2nd Jul 2020. 9.01am

Regency View:

BUY Craneware (CRW)

Regency View:

BUY Craneware (CRW)

The little Scottish firm with a key foothold in the US healthcare market

Throughout the last century, developments in technology have delivered miraculous advances in medicine. Incurable diseases have been eradicated and conditions that were once death sentences are now vanquished with a quick pill or surgical fix.

But underneath all this progress lies a tumour that is weighing down the entire health care industry – its limited financial system. While medical care and technology itself has advanced to greater heights, the underlying business and financial functions have failed to keep pace.

A small, Edinburgh-based software business is helping to change this and bring the archaic health care financial system into the 21st century…

A business that benefits its client’s bottom line

Craneware provides billing and healthcare analytics software to hospitals and pharmacies.

The private healthcare system across the pond is the perfect market for Craneware’s cost-saving software. Research suggests that the average 350-bed hospital misses out on $22m in revenue capture opportunities every year due to a lack of financial automation.

Many key tasks such as client tracking and billing are still done by admin staff using spreadsheets, creating significant scope for human error. Craneware’s Chargemaster and Pricing Analyser software automates the client authorisation code journey. This ensures that each patient gets tracked right through the treatment process, helping hospitals to more effectively price, code, charge and retain earned revenue for patient care services and supplies.

Craneware’s software is used by just under a third of US hospitals and like all the best Software as a Service (SAAS) businesses, contracts are multi-year and very sticky, making future income visible, high margin and cash generative.

Transition towards value-based healthcare will drive Craneware’s growth story

When it comes to healthcare, higher per-person spending does not always equate to higher-quality care. In the 2019 Deloitte Global Healthcare Report, when compared to 10 developed countries, the United States ranked last in overall health care performance, highlighted by per capita spending that is 50% greater than the next country and last place rankings in efficiency, equity, and healthy lives.

With the traditional ‘fee-for-service’ health care payment model failing there is growing demand for a new value-based approach.

Under a value-based approach, hospitals are held accountable for what value they bring and not what laundry list of treatments they doll out. They are required to have a far greater understanding of their costs, the value they provide and their impact on the total cost of care. This of course plays straight into Craneware’s hands whose software is perfectly designed to meet this growing demand.

Craneware’s revenue visibility is highly attractive

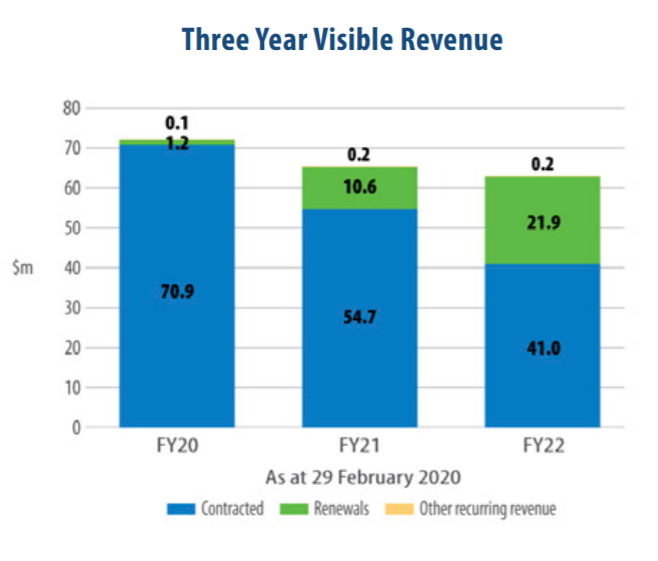

Craneware’s sticky SAAS model creates a fantastic level of earnings visibility.

In its February Half Year numbers, £65.5m of Craneware’s £72.2m FY20 revenue was recurring in nature – that’s a staggering 90% earnings visibility.

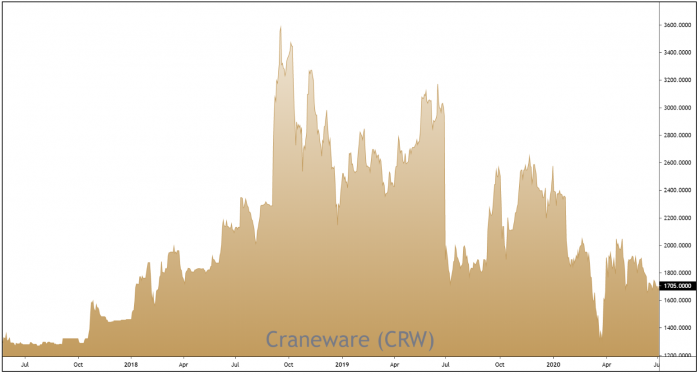

This goes some way to explaining why Craneware still trade on a premium forward earnings multiple of 32, despite a significant sell-off in its share price.

The primary cause of the sell-off was the loss of a hospitals network customer. This was due to changing management at the client end, meaning Craneware’s software was never fully integrated – implying a one-off issue which is now fully priced in.

Last year’s slowdown in sales also looks to be behind them, with first-half new sales were up by more than 30% – due largely to “expansion sales” to existing customers. This ability in generating growth by cross-selling its products, has been helped by the introduction of Trisus Health Intelligence, Craneware’s new cloud-based analytics platform that launched in 2019. The new platform combines the best of the firm’s core price, cost and compliance features with new financial, operational and clinical data tools.

Income and growth

Craneware is most definitely a growth stock but to dismiss its potential for escalating shareholder pay-outs over the coming years would be a mistake.

Its strong track record of revenue growth and free cash flow have seen its dividend rise consistently for the past five years.

This trend looks likely to continue long into the future and if you were to extrapolate the current growth rate over the next five years the dividend would almost double from last year’s 33p per share pay-out to about 60p.

Overall, we believe Craneware is highly deserving of a place in our AIM Investor portfolio. It’s unique position within the US healthcare sector should see it grow rapidly for years to come.