21st Sep 2023. 9.01am

Regency View:

Buy Belvoir (BLV)

Regency View:

Buy Belvoir (BLV)

Belvoir: Leading the UK rental market surge

In recent years, the UK rental market has displayed remarkable resilience and growth, defying economic uncertainties and reshaping the real estate landscape.

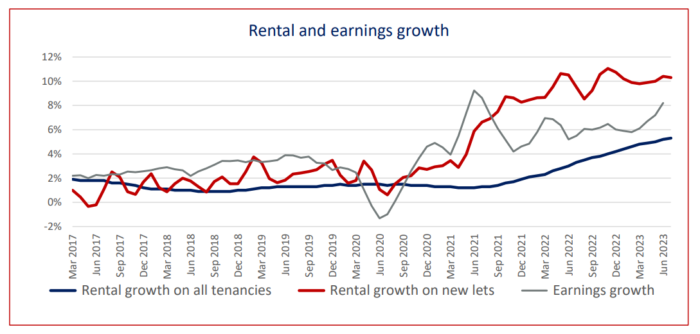

As highlighted by the June 2023 ONS rental index, showcasing a significant 5.2% increase in rental rates, this sector has become a compelling focal point for investors seeking income and growth.

Against this backdrop, Belvoir (BLV) emerges as a standout choice for those looking to capitalise on the sustained growth of the UK rental market.

Belvoir operates a resilient yet high margin business model which generates plenty of cash and has an impressive track record of delivering shareholder returns. The stock looks attractively priced, and with the shares gaining momentum from a strong set of half-year results, we believe Belvoir is a buy.

A two-pronged approach

Belvoir’s business model revolves around a two-pronged approach, incorporating property franchising and financial services advisory. This dual strategy positions Belvoir at the intersection of real estate and finance, allowing them to capitalise on the growth in the UK rental market.

In terms of their property franchising division, Belvoir operates a network of property franchisees throughout the UK. These franchisees serve as local experts in property management, rentals, and sales, leveraging the strength of the Belvoir brand.

As the UK rental market has been experiencing significant growth, Belvoir’s franchisees play a crucial role in facilitating property rentals and management services for landlords and tenants. The growth in the rental market has translated into increased demand for property management services, making Belvoir’s franchise model particularly relevant and profitable.

Belvoir’s second division involves a network of financial services advisers, who provide mortgage and other property-related financial services advice. In the context of the growing rental market, this division becomes even more significant. As rental demand increases, so does the demand for mortgage and financial advice for both landlords and prospective homeowners. Belvoir’s advisers can leverage this trend, benefiting from the reliable lead source provided by the property franchisees.

Strong cashflow drives 25% dividend hike

Belvoir recently published its first-half performance which highlighted the strength and resilience of its business model.

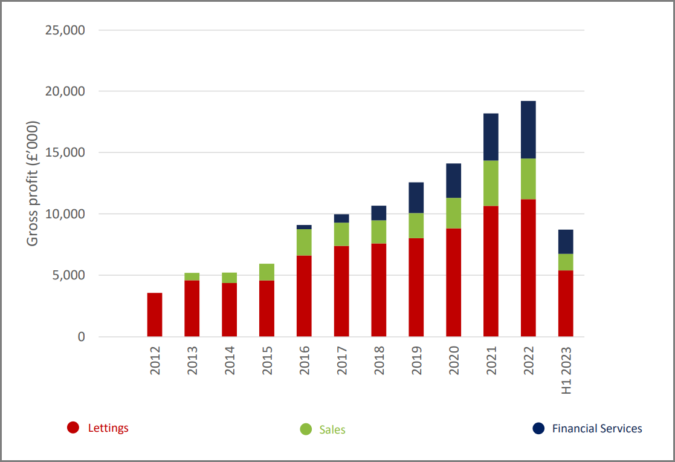

Despite the overall market’s volatility, Belvoir managed to achieve a 3% growth in earnings per share (EPS) for the first half of the year. This growth was predominantly fuelled by the success of the company’s Lettings segment, benefiting from rising rental income and effective acquisitions. These positive factors managed to offset the relatively weaker performance in sales and mortgages.

One standout feature in Belvoir’s first-half report is its impressive cash flow generation. This financial strength has enabled the company to boost its interim dividend by a significant 25%. Beyond benefiting shareholders, this robust cash flow offers Belvoir ample opportunities for reinvestment.

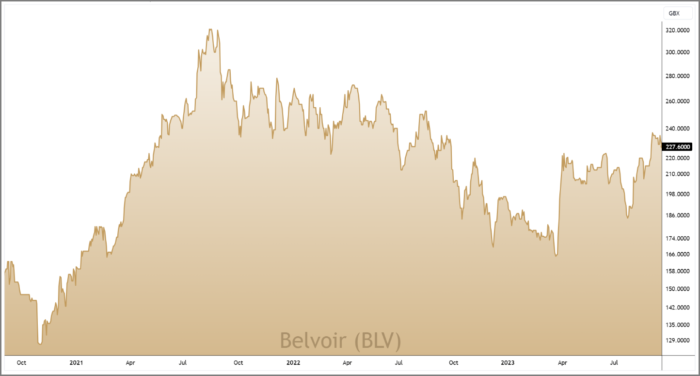

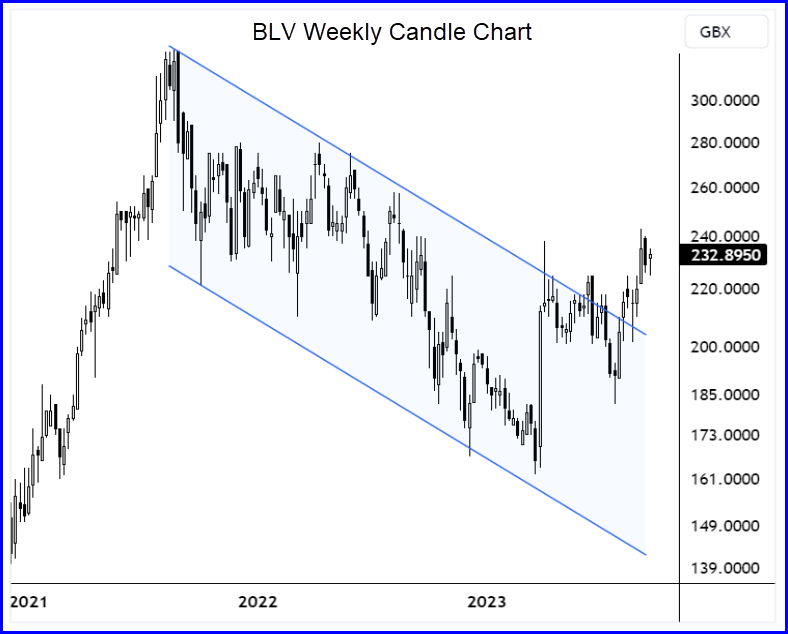

The market enjoyed Belvoir’s H1 report, and the shares have recently broken out from a descending channel which has been in place since September 2021.

Belvoir’s strong H1 performance underscores its ability to navigate market challenges effectively. As these market obstacles gradually subside, Belvoir will be well positioned to capture more market share.

Quality at a value price

Belvoir is a high-quality stock that has consistently delivered a Return on Equity (RoE) north of 20% for each of the last five years.

The business generates plenty of cash and has an operating margin of 22.3% which feeds through into high levels of free cashflow.

This strong cashflow makes Belvoir is well-prepared to capitalise on direct reinvestment opportunities and provide support for its franchisees’ growth plans. Belvoir’s proactive approach to growth, coupled with an estimated free cash flow yield of 9.5% for FY 2023, suggests that the company’s current valuation may not fully reflect its growth potential.

Belvoir’s substantial future cashflows give the shares has an estimated Fair Value of £3.67 – indicating that the stock is theoretically 37% undervalued.

In terms of forward valuation, investors are being asking to pay just over 12x forward earnings, which seems very reasonable for a business of this quality.

And whilst the stock is by no means trading on a bargain basement valuation, it does score well across a number of value metrics. These include a Price to Sales ratio of 2.50 – one of the best in the Real Estate Operations sector, and an Enterprise Value to Adjusted Earnings ratio (EV to EBITDA) of 8.42 – also one of the best in its peer group.

The confluence of a thriving rental market and Belvoir’s well-positioned business model makes it a compelling investment opportunity for those seeking long-term growth and income in the real estate sector.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.