4th Aug 2022. 9.01am

Regency View:

BUY CML Microsystems (CML)

Regency View:

BUY CML Microsystems (CML)

The micro-cap microchip stock benefiting from global ‘mega trends’

Finding small stocks that have a foothold in global, growing markets is the primary reason we invest in AIM.

Today’s stock is a prime example of this…

CML Microsystems (CML) is a semiconductor chip designer and manufacturer that has a global, blue-chip client base.

The business is well managed, with a cash laden balance sheet, and revenues that are comfortably beating expectations.

And with a market cap that’s a mere fraction of its $1 billion addressable market, we believe CML is an exciting long-term investment.

Transmitting data faster and more securely

CML develop mixed‑signal, RF (radio frequency) and microwave semiconductors (chips) for the global industrial communications markets.

To put it simply, CML’s chips allow data to be transmitted faster and more securely…

They’re used in telecoms infrastructure, private commercial wireless networks, and satellite communications applications.

CML utilises a combination of outsourced manufacturing and in-house testing, employing more than 140 staff, of which around half are engineers, across operations in the UK, Asia and the US.

The business has been reshaped in recent years, ditching its solid-state storage division and snapping up chip design house, PRFI in 2020.

The acquisition of PRFI has been a game-changer for CML…

PRFI is an approved third-party design house for several leading global semiconductor companies, and they have expertise in microwave and millimetre-wave frequencies, including wide band applications for high data rate applications.

The reshaped business has a substantially widened product offering, a quicker time to market across several products and an expanded blue chip client base which includes many of the world’s Tier 1 equipment manufacturers and distributors.

Global ‘mega trends’ driving long-term growth

CML may be small, but their addressable market is large, global and backed by significant long-term drivers or ‘mega trends’.

- 5G, Satellite Communications and the Industrial Internet of Things (IIoT)

The industrial internet of things (IIoT) is the use of smart sensors and actuators to enhance manufacturing and industrial processes. Also known as the industrial internet or Industry 4.0, IIoT uses the power of smart machines and real-time analytics.

IIoT will rely heavily on 5G infrastructure such as base stations, small cells, distributed antenna systems, and satellite communications.

These areas are currently a relatively small part of CML’s revenue, but this is forecast to increase following the launch of a CML’s new range of high frequency, high bandwidth SµRF chips…

SµRF chips are integrated circuits targeting RF and millimetre-wave frequencies designed to support 5G and satellite communications.

First orders have already been received from early-stage adopters within vehicle tracking and smart grid applications.

- Private mobile radio and critical infrastructure

The majority of CML’s current revenues come from Professional Mobile Radios (used by police, ambulance service, military) and data-centric wireless applications for use in critical infrastructure, public utilities, smart grid.

These markets are stable, global and forecast to grow as demand for secure data transmission increases.

Impressive Full Year Results

Last month, CML published a strong set of Full Year 2022 Results which comfortably beat market expectations and underlined the current momentum within the business…

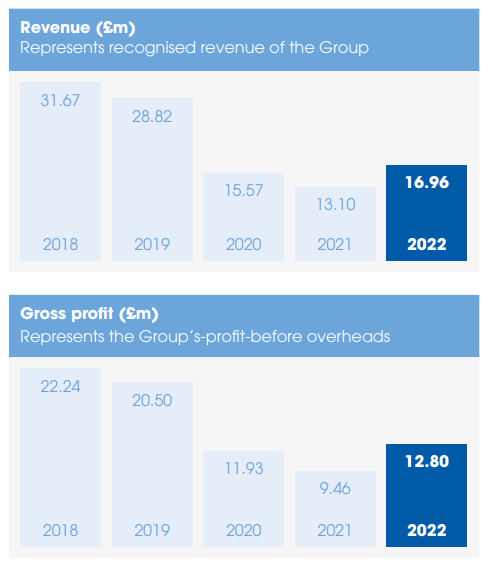

Revenues jumped 29% to £16.96m up from £13.10m the year prior – driven by the recovery in established voice and data-centric markets and secular markets, too.

Higher sales and a slightly improved margin due to product mix delivered a Gross Profit of £12.8m, representing an increase of 35% year-on-year (2021: £9.46m).

This is a very good result given the raw material price increases CML have had to face – indicating that they can successfully pass on price increases across its product range.

“The future has never been brighter for CML, and we are confident in growth for both the full year ahead and in the longer term” commented Exec Chair Nigel Clark.

Strong cash position and growth prospects justify premium valuation

CML’s forward price to earnings ratio of 27 looks justified given forecast earnings per share growth of 49.5%.

The stock’s valuation seems reasonable when looking at Price to Book Value (1.28) and Enterprise Value to Adjusted Earnings (EV to EBITDA).

It’s also worth noting that CML operate a strong, debt-free balance sheet which has a net cash position of £27m.

This cash position is likely to increase by around 50% when CML sell an investment property in Fareham and 19 acres of surplus land at the company’s Maldon headquarters.

Hence, CML will not have to dilute shareholders to grow, and CML can “move quickly if opportunities materialise” as commented by Mr Clark in their recent results.

CML’s strong cash position also adds security to their modest 5p per share dividend (FY22) which is forecast to double to 10.8p per share next year.

This is a small-cap, thin volume stock so investors should expect significant price swings, but over the long-term we believe buyers will be well rewarded.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.