18th Mar 2021. 8.58am

Regency View:

BUY Ceres Power (CWR)

Regency View:

BUY Ceres Power (CWR)

Click here for printer friendly version

Ceres ready to power higher as partners ramp up production

“Energy transition investment will have to increase by 30% over planned investment to a total of $131 trillion between now and 2050”.

These staggering numbers were just one of the findings from the recently published, International Renewable Energy Agency (IRENA) report, designed to outline the a pathway for the world to achieve the Paris Agreement.

At the center of the report’s recommendations was a huge ramp up in the production and use of green hydrogen, which has superior energy density than any other environmentally friendly fuel…

One kilogram of hydrogen contains as much energy as 3.3 litres of diesel – making it the only viable green option when it comes to powering a gas guzzling jumbo jet or cruise ship.

In the not-too-distant future, hydrogen fuel cells will more than likely be powering our public transport, heating our homes and dramatically reducing the environmental impact of many factories.

A company at the forefront of driving this transition towards a low-emission future is Ceres Power (CWR).

Ceres is the creator of SteelCell, a low cost, non-combustion fuel-cell.

Put simply, SteelCell is a perforated sheet of steel with special screen-printed ceramic layers that electrochemically convert a variety of different fuels directly into power at the point of use.

The SteelCell can generate power from conventional fuels like natural gas and from sustainable fuels like biogas, ethanol or hydrogen. The fuel agnostic nature of the SteelCell is a huge advantage as it allows the product to be relevant now as well as future-proofed for a time when the cost of green hydrogen becomes more cost effective.

Being made from inherently low-cost raw materials, SteelCell can be mass-produced at low-cost and high-volume. Ceres have recently introduced a new high-speed print line, meaning production time is ten times faster than before, and with cost not a limiting factor, widespread adoption is achievable.

Partnering with big players

Ceres growth strategy is to sign joint development and licensing agreements with key manufactures who can take their SteelCell technology and run with it.

So far, this strategy is working brilliantly, and it is Ceres’ blossoming relationship with German manufacturing giant Bosh which has really grabbed the headlines…

In September 2018 Bosch, who are a leading investor in the hydrogen market, signed an initial licence agreement with Ceres, buying a 4% stake in the firm worth £9m.

This relationship has deepened to the extent that in January Bosch purchased a further 11.9m new shares worth £38m – taking their stake in Ceres to 18%. Bosch has now installed prototype products of its 10kW motor utilising Ceres technology at five locations in Germany.

Ceres also have a strong foothold in the key Chinese market through a partnership with engine maker Weichai.

China is the world’s fastest growing market for fuel cells and last year Ceres and Weichai developed a first prototype range extender for Chinese electric buses. Weichai hold a 20% steak in Ceres – ploughing in a further £11m investment as recently as April.

Ceres and Weichai have ambitious plans to develop a high-volume manufacturing plant in Shandong Province to better serve the Chinese electric bus market. Ceres recently said that their green bus project with Weichai should move to joint venture status later this year following a successful trial.

Another major player which Ceres has a blossoming partnership with is South Korean conglomerate Doosan – one of the world’s largest fuel cell developers.

The original deal with Doosan, signed last year, was for the two firms to develop a solid oxide fuel cell power system for the commercial building market and worth £8m to Ceres over two years. But just like Ceres other key partnerships, this strategic collaboration has expanded considerably…

In October, Doosan Fuel Cell announced that it plans to build a manufacturing facility with an initial 50MW capacity by 2024 in collaboration with Ceres. This additional deal is worth £36m to Ceres over 3 years with an additional £7m contingent on KPIs.

These growing relationships with a series of market leaders makes Ceres stand head and shoulders above their AIM-listed green energy peer group. And as Ceres partners begin to ramp up production, we expect its high margin licensing model should come to the fore.

A worthy exception

As a general rule, we tend to avoid loss making companies due to their cash-burning qualities. In fact, of all the stocks in our AIM Investor portfolio, only Bango was loss making at the time of investing. And we believe Ceres is another worthy exception to our rule…

Thanks to their partnerships with deep-pocketed Bosch and Weichai, Ceres have a rock-solid balance sheet. They are sitting on £110m in cash and short-term investments – meaning they have no long or short-term borrowings.

Ceres released their interim results this morning with operating income for the 18-month period to 31 December 2020 coming in at £33m, above market expectations. Their order also looks very healthy at £54.3m versus £22m the year prior and they managed to raise £181m via a share placing.

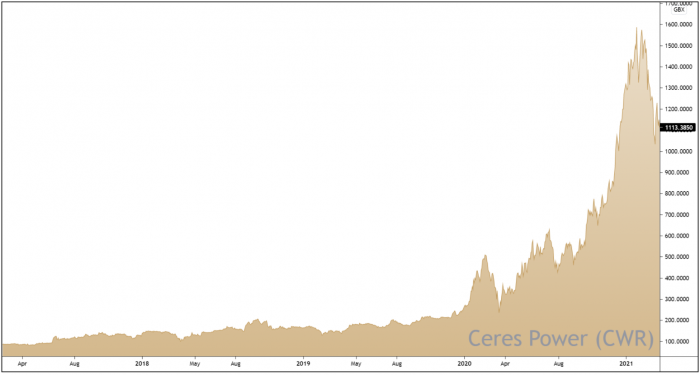

Pullback finally creates entry opportunity

As many of you will know, we’re not in the business of chasing hot stocks. As Ceres surged higher during the festive period, we were patiently sat on our hands waiting for a pullback…

After double tapping £16 highs in February, Ceres share price has indeed undergone a much-needed pullback – retracing more than 30% from the highs.

This retracement has taken prices back towards the support of the first ascending trendline. Given the strength of Ceres long-term uptrend, and the quality of their recent trading update, we would expect this trendline to hold.

We feel the timing is right to add this future-focused growth stock to our portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.