of the attractive aspects of Duke Royalty’s model is the steady income stream the royalty payments provide. As their investee companies generate revenue, Duke Royalty gets a portion of that through their royalty agreements. This is a nice source of consistent cash flow which has enabled Duke Royalty to become one of the top income stocks in its sector and the wider market.

Duke Royalty pay dividends quarterly and the stock has a forward dividend yield of 8.94%. Whilst dividends are not guaranteed, Duke Royalty’s dividend is comfortably covered more than twice over by future earnings.

But it’s not just about income. Duke Royalty also offers potential for capital appreciation. As they continue to identify and invest in promising businesses, their portfolio value can increase over time. This growth potential adds an extra layer of excitement for long-term investors who want both income and the potential for their investment to grow in value.

Another positive point is the experienced management team at Duke Royalty. CEO Neil Johnson had over 15 years of experience bringing successful Canadian ideas to the UK market before he started Duke Royalty with colleague and CIO, Charlie Cannon-Brookes. With a proven track record in royalty financing, there is a high degree of confidence in their ability to seize promising opportunities and drive the company’s success.

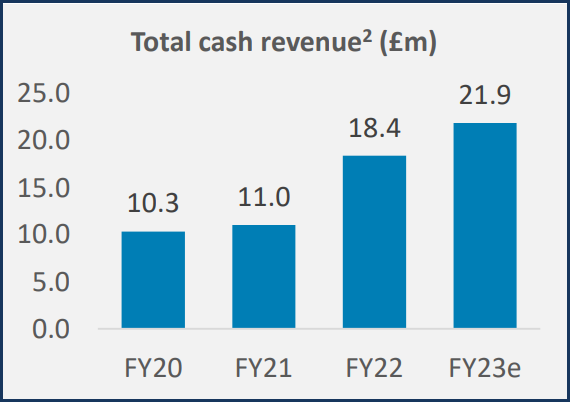

Record-breaking revenue sparks bullish breakout

Duke Royalty recently unveiled an impressive trading update, signalling a bullish end to their financial year. In the fourth quarter of FY23, they achieved record-breaking recurring cash revenue of £5.7m, marking a 21% increase compared to the same period the previous year.

In terms of operations, Duke Royalty has been busy making strategic moves. They closed a credit facility with Fairfax Financial Holdings Limited, which not only gives them more financial flexibility but also lowers their interest costs.

On top of that, they made a substantial new royalty investment in Instor Solutions, a California-based company involved in data center services. Plus, they continued to support their existing partners by investing in Intec Business Solutions Limited to facilitate their acquisition of Frog IT Services Limited.

Looking ahead to the first quarter of FY24, Duke Royalty expects to achieve recurring cash revenue of £6m. If they succeed, it will be a significant milestone for them, with an average monthly revenue of £2m for the first time in their history. That’s impressive growth, representing an 18% increase compared to the same period last year.

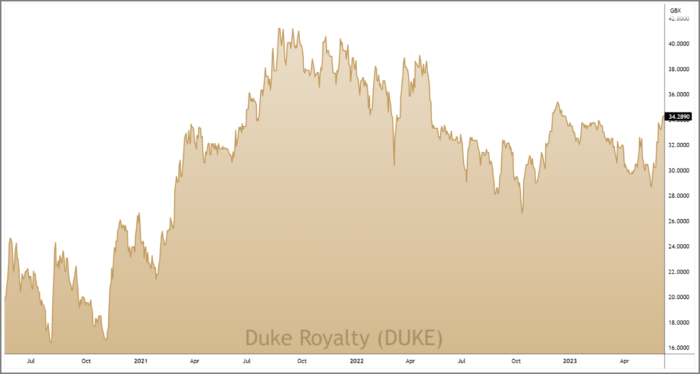

On the back of the bullish update, Duke Royalty’s share price broke above the descending channel which had been in place since the turn of the year. And this bullish momentum should propel the shares towards their 2021 highs at around 42p, which is some 25% above current prices.

Compelling valuation and significant upside potential

On a forward valuation basis, Duke Royalty offers attractive levels of value. Investors are being asked to pay nine times future earnings which compares well to the Investment Banking & Investment Services sector.

Price to Free Cashflow is also low at 9.5 and another measure of value, Enterprise Value to adjusted earnings (EV to EBITDA) comes in at 5.80 which is also low relative to its peer group and the wider market.

In terms of cash flow modelling, Duke Royalty’s stock holds a Fair Value estimate of 71p. This figure surpasses the current share price by more than double, further underscoring the company’s attractiveness in terms of value.

Overall, Duke Royalty’s compelling valuation metrics and significant upside potential highlight its standing as one of AIM’s most eye-catching stocks.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.