7th Jan 2021. 9.01am

Regency View:

BUY Central Asian Metals (CAML)

Regency View:

BUY Central Asian Metals (CAML)

Click here for printer friendly version

Copper set to shine brightest in 2021

Large cap to small cap, precious metals to industrial commodities, London-listed miners are enjoying life right now and for good reason…

A weakening US dollar, insatiable Chinese demand and a global economy poised for a vaccine-led recovery, all point to higher commodity prices.

Whilst it was ferrous metals (steel and pig iron) that outperformed in 2020, thanks to booming Chinese construction and manufacturing demand, it is base metals, like copper that are poised to lead in 2021, as vaccine rollouts spur a global economic recovery.

This view is echoed by Dong Hao, director of Chaos Research Institute, a subsidiary of Shanghai Chaos Investment, one of China’s largest commodities asset managers, “we’re more bullish base metals than ferrous. Base is about the global economy. Ferrous is more reliant on China’s economy via infrastructure construction” he said in a recent interview with Reuters.

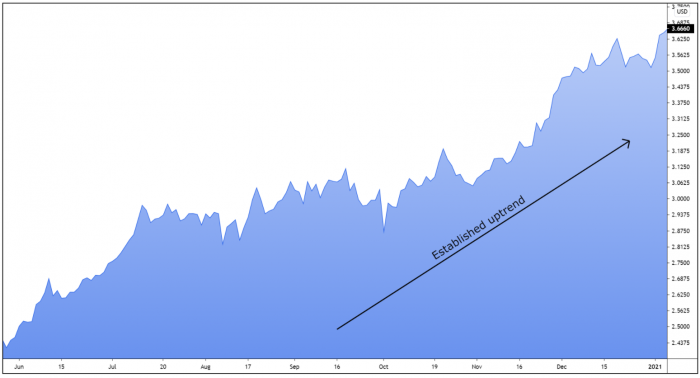

We can see from the copper futures (Jan 2021) chart below that prices have established a powerful uptrend in recent months, a trend that shows no sign of slowing.

Although we have several gold plays in our AIM Investor portfolio, we’re lacking exposure to copper, and low-cost producer, Central Asian Metals (CAML) is our pick of the bunch…

Low-cost copper

CAML is the sole-owner and operator of a copper recovery plant at the Kounrad open-pit mine in central Kazakhstan.

Copper is produced by leaching (through Solvent Extraction and Electrowinning) the metal from waste dumps that were formed from years of historic mining.

This process is far less cost intensive than traditional mining, as there is no need to drill, blast or transport ore – the waste dump rocks can be leached in-situ. This allows CAML to produce copper cheaply and efficiently.

CAML’s copper cash costs of just $0.48 per pound puts them top quartile on the Wood Mackenzie copper cost curve (the industry standard measure of production efficiency) and this gives CAML operating margins north of 60%.

Production runs continuously 24/7 and CAML can produce up to 13,500 tonnes of copper each year – generating group revenues of $158m (TTM) which delivers operating profits of $64.8m (TTM).

Based on a JORC resource of 600,000 tonnes of contained copper and 160,000 tonnes of remaining recoverable copper, CAML have a life of operation in the order of 14 years.

They also own the Sasa zinc and lead mine in North Macedonia – producing 32,000 tonnes of lead and 25,000 tonnes of zinc each year. This mine has not been without its controversy following a rupture in its tailings dam which sent waste into the surrounding environment in September and saw production halted. However, CAML managed to implement a swift clean-up operation and production has since resumed.

Income and growth

In November, CAML announced that it would be reinstating its dividend payout, which was suspended following the tailings spill at the Sasa zinc mine.

The dividend reinstatement puts CAML on a forward yield of 4.79%, which is ranked 13th out of the 40 London-listed stocks in the Metals & Mining sector.

When you combine this projected income with the copper-supportive global recovery story outlined above, we believe CAML will keep investors well compensated. This is backed up by their valuation which see them trading on a competitive forward price / earnings growth ratio (PEG) of 0.5%.

CAML is also going through a process of deleveraging, which has seen net debt fall for the last three years. And with strong operating margins, cash generation has never been an issue.

The momentum-drive which caught our eye

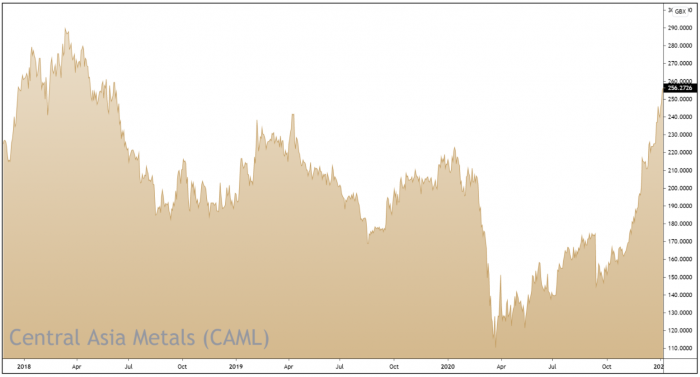

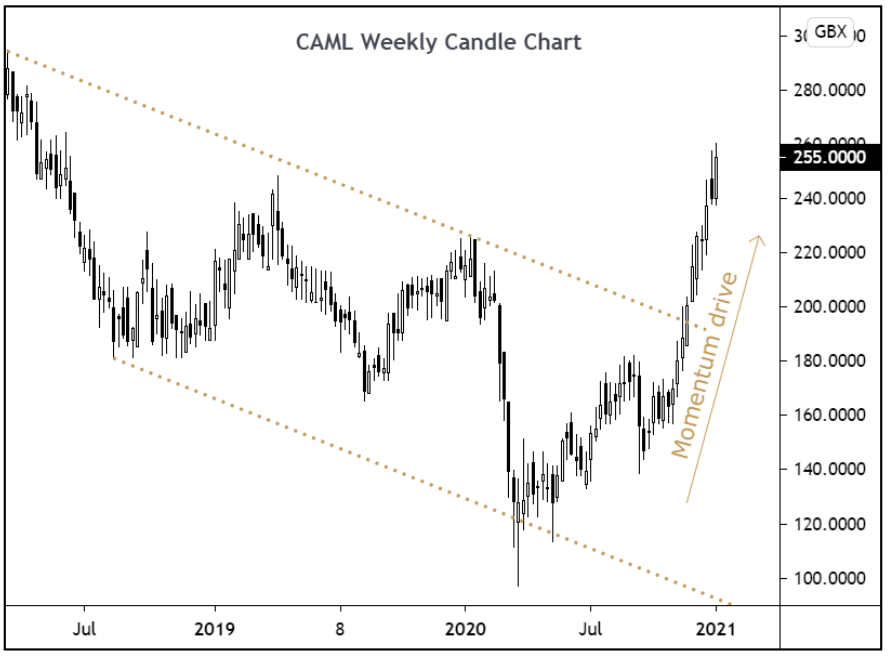

From 2018 to November last year, CAML’s share price had been making lower swing highs…

Zoom out on the price chart far enough, and you’ll see that this period was a prolonged and choppy consolidation phase within a long-term uptrend.

The positive vaccine news in early November sparked a strong surge higher in CAML’s share price – breaking the series of lower swing highs.

This ‘momentum-drive’ is characteristic of the end of a consolidation phase and the beginning of a new long-term trend.

Whilst we’ll more than likely see some pullbacks over the short-term, CAML’s bigger picture technical structure is now firmly bullish – creating a solid platform for the shares to outperform in 2021.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.