30th Nov 2023. 9.00am

Regency View:

BUY Billington (BILN)

Regency View:

BUY Billington (BILN)

Bolster your portfolio with Billington’s steel

Continuing our recent trend of seeking out top performers from the earnings season, this week we set our sights on Billington (BILN).

Billington is a leading force in the UK’s structural steel and construction safety solutions landscape.

The company has plenty of momentum, recently upping its full year guidance and building on record first half revenues in September.

Billington generates plenty of cash and boasts a debt-free balance sheet. And with the stock trading on a single digit forward earnings multiple we’re keen to add some of Billington’s steel to our AIM Investor portfolio.

Sturdy business model

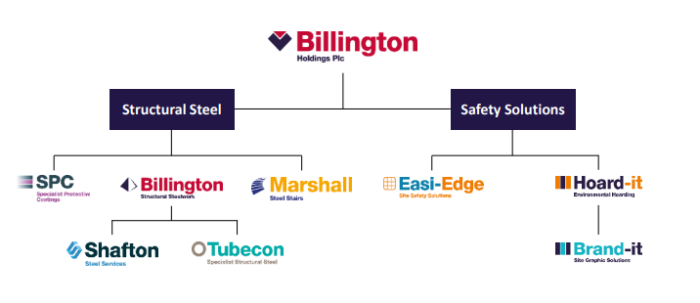

Billington’s business model centres on providing high-quality structural steel and engineering services across the UK and European markets.

The company encompasses various subsidiaries, each specialising in distinct facets such as structural steelwork, edge protection solutions, steel stairs, hoarding, and protective coatings.

In terms of revenue generation, Billington Structures are by far the most significant – delivering 81% of half-year (HY23) group revenues of £60.2m.

Billington Structures has been providing top-tier structural steel solutions for over 75 years. Their portfolio spans from straightforward building frames to intricate, high-capacity structures, highlighting their versatility and extensive capabilities.

With advanced steel fabrication facilities in Barnsley and Bristol, Billington Structures has an impressive annual processing capacity of over 50,000 tonnes of steel. This substantial production capability positions them to cater to diverse projects across the UK and Europe, ensuring efficient and high-quality deliveries.

Their expertise extends across a wide array of sectors, reflecting a depth of experience and adaptability in the construction domain. They cater to commercial, defence, education, health, infrastructure, leisure, residential, retail, distribution, energy, and data centre sectors – this high level of diversification has created a strong and sturdy business model which has withstood shocks to the industry like the recent war in Ukraine.

Bullish trading update builds on record first half

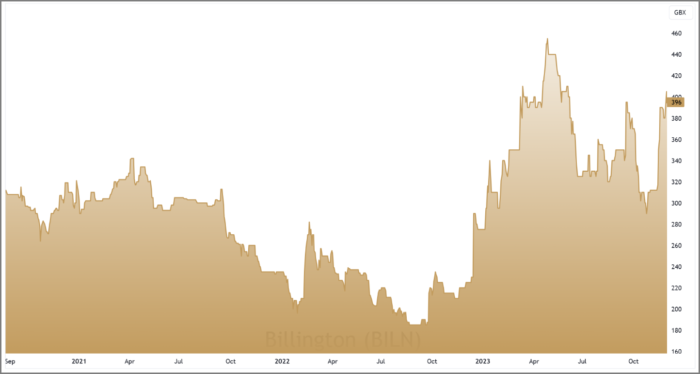

Billington’s bullish trading update in November serves as a reinforcement of the strong foundation established by the record-breaking first-half revenues reported in September. The November update builds upon and further amplifies the positive trends observed earlier in the year.

The November update solidified the earlier reported 30.2% revenue surge in the first half of 2023 to £60.15 million. It reaffirmed sustained growth by illustrating the Group’s ability to secure further orders, signalling a continued upward trajectory in revenue generation.

September’s interim report highlighted a substantial 237.4% increase in adjusted profit before tax, reaching £4.96 million. The November update amplified this success by projecting expectations to surpass previous market estimations for profit before tax – causing the shares to gap higher.

The trading update highted three factors driving Billington’s profitability:

1. Operational efficiency: Billington’s capital investment program has yielded improved manufacturing efficiencies across production facilities, elevating their capacity to meet increased demand.

2. Contract quality and quantity: The company’s successful delivery of high-quality contracts and increased volumes underscores their market resilience and growth trajectory.

3. Diversification: Through a portfolio of subsidiaries like Easi-Edge, Hoard-it, and Marshall Steel Stairs, Billington taps into diversified market segments, enhancing its adaptability and revenue streams.

Billington’s ROCE: Fuelling profitability and growth

Return on Capital Employed (ROCE) measures how effectively a company uses its capital to generate profits. It’s a ratio that shows the percentage of profit a company earns in relation to the capital it has invested in its operations.

For Billington, their current ROCE is 38.3%, as of June 2023. This means that for every pound of capital invested in their business, they generate a return of 38.3 pence in profits.

The company has a trend of rising ROCE over the last five years which indicates a consistent improvement in their efficiency in generating profits with the capital they deploy. Billington is becoming more effective and efficient in using its capital, indicating better management of assets and resources. For investors, this trend signifies that Billington is increasingly proficient in generating more earnings from the same level of invested capital, which is signal of financial health and effective business operations.

Value and income

Investors are not being asked to pay a high premium for Billington’s quality. The shares trade on forward price-to-earnings ratio of just 7.7 which compares favourably to the wider market.

Billington also compensates shareholders with a well-covered dividend. The stock has a forward dividend yield of 4.94% and this payout is covered more than 3x by earnings – leaving plenty of scope for further dividend hikes.

In summary, Billington’s bullish trajectory, underpinned by robust operational efficiency and diverse revenue streams, positions the company as a compelling investment opportunity. Coupled with its undervalued position in the market and the potential for consistent dividend growth, we believe Billington offers scope for a re-rating and reliable income streams.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.