1st Feb 2024. 8.58am

Regency View:

BUY Craneware (CRW) – Second Tranche

Regency View:

BUY Craneware (CRW) – Second Tranche

Craneware: AI and US healthcare spending trends fuel growth

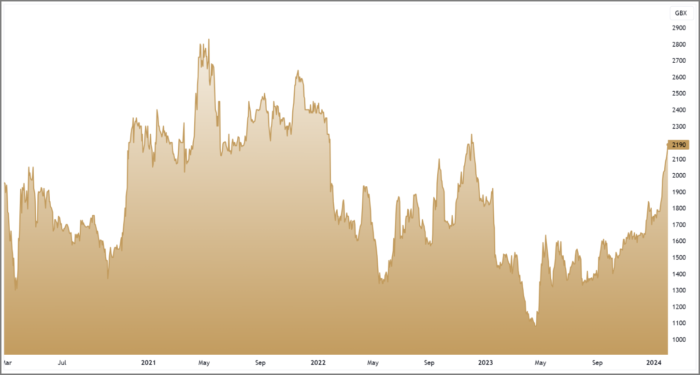

As we recently filtered through our earnings season winners and losers, it quickly became clear that one of our long-term positions has sprung back to life.

We have held Craneware (CRW), which provides billing and healthcare analytics software to US hospitals, in our AIM Investor portfolio since 2020.

Craneware finds itself uniquely positioned to play two key investment themes, the AI revolution and the rise in US healthcare spend. The businesses Software as a Service (SaaS) model generates recurring revenues north of 90%. And high levels of cashflow have created a rock solid balance sheet.

With earnings momentum starting to build again, we believe Craneware is set to bounce back in a big way in 2024.

Optimal pricing, streamlined pharmacy, and expert administration

Craneware specialises in healthcare software solutions, aiding organisations in managing finances and operations efficiently. Their product suite includes:

- Pricing and revenue solutions:

Products such as Trisus Pricing Transparency helps organisations meet regulatory requirements and provides valuable analytics to monitor market dynamics. And Trisus Pricing Analyzer simplifies and automates the price-modelling process, allowing organisations to assess the potential impact of pricing changes.

- Pharmacy solutions:

Craneware’s pharmacy solutions collectively streamline pharmacy operations, ensure regulatory compliance, and optimise benefits from the 340B program – a pricing which allows US hospitals and clinics that treat low-income and uninsured patients.

- Other solutions:

Craneware’s other solutions include; Professional Services which offer expertise in value cycle solutions, Appeal Services which provide experienced staff to review and overturn denials, and InSight Audit a powerful application facilitating streamlined audit reporting.

Confluence of two crucial trends

Craneware finds itself uniquely positioned at the intersection of two pivotal trends: the unrelenting rise of AI and the escalating spending within the US healthcare sector.

Craneware strategically applies AI to the intricate administrative challenges which occur in the US healthcare system. In the context of the surging spending within the US healthcare sector, Craneware’s role becomes even more crucial. The company specialises in providing tools and solutions that allow healthcare providers to make cost-effective decisions, directly addressing the need for financial efficiency.

As the Centers for Medicare and Medicaid Services predict a continuous increase in health spending as a share of GDP, Craneware is a key player. The company’s focus on reducing operational strains, wage inflation, and personnel shortages aligns seamlessly with the challenges contributing to the mounting healthcare spending in the US.

Craneware’s relevance is further emphasised as discussions often gravitate towards clinical “digital transformation” and the potential applications of AI in healthcare. Amidst these conversations, Craneware remains uniquely positioned to address the often-overlooked aspect of reducing the $1 trillion overall administrative burden on the US healthcare system.

By bridging the gap between AI advancements and the pressing need to control and manage healthcare spending, Craneware plays a pivotal role in shaping the future of efficient and financially sustainable healthcare administration.

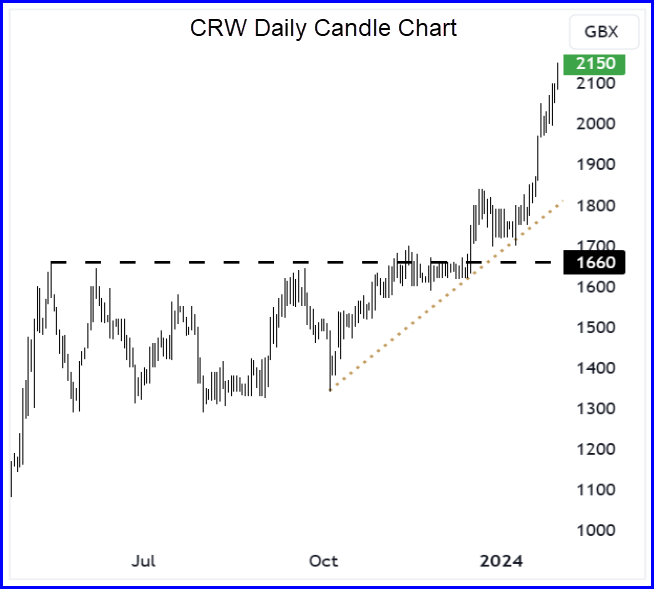

Bullish momentum backed by strong trading update

Craneware’s share valuation reflects a forward Price-to-Earnings (PE) ratio of 28.4, indicating a premium in the market. However, this valuation appears well-justified by the company’s strong fundamentals…

The high level of recurring revenue, standing at over $169 million in Annual Recurring Revenue (ARR) and constituting more than 90% of the group revenue, contributes to the company’s resilience and financial stability. The impressive cash generation and forecasted growth in Earnings Per Share (EPS) of 52.6% further support the premium valuation.

Craneware’s share price has plenty of bullish momentum and the shares have comfortably outperformed the wider market so far this year. This momentum is propelled by a recent strong trading update for the first half of FY24. The report highlighted an 8% growth in revenue, reaching approximately $91 million, and an 8% increase in adjusted EBITDA to around $27.5 million, in line with Board expectations.

Craneware’s trading update reinforced its financial strength, revealing a reduction in total bank debt to $59.2 million and substantial cash reserves of $63.9 million. The decision to extend the share buyback program until April 17th 2024, indicates confidence from the Board in the company’s financial health and growth prospects.

Craneware anticipates a return to double-digit growth rates in the near term, driven by its solid ARR foundation, diverse solutions in the Trisus platform, and substantial data flow. Overall, the combination of robust financials, positive trading results, and strategic positioning aligns with the upward momentum in Craneware’s share price.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.