18th Jun 2020. 8.58am

Regency View:

BUY Bango (BGO)

Regency View:

BUY Bango (BGO)

The Mobile Payments Platform Amassing a Gold Mine of Data

The pandemic is fast-tracking our digital transformation

From work, to school to entertainment, the adoption of new technology by individuals and businesses has never been faster. And whilst ‘normal life’ is likely to resume in the coming weeks, the pace of our digital transformation is unlikely to slow.

A company that is enjoying life in this new normal is mobile payments provider Bango (BGO).

Bango have created a state-of-the-art mobile commerce platform that allows smartphone users to charge purchases to their mobile phone account and app developers to target paying customers more efficiently.

They may be a relatively small AIM listed stock, but Bango’s platform is used by the giants of global tech including Google, Amazon, Microsoft and Spotify.

Bango’s platform payment volumes surpassed the billion dollar mark two years ago and the amount of data that Bango is collecting on these transactions is getting increasingly more valuable.

Power of the Platform Model

The power of Bango’s platform model should not be underestimated.

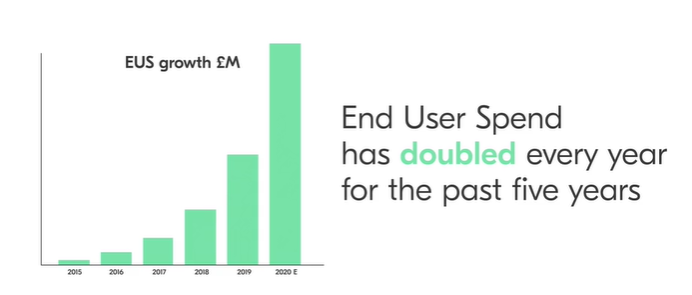

Companies who connect to the platform have opportunities to connect to multiple other companies – creating a virtuous cycle which has seen End User Spend (EUS), Bango’s key KPI, double every year for the last five years.

If we take a simple example, where a mobile operator like AT&T wants to offer Spotify to its client base. The Bango platform not only facilitates this, but once AT&T are part of the platform, they have potential connectivity to all other services on the platform such as YouTube TV and Netflix. Likewise, once Spotify are on the Bango platform, they can connect to all the other mobile operators on the platform and in effect they get those connections for free.

Bango’s payment business makes revenue by collecting a fee for each transaction processed through the platform. Alongside this transactional based revenue, Bango have also managed to collate and leverage the vast amount of valuable transaction data that takes place across its global mobile platform.

Many app developers have found that acquiring users for their app isn’t the hard part, what’s really hard is finding users who are prepared to buy your in-app content. Bango Audiens, it’s advanced data service, allows app developers to precisely target users that have, or are likely to, make in-app purchases. In April, South Korean big data business NHN Corp invested £6.5m into the Audiens and has purchased a 4.7% shareholding in Bango, too.

Multi-Year Agreement Major Telecoms Provider

Global lockdown has been a brutally tough period for most business, but Bango are flourishing.

Demand for streaming services has surged during lockdown and telecom operators are trying to capitalise on this trend by delivering ‘bundles’ of third-party products and services such as Netflix, Amazon Prime and YouTube TV.

Last month, Bango signed a significant, multi-year platform agreement with a major global telecoms provider.

Under the three-year agreement, the unnamed telecoms provider will deliver a range of third-party products and services to its customers through the Bango Platform and will also benefit from Bango data insights to optimize the targeting of product offers.

The deal is worth at least £1.5m to Bango, and there is a further opportunity to earn additional revenues by upscaling the offering. More importantly though, the deal is a major endorsement of Bango’s technology and is likely to see other major telecom players follow suit.

Japan’s Booming Mobile Payments Market

Japan’s high spending population leads the world in mobile commerce.

Charging the cost of goods to the phone bill is a widely adopted payment method, with billions of dollars in online purchases charged to Japanese phone bills.

Unsurprisingly, Japan represent a key growth market for Bango who have Amazon Japan (amazon.co.jp) on their platform.

On Tuesday of this week they announced a deal with Japanese mobile provider SoftBank to allow Amazon customers with a SoftBank mobile phone to add the cost of goods purchased on Amazon to their mobile phone bill.

Bango now powers carrier billing for amazon.co.jp across Japan’s three largest operators, adding SoftBank in addition to NTT Docomo and KDDI – not bad for a little AIM listed tech stock I’m sure you’ll agree!

Poised for Profitability

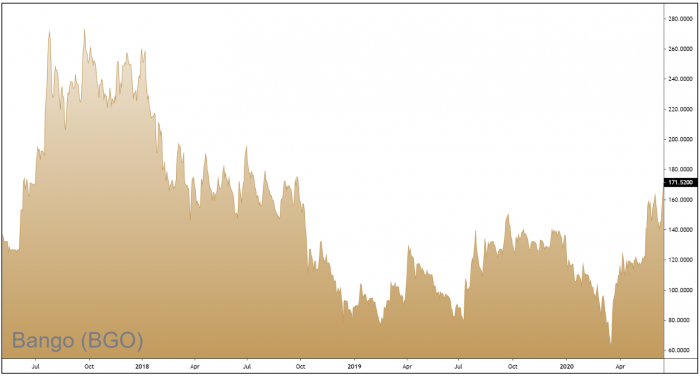

Those of you who have followed our AIM Investor portfolio for several months will know that we tend to select stocks that already deliver consistent profits. Whilst Bango are not yet turning a profit, we believe them to be a worthy exception…

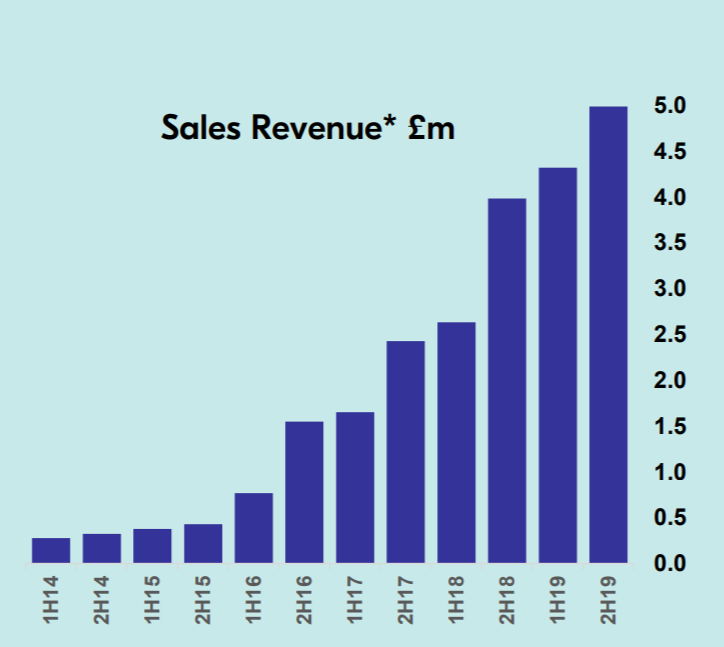

Sales are growing at pace north of 25% and costs have remained stable, this puts Bango on track to turn a maiden net profit this year.

The balance sheet is lean and mean with a net cash position of £2.25m (Full Year 2019) and the investment from NHN will further strengthen this.

Management expects continued exponential growth in End User Spend driven by the “success from existing customers, new opportunities from 5G and new market opportunities”.

Overall we believe that Bango represent an exciting addition to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.