19th Sep 2019. 8.37am

Regency View:

BUY Bioventix (BVXP)

Regency View:

BUY Bioventix (BVXP)

The small UK biotech with big profit margins

The UK biotech sector is booming.

As many as three new biotech companies were incorporated every working day in the UK during the first two months of 2019. There are currently, 3,456 active companies involved in biotech R&D activities, representing a 65% increase on Q1 2016.

The exciting stories and endless potential of this sector is almost overwhelming, but for investors, the reality is that scientists can often have terrible business acumen and most small biotech firms are like giant cash incinerators burning money at an astonishing rate.

Today’s report showcases a UK biotech that has bucked this trend. This company has high levels of recurring revenue, high profile clients and high profit margins.

Meet Bioventix

Bioventix identify and clone antibodies for use in blood testing.

The Farham-based biotech has over thirty years of experience in synthesising antibodies from sheep, yes sheep! Whilst the science behind this process is highly complex, their business model is beautifully simple – they are, in essence a licence company…

Once Bioventix team of scientists discover an antibody, they license the ‘recipe’ so that large biotech companies can make the antibody in bulk for themselves. Bioventix boast three of the world’s biggest players in the blood testing space as key customers, Siemens, Roche and Abbott Laboratories. If one of these major customers has a test approved using one of Bioventix antibodies, then Bioventix can count on a secure stream of royalty payments.

Here comes the science bit…

Antibodies are shaped to fit directly onto specific antigens (viruses, bacteria or chemicals) and won’t match up with anything else. If a certain antibody is present in a blood sample, doctors will know that there is a specific antigen present. Antibodies are therefore a critical component blood testing – also known as immunodiagnostics.

Bioventix make antibodies from sheep by exposing the animals to an antigen over time so that it produces specific antibodies in its spleen which can be used to detect a disease. The antibody producing cells are extracted from the sheep’s spleen and put through a series of processes which allow Bioventix to grow the antibodies. These antibodies are then licenced to big biotech’s for use in blood testing as mentioned above.

A great example of Bioventix licensing process was the development of troponin antibodies. Troponin is a ‘cardiac marker’ used in the diagnosis of patients with chest pain and suspected acute coronary syndrome (ACS). Siemens commissioned Bioventix to find a way of synthesising troponin antibodies for use in its revolutionary heart attack test which is far quicker and more reliable than current tests which take almost a day to complete.

In July 2018, Siemens gained FDA approval for the use of its troponin detection test in the US – a market estimated to be worth $2bn. Bioventix will make a 2% royalty on the sales of Siemens troponin product, creating a large and stable revenue stream.

Global blood testing market is in rude health

The global blood testing market is vast and estimated to be worth in excess of $50bn – growing at a pace of 5% each year. There are several key demographic trends which is driving growth in blood testing, these include:

1. Aging populations in developed countries

2. Increasing obesity

3. Higher levels of pollution

4. A move towards point of care healthcare in the US

5. Growing middle class in developing nations

The final point is driving rapid healthcare development in China which is investing significantly in local healthcare infrastructure.

China is looking at reforming its healthcare market through several economic and demographic trends over the next decade through its ‘Healthy China 2030’ initiative.

Mobile healthcare is a particularly fast-growing sector in China and it relies upon efficient diagnostics – representing a big opportunity for Bioventix. The group has already begun selling its non-exclusive antibodies in China, making it well positioned to gain traction in this market.

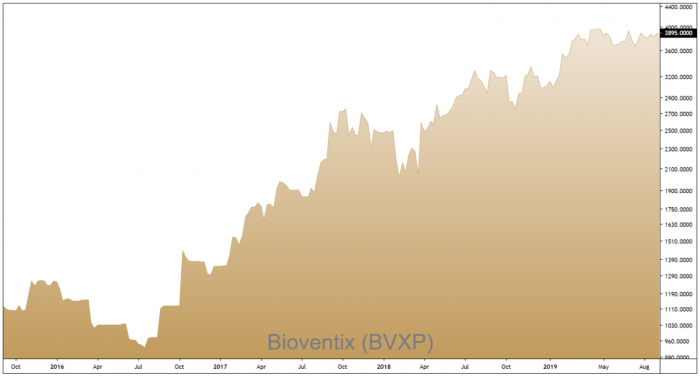

Powerful price pattern

Before we dive further into Bioventix fundamentals, it’s worth taking a second to look at their price chart which is forming a powerful pattern.

After breaking to new trend highs at the start of the year, the shares have spent the last five months quietly consolidating in an ever-tightening trading range. This compressive price action is known as a ‘wedge formation’ and signals that we’re likely to see an explosive breakout in-line with the dominant trend.

Rock-solid balance sheet

Bioventix high margin royalty model generates plenty of cash. Free cashflow per share has grown at a compound annual rate of 33% over the last five years – creating a rock-solid balance sheet.

Trading on a lofty PE multiple of 30, Bioventix shares can’t be classed as cheap. However, in the biotech sector we believe the best strategy is to pay up for quality rather than hunt for ‘bargains’. And with a steadily rising dividend, high medium-term revenue visibility and significant scope for the increased uptake of troponin in the US, we believe Bioventix justifies it valuation.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.