7th Sep 2023. 9.08am

Regency View:

Buy Cerillion (CER)

Regency View:

Buy Cerillion (CER)

Cerillion’s strategic advantage: riding high on telecom market tailwinds

The telecom industry is undergoing rapid transformation, driven by emerging technologies and shifting consumer demands.

Amidst these changes, Cerillion (CER), a leading provider of billing, charging, and customer relationship management (CRM) software solutions, has positioned itself as a standout player, harnessing the tailwinds of the telecom market for long-term success.

Cerillion’s core business

Before delving into the market dynamics, let’s understand Cerillion’s core business…

The company specialises in delivering mission-critical software solutions that empower telecommunications service providers to efficiently manage their operations, billing processes, and customer relationships.

With a 23-year track record and a global presence, Cerillion serves approximately 80 customers across 44 countries, primarily in the telecom sector.

Global diversification and robust business model

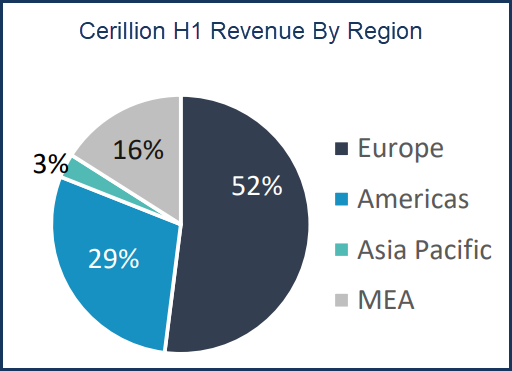

One of Cerillion’s key strengths is its global diversification. Operating across multiple continents, including Europe, Asia, and Australia, the company has built a strong client base worldwide.

This diversification not only minimises geographical risk but also positions Cerillion to capitalise on regional growth opportunities.

Cerillion’s business model revolves around providing comprehensive revenue and customer management solutions, including support and maintenance, managed services, and Cerillion Skyline (cloud-based billing software) revenue.

This multifaceted approach allows the company to offer tailored solutions to its diverse customer base.

Tailwinds in the telecom industry

Several key trends are propelling the telecom industry forward, and Cerillion is perfectly positioned to benefit from these tailwinds:

- Artificial Intelligence (AI): AI is reshaping the telecom landscape, enhancing customer care, support, and operational efficiency. Cerillion has adapted to this trend by integrating AI capabilities into its solutions, helping telecom service providers stay competitive in “The Age of AI.” While AI-driven automation is a concern for some industries, Cerillion’s approach focuses on augmenting human capabilities rather than replacing them.

- Smart Cities: The global smart city market is booming, with projections to reach $301 billion by 2032. Cities worldwide are embracing innovative technologies to improve infrastructure and services. Cerillion is not merely an observer in this trend; it actively contributes by providing data analytics and digital twin solutions. These offerings empower smart city development and position Cerillion as an integral partner in building future-ready urban centres.

- Open APIs: The industry’s shift toward open standards and APIs (Application Programming Interfaces) presents a significant opportunity. Cerillion is at the forefront of this trend, with its participation in the GSMA Open Gateway scheme. By enabling universal APIs for operators and developers, Cerillion plays a vital role in redefining how telecom services are designed and delivered.

- eSIMs: An eSIM, or embedded SIM, is a digital SIM card that is embedded directly into a device. Unlike traditional physical SIM cards, which need to be inserted and removed from a device, eSIMs are integrated into the device’s hardware and can be remotely programmed with the necessary subscriber information and network profiles. The global market for eSIMs is on the rise, driven by the adoption of eSIM-enabled devices like smartphones and IoT devices. Cerillion has been quick to adapt, capitalising on the eSIM wave by offering services and support that cater to this growing market.

Recent results and investment quality

Cerillion’s recent half-year results for 2023 underscore its position as a high-quality investment…

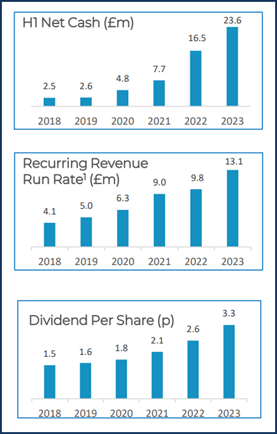

The company reported substantial growth in key financial metrics, including a 27% increase in revenue, a 34% surge in annualised recurring revenue, and a 43% rise in net cash. Adjusted earnings (EBITDA) and profit before tax showed significant increases of 38% and 46%, respectively.

Cerillion’s net cash position, strong dividend performance, and focus on free cash flow distribution demonstrate its commitment to delivering value to shareholders.

The company’s strategic investments in R&D, combined with its expanding teams and global presence, showcase its dedication to staying at the forefront of industry trends.

Bull channel creates catalyst for entry

High quality stocks like Cerillion tend to have a price chart to match, and Cerillion’s share price is locked in a powerful long-term uptrend.

In recent months, this uptrend has been characterised by breakouts from consolidation channels (see chart right).

And having undergone a pullback from trend highs, another bullish consolidation channel has formed – creating a short-term catalyst for entry.

In terms of valuation, Cerillion certainly isn’t a cheap stock because it has a forward price-to-earnings multiple of 28.

However, we believe this premium valuation is more than justified given Cerllion’s high level of earnings visibility, its double-digit operating margin and its sector-leading Return on Equity (RoE) of nearly 40%.

In short, you get what you pay for and Cerillion’s strategic advantage lies in its ability to ride the tailwinds of the ever-evolving telecom market.

With a global footprint, a robust business model, and a proactive approach to industry trends, the company is poised to thrive, making it an attractive prospect for long-term investors seeking exposure to the dynamic telecom sector.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.