10th Jun 2021. 9.00am

Regency View:

BUY Bango (BGO) – Second Tranche

Regency View:

BUY Bango (BGO) – Second Tranche

Bango deepens ties with big name clients

Building positions in stocks that continue to prove their quality is a strategy we’ve been keen to employ, and Bango (BGO) is a perfect example…

It’s almost a year since we first added Bango to our AIM Investor portfolio and in that time the mobile payments platform has delivered another year of record revenue growth along with a maiden profit.

To recap, Bango have created a state-of-the-art mobile commerce platform that allows smartphone users to charge purchases to their mobile phone account and app developers to target paying customers more efficiently.

Bango processes billions of dollars of payments from hundreds of millions of users worldwide, primarily from spending in apps and from customers purchasing subscriptions to a wide variety of products and services.

A virtuous cycle powering Bango’s growth

Whilst Bango receives revenue for each transaction made on its platform, the real value in Bango’s business lies in the payment data which is leveraged to deliver real-time insights to app developers and marketers.

“Don’t forget that 5% of users generate over 80% of app revenues” commented Brett Orlanski, Bango’s SVP Marketplace in a recent interview…

“When you know who buys, your targeting becomes much more valuable” he added.

Bango’s advanced data service, allows app developers to precisely target users that have, or are likely to, make in-app purchases.

In simple terms, 20 years ago Google revolutionised marketing by allowing businesses to target based on what people look for, Facebook came along a decade later to target based on what people say they like, and Bango’s platform is targeting based on what people pay for.

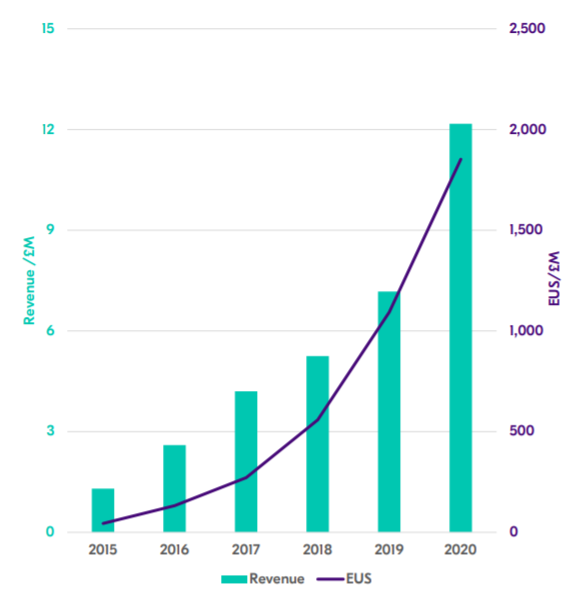

Its platform has seen exponential growth in End User Spend (EUS) during the last five years with EUS hitting £1.85 billion (FY2020) after breaking through the £1 billion barrier in 2019.

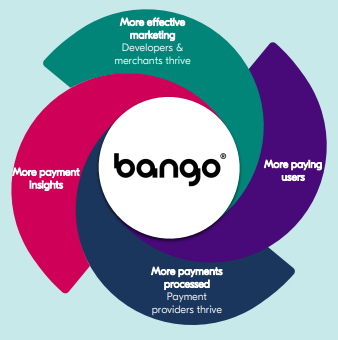

The platform growth has been built on a virtuous cycle with higher levels of payment data, creating better insights, allowing merchants to provide more effective marketing, which in turn generates more paying users generating more data and the cycle starts again.

Bango and Microsoft expand access to Xbox cloud gaming

A key reason behind our decision to snap up a second tranche in Bango is the deepening relationships it is forging with some of the giants of global tech.

Bango’s partnership with Microsoft is a prime example of this…

In November 2020 Bango expanded its long-term relationship with Microsoft to include Xbox Game Pass and consoles on the Bango platform – enabling Telcos to offer Microsoft’s Xbox cloud gaming options as part of their consumer bundles.

In May, Bango released a further update on this partnership when it said the first three Telcos companies offering bundled Xbox cloud gaming subscriptions in Europe are using Bango’s payments platform.

“What we announced (in May) was the fruits of our labour since November with the first launches of these commercial services across both fixed and mobile” commented Bango CEO Paul Larbey.

“To boost consumer take-up of these bundles, offer targeting will be optimized through Bango data insights” he added.

Gaming subscriptions is one of the fastest-growing segments within Bango’s payments business and this growth is being driven by the global 5G rollout – making it far easier to stream high-quality games on mobile using cloud-based gaming platforms such as Xbox.

“It (gaming) is moving ever more to the cloud and ever more to a streaming subscription model, and that fits very nicely with our core technology around subscription bundling” said Mr Larbey.

Emerging market expansion continues to gather pace

Bango’s growth story across India and Asia Pacific regions has continued at pace this year.

In April, Bango and Indian Telco giant Airtel announced a partnership to offer Amazon Prime Video to its mobile-only customers and available only as a bundled offer.

“It’s been incredibly popular, the take-up has been very exciting…it’s a great tool for the operator in terms of retention…and obviously a great tool for Amazon in terms of bringing new customers into their ecosystem” said Paul Larbey in a recent interview.

In Asia Pacific, Bango recently announced a deal with Japanese Telco NTT DATA to expand payments across Asia – bringing more than 30 wallets and digital payment methods – great news for the merchants on Bango’s platform looking to expand in the region.

Bango back at the bottom of bullish consolidation box

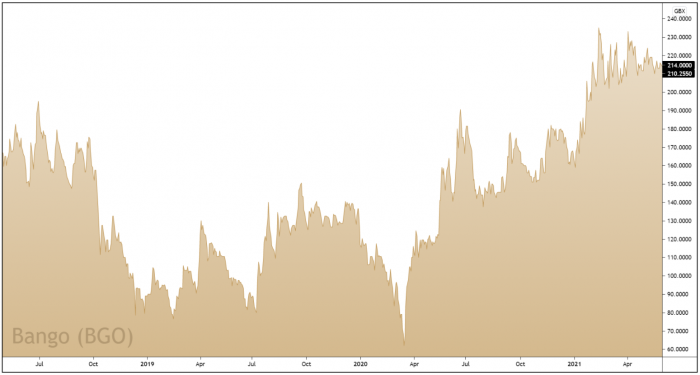

The timing of our first entry, in June last year, was less than optimal in hindsight with prices moving into a prolonged period of sideways consolidation.

This consolidation phase came to an end in January as prices surged higher following Bango’s market-beating trading statement.

The New Year rally saw Bango break through resistance and hit highs of 235p in February. Since then, prices have entered another consolidation phase, this time forming a bullish ‘consolidation box’.

With prices drifting back towards the bottom of the consolidation box and multiple layers of support in place, we believe this has created another attractive opportunity to snap up a second tranche.

Premium valuation is justified

Bango isn’t your typical fast-growing tech stock…

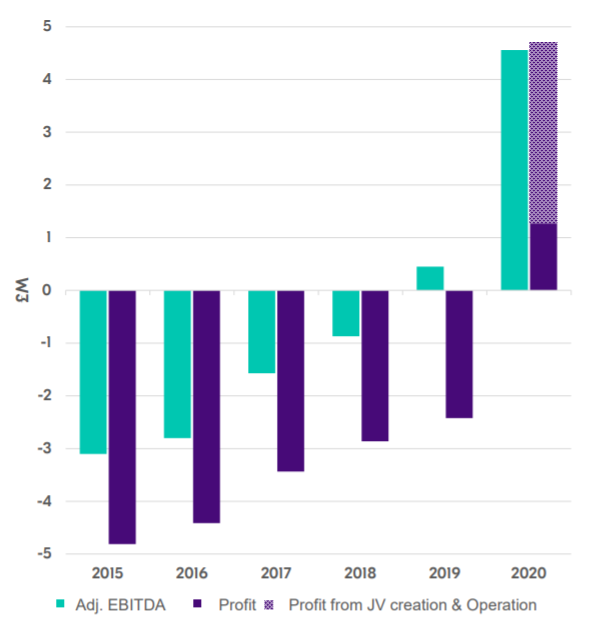

For starters Bango has achieved profitability, not something to be sniffed at given 99% of small-cap tech stocks never move into the black.

Net profit was £4.68m (FY 2020), up £7.01m from the 2.34m loss in 2019 and we expect rapid profit expansion from current levels.

Bango does trade on an eye-watering forward PE ratio (49.3), but we believe this is justified given the projected growth rates of the mobile payments market, the quality of Bango’s balance sheet, its proven track record at delivering high rates of revenue growth and its lean fixed cost base.

Bango boasts a forecast earnings growth rate of 95.6% – top quartile within the Software & IT Services sector, and with its deepening ties with the giants of global tech, we believe Bango will be a key growth play in our portfolio for many months to come.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.