7th May 2020. 8.59am

Regency View:

BUY Cohort (CHRT)

Regency View:

BUY Cohort (CHRT)

Chess and Battleships

From insect size drones to hypersonic missiles, warfare is a catalyst for technological innovation like no other.

Indeed, if the art of modern warfare is to defeat the enemy without ever fighting, then superior technology is a military’s deadliest weapon.

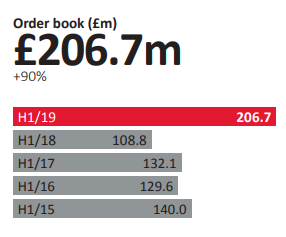

Today’s stock, Cohort (CHRT) is a parent company of five innovative businesses which supply the global defence and security market with cutting edge technology.

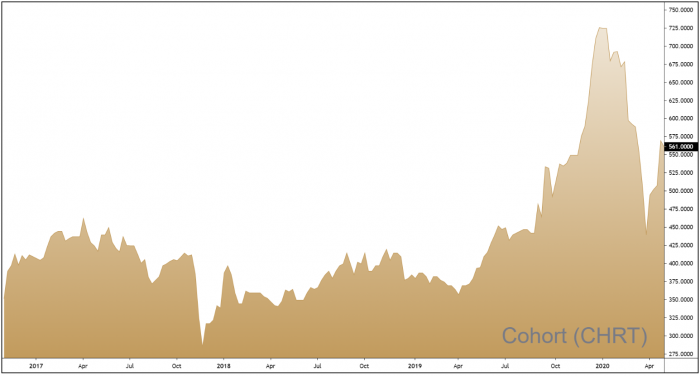

The group has seen profits quadruple in the first half of their financial year and its record order book is set to underpin a strong second half.

Cohort’s subsidiaries include:

Chess – a leading supplier of electro-optical and electro-mechanical systems designed for detecting, tracking, classifying and disrupting a wide range of naval, land and air threats.

Chess delivered 23% of group first-half revenues and contributes a third of total group profits. It is seeing strong growth in sales of its counter-drone system to military customers in the United States and Norway.

EID – a Portuguese high-tech company with significant experience in the fields of electronics, tactical communications, command and control.

EID delivered 10% of group revenues and turned a modest £0.1m profit for in the first half of the year. However, revenue and profits are expected to pick up considerably during the second half of the year due to a £37m strong order book.

MASS – a data technology company which provides electronic warfare operational support, cyber security, information management, digital forensics and training support to military operations.

MASS is the standout performer in the group, delivering a third of Cohort’s revenues and more than two-thirds of the group’s profits. Following “significant order intake” in 2018/19, MASS secured further renewals in the first half of 2019/20 and Cohort “expect it to maintain its order book into 2020/21”.

MCL – Marlborough Communications Limited (MCL) is a surveillance technology specialist who works closely with the UK MOD. The company’s portfolio includes signals intelligence, radio communication devices and electronic warfare systems.

In the first half of the year MCL delivered 12% of group revenue and 8% of group profits.

SEA – a producer of Maritime Missions Systems requirements, including communications, Torpedo and Decoy launching systems, Sonar systems, Infrastructure and Training.

SEA delivered 13% of group revenues but was the only subsidiary to produce a first half loss. This was largely due to investment in its anti-submarine warfare Krait Defence System, and “extensive bidding activities” on export opportunities for naval systems.

In December 2019, Cohort agreed to buy German naval sonar systems business ELAC for €11.25m (£9.5m).

ELAC is viewed as complementary to SEA and brings a presence in the German domestic market. The deal is expected to complete before 30 June 2020 but is subject to approval from the German government.

Operating Profit Quadruples

In January Cohort posted a stellar set of interim numbers which saw revenues almost double to £60m and operating profit quadruple to £4m.

Chairman Nick Prest CBE commented, “the order book of nearly £207m underpins a significant proportion of the second half revenue, and, as in recent years, we expect a stronger second half”.

Cohort also hiked their interim dividend by 12% to 3.2p per share – a trend that Cohort have maintained for the last five years and reflects management’s confidence in their strong outlook for the second half.

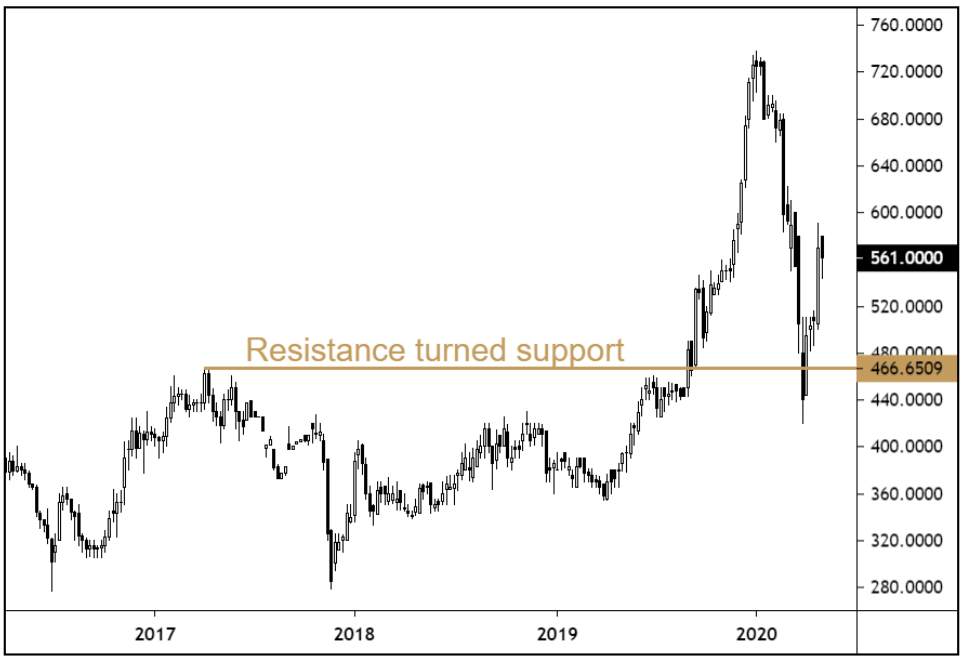

Resistance Turned Support

We’ve been waiting for an optimal entry point into Cohort’s long-term uptrend for more than eight months…

The shares surged past their 2017 highs at 471p in September last year, going on to hit highs of 737p in January. After undergoing a sharp sell-off in March, it came as no surprise to see buyers step back in at the broken 2017 highs. Indeed, broken resistance turning into new support is a key characteristic of a strong stock and Cohort’s share price has displayed this in almost text-book fashion.

After the March pullback there is more than more than 35% headroom to the January highs and with the shares trading on a very reasonable forward earnings multiple of 14.3, we believe Cohort will add value to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.