23rd Nov 2022. 3.33pm

Regency View:

Buy Cake Box Holdings (CBOX)

Regency View:

Buy Cake Box Holdings (CBOX)

Cake Box look tasty with prices at long-term lows

I love a quality stock as much as I love a good cake pun!

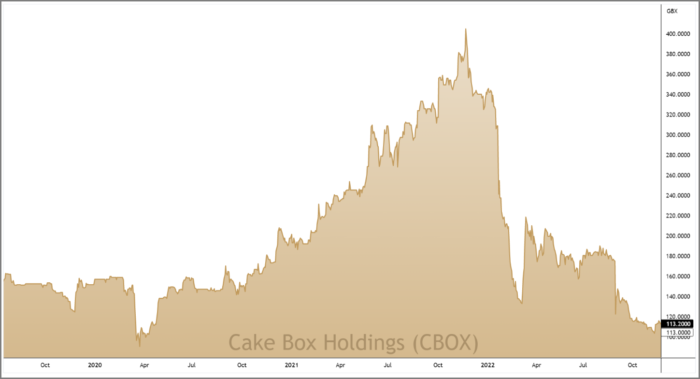

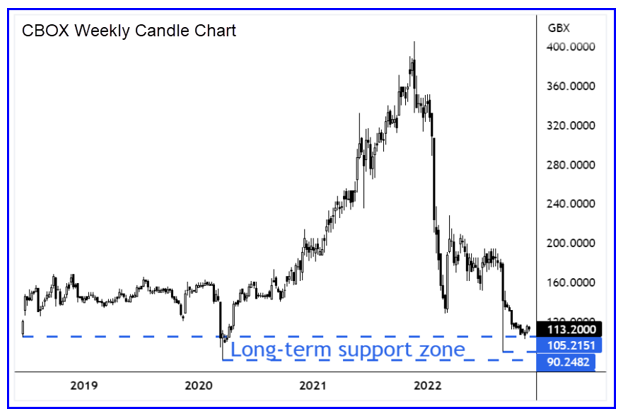

Cake Box (CBOX) may not be an obvious example of a quality stock given its tumultuous year which has seen the shares tumble to long-term lows.

But with the dust starting to settle, Cake Box’s asset-light franchise model is starting to look attractive.

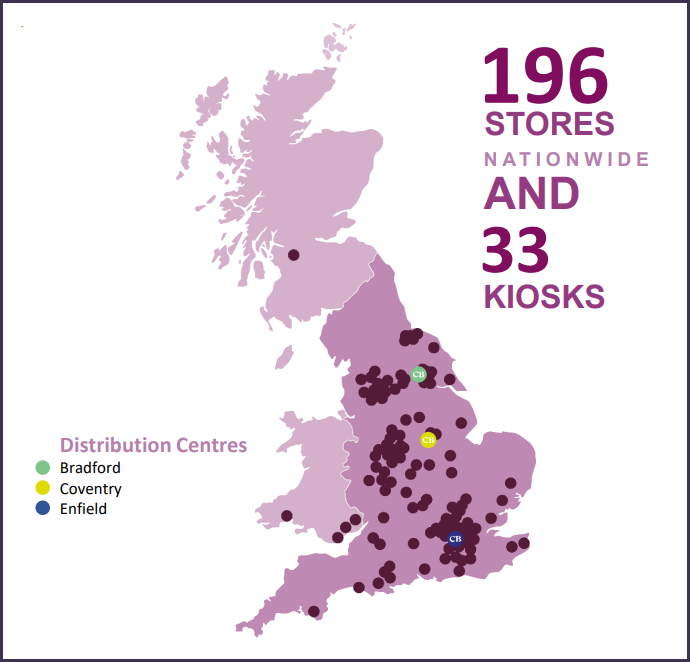

The egg-free cake company has a network of around 185 standalone shops and 35 supermarket and shopping mall kiosks – generating plenty of cash and robust levels of growth.

We believe Cake Box has a sufficient sustainable competitive advantage and a long enough runway to generate very high long-term returns.

Annus horribilis

For Cake Box, 2022 has been an absolute stinker…

The identification of “an erroneous £2m entry within the cash flow statement” by a finance blogger in mid-January, alongside historic errors in stock control caused the shares to plummet 62% in less than two months.

This shambolic reporting led to a boardroom shakeup which saw Cake Box co-founder and CFO Pardip Dass step aside in March after 10 years at the company.

Cake Box then moved to appoint David Forth as interim CFO and the highly experienced Michael Botha of the Domino’s Pizza franchise as permanent CFO from April 2023.

Cake Box have also worked with an internal auditor to improve its control environment which should help to address concerns.

Just as the dust had appeared to settle from the reporting scandal, Cake Box then released a shock profit warning in August causing the shares to drop 40% in a single session!

Cake Box said it expected full-year profits to be “significantly below current market forecasts” due to rising cost pressures across the group.

The reporting scandal and profit warning has left Cake Box’s share price some 67% lower year-to-date.

And whilst catching falling knifes in never something we advocate at AIM Investor, we are starting to see some green shoots of recovery.

Interim results indicate bad news is baked in

Last week, Cake Box released a surprisingly upbeat set of interim results in which it said it had begun to see a recovery in sales numbers.

October like-for-like franchisee sales were up 4.6% and total franchisee sales in six weeks to Nov. 6 jumped 12.9%.

Cake Box said it was on track to achieve full year market expectations with gross profit up 5.5% in the half year to £8m – a clear change in tone from the August profit warning.

“Encouragingly, the improvement in trading seen towards the end of the half year has continued into October” commented CEO Sukh Chamdal.

“Whilst the Board remains cautious in light of the uncertain economic climate and the unpredictability in consumer spending, the Group’s current trading is on track to achieve full year market expectations” he added.

The market responded in bullish fashion with the shares posting their biggest intra-day gain in over two months, indicating that the bad news may now finally be baked into Cake Box’s share price.

Competitive advantage and cashflow make Cake Box a buy

If we start to assume that the dust has settled and Cake Box can move on from the horrors of 2022, what’s left is a high-quality stock that’s trading on at an eye-catching valuation.

Cake Box have a five-year average Return on Equity (ROE) north of 20% and a 5-year average gross profit margin greater than 30%.

This indicates that Cake Box has a sustained competitive advantage and that it can effectively deploy shareholder capital to generate growth at attractive rates.

The stock trades on a forward PE multiple of 10.5 which looks very reasonable given Cake Box’s strong pipeline of future franchise openings (44 deposits held at end October) and further supermarket kiosk openings being negotiated.

Operating cashflow is very robust at £13.4m on a trailing twelve-month basis (TTM) and this has created a rock-solid balance sheet.

Cake Box also offer an attractive dividend, which is well covered by future earnings. A forward dividend yield of 5.99% and dividend cover of 1.58 (FY23) make Cake Box one of the standout income plays on AIM.

And with the shares bouncing from an area of long-term support created by the IPO and 2020 lows, we believe the time is right to buy a slice of Cake Box.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.