14th Nov 2019. 8.55am

Regency View:

BUY Boohoo Group (BOO)

Regency View:

BUY Boohoo Group (BOO)

AIM’s Fast Fashion Super Stock

The buzz around a fast-growing business is unmistakeable.

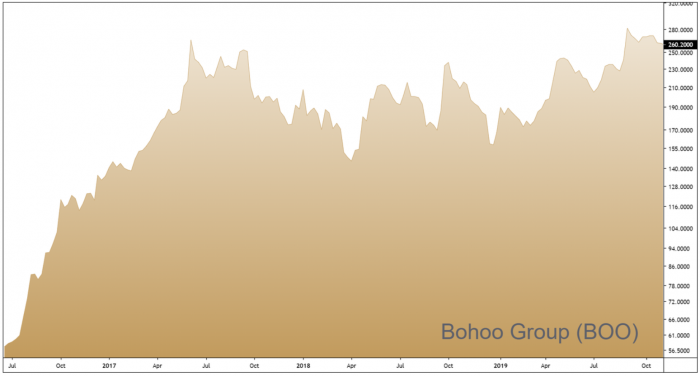

From the positioning of the brand to the strategic decisions of management, certain companies hit a sweet spot where global growth becomes seemingly self-fulfilling and online fashion house Boohoo (BOO) is a perfect example…

While established high street fashion names like Topshop, New Look and Monsoon are struggling to survive, business at Boohoo is booming. It has enjoyed huge growth by targeting young shoppers who prefer to buy clothes on their phone and take their fashion advice from Instagram influencers rather than traditional magazine editorials.

Selling glamorous clothing and beauty products for as little as £1, the company which owns the popular labels Miss Pap, Nasty Gal, PrettyLittleThing and BoohooMan is growing at breakneck speed, outstripping its own forecasts and overtaking its biggest rival Asos.

Second Mover Advantage

As with many new market sectors, a lot can be learned from the trail blazing first movers and it is often the second movers which step in and clean up. This certainly seems to be the case with online fashion…

In 2001 Asos were the first to prove that you could successfully bypass traditional retailers and sell directly to your target market. Five years later, Boohoo founders Mahmud Kamani a Manchester businessman working for his family’s textile business, and Carol Kane, a senior designer at the Kamani family’s company Pinstripe, took the Asos model and supercharged it, making it hyper-responsive to the fast-changing demands of social media driven fashion trends.

Boohoo’s model can move significantly faster than Asos. Around half of Boohoo’s products are manufactured in the UK, and Boohoo owns many of its suppliers. Where most brands work to a lead time of around 6-9 months, Boohoo’s brands can reportedly release a new line of clothing – from design to sale – within two weeks! In comparison, Asos aggregates almost 900 brands, so if Nike takes four months to respond to the latest shoe trend, so does Asos.

Under the influence

Along with its super-fast lead times, Boohoo have been incredibly adept and harnessing the god-like power social media ‘influencers’ have over their millennial followers.

While most high street retail chains were focusing on broad-based marketing campaigns, Boohoo were building an army of Instagram influencers who have been peppering the market with highly targeted content. And with the success of reality TV shows like Love Island, Boohoo have a ready-made supply chain of influencers just waiting to join their ranks.

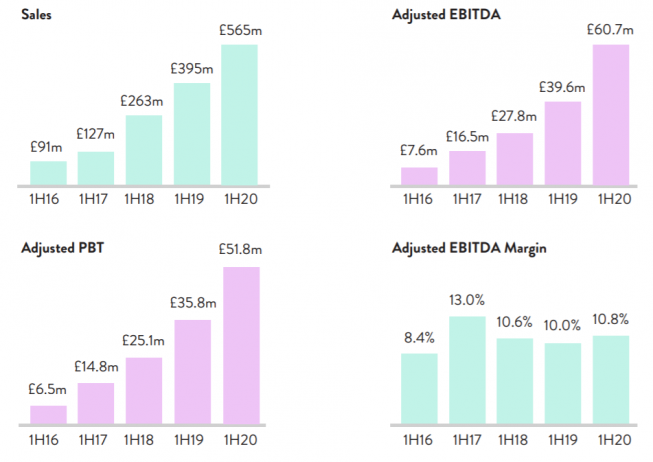

Bohoo’s use of influencer partnerships is really paying off: last year, Boohoo saw a 9% increase in the number of active customers who had shopped with them in the last 12 months, engaging seven million 16-30 year-olds and keeping them shopping. They’ve hit almost three million likes on Facebook, more than six million on Instagram and have delivered an average compound annual sales growth rate 50.8% over the last five years.

BOO Breaks £1 Billion Sales Barrier

Management have made a series of strategic acquisitions during the last two years which have put Boohoo on a global growth trajectory.

In 2017, Boohoo acquired US-based Nasty Gal for £15.6m and this purchase is proving wildly successful…

Revenue at Nasty Gal was up 148% to £43.9m in the six months to 31 August – the largest increase among Boohoo’s brands. The number of active customers more than doubled, rising 112% to £1.5 million, and Nasty Gal was described as “gathering momentum across all markets” in Boohoo’s recent half-year results.

This year has seen Boohoo take ownership of Manchester-based MissPap and the online operations of British high-street brands Karen Millen and Coast.

The purchase of Karen Millen and Coast is aimed at bringing in an older demographic that may be willing to spend more. The integration of these purchases completed in October and should Boohoo manage to tap into this more lucrative end of the fast fashion market it could lead to a significant re-rating in their share price.

The group as a whole broke £1bn in sales over the past 12 months with all core brands delivering double or triple-digit growth in sales and customer numbers. UK sales jumped 37%, while international sales surged 64% – with management upping their full-year forecasts in September.

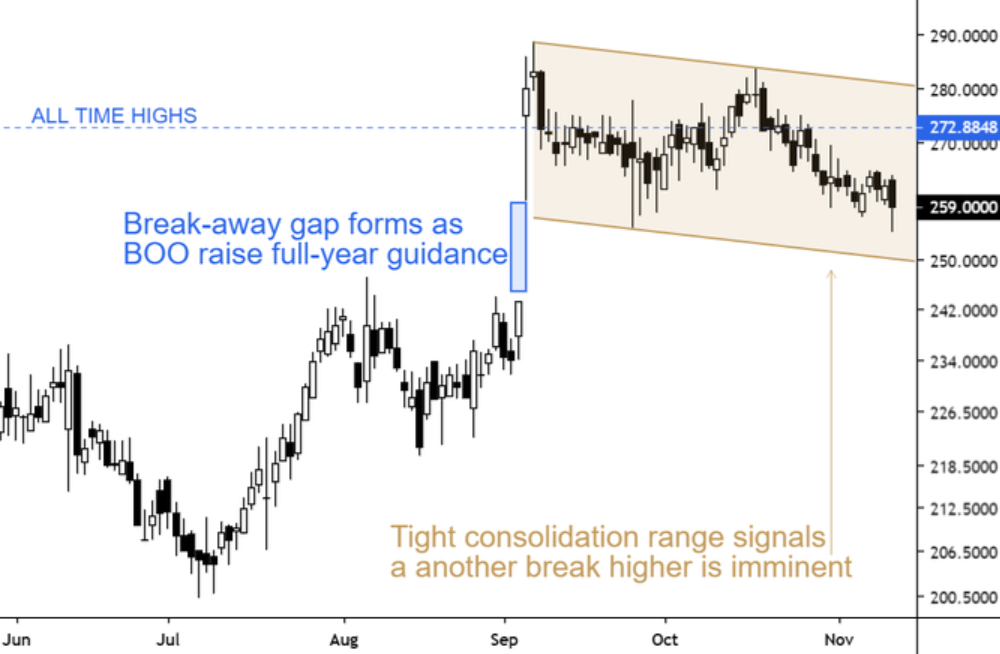

Gap and go

The September trading update saw Boohoo’s share price gap significantly higher.

Large ‘break-away price gaps’ of this nature create a burst of bullish momentum which continue to reverberate through the share price for several months. They also create two layers of horizontal price support, one at the top of the gap and another at the bottom.

Boohoo’s price action following the gap has seen the shares tread water and consolidate in a tight range, just below all-time highs. This high and tight consolidation pattern is statistically weighted in favour of a breakout in the direction of the prevailing trend. With this in mind, we are happy to position ourselves within the consolidation pattern in order to optimise our entry and achieve maximum risk/reward.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.