26th May 2022. 8.59am

Regency View:

BUY Atalaya Mining (ATYM)

Regency View:

BUY Atalaya Mining (ATYM)

High-quality exposure to supply-hit metals sector

“Europe needs to decide urgently how it will bridge its looming supply gap for primary metals”.

One of a handful of stark conclusions from a new study commissioned by Eurometaux, an industry group that represents some of Europe’s biggest metal producers.

The report estimates that should Europe wish to achieve its key objectives of being carbon neutral by 2050, whilst reducing its dependence on imported Russian energy and making a quicker switch to renewable energy, Europe will require:

35 times more lithium, seven to 26 times the amount of rare earth metals, 35% more copper and double the amount of nickel in 2050 compared with today.

Europe’s looming supply crunch of critical commodities means lower-carbon local producers and explorers are likely to be hot property for years to come.

One such producer and explorer with carbon-footprint advantages is Atalaya Mining (ATYM)…

Atalaya is Europe’s premier pure-play copper producer. The company is highly profitable and cash generative and the shares currently have an eye-catching valuation which includes a rock-bottom PE and an attractive dividend yield.

Lower-carbon and local

Atalaya hold a 100% interest in Proyecto Riotinto, a collection of open-pit copper mines located in the Andalusia region of Spain.

Proyecto Riotinto has Proven and Probable Ore Reserves totalling 197 million tonnes at 0.42% copper (0.82 million tonnes of contained copper) with Measured and Indicated Mineral Resources of 258 million tonnes at 0.40% copper.

Copper production guidance for 2022 currently stands at 54,000 – 56,000 tonnes and Proyecto Riotinto is only 75km away from a major smelter and seaport, giving it a low-carbon footprint.

And management are keen to push home their low-carbon advantage by initiating construction of 50MW solar plant which should reduce its reliance on local electricity.

Plenty of scope for production growth

Since its restart in 2015, all mining at Proyecto Riotinto has been conducted from the Cerro Colorado open pit.

The other known mineral deposits within the Riotinto concession area – the San Dionisio deposit and the San Antonio deposit – have not yet been mined by Atalaya.

Both San Dionisio and San Antonio deposits are located within a 1km radius of the Cerro Colorado pit.

Recent drilling results at San Dionisio have been very positive, showing Measured and Indicated Mineral Resources of 54 million tonnes at 0.89% copper.

And based on the new Mineral Resource Estimate and prior internal studies, Atalaya believes that the development of the San Dionisio deposit has the potential to “create significant value for the Company”.

Current expectations are that San Dionisio would contribute approximately one-third of existing processing capacity of 15 Mtpa, while Cerro Colorado would account for the remaining two-thirds of ore.

San Antonio hasn’t had the same level of drilling as yet but results so for indicate an Inferred Mineral Resource of 11.8 million tonnes at 1.32% copper.

High-quality financials

The mining industry has a long history of taking investors’ money and not delivering promised returns.

It is with this in mind that we always seek to ensure that any mining stock we add to our portfolio has very high-quality financials…

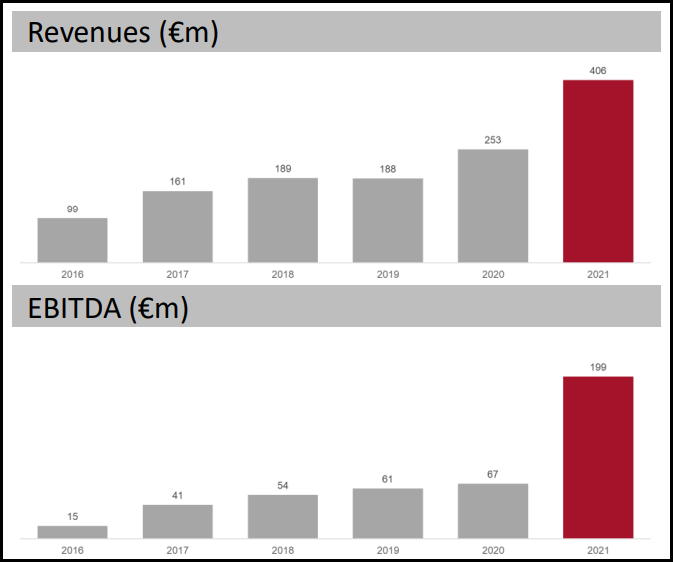

Atalaya has an impressive track record of delivering profitable growth with revenue and operating profit growing at a compound annual rate (CAGR) of 32.7% and 133% respectively over the last five years.

This ability to invest shareholders money wisely is further demonstrated by Atalaya’s impressive Return on Equity (RoE) of 27.9%, which is top quartile in the Metals & Mining sector.

The company is highly cash generative with operating cashflow of €99.1m (TTM) of which €77.1m flows through into free cashflow.

It is therefore no surprise that Atalaya has a rock-solid balance sheet with a net cash position of €128m (TTM).

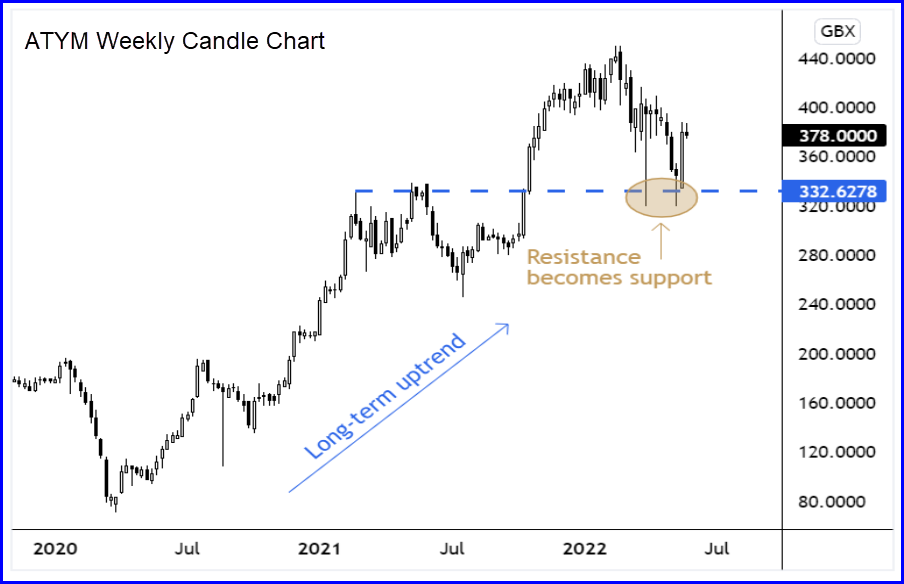

Long-term uptrend sees resistance turn to support

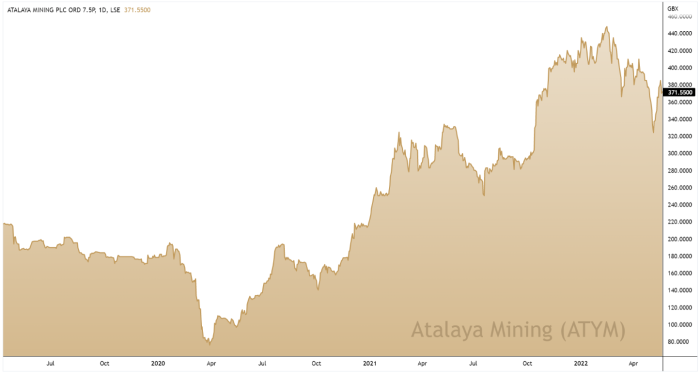

Atalaya’s share price has carved out a strong uptrend since March 2020 and recent price action indicates that this trend is likely to continue…

A textbook characteristic of uptrend’s is a ‘staircasing’ form of price behaviour in which broken resistance turns to support as the trend progresses.

Having broken through resistance at 320p late last year, the shares have found support at this broken resistance level on multiple occasions (see chart right).

And the shares remain reasonably price despite the long-term uptrend…

Atalaya currently trade on a forward Price Earnings (PE) multiple of just 5.1 which is one of the most attractive in the Metals & Mining sector.

And whilst earnings per share (EPS) growth is forecast to slow, this has been offset by the introduction of an attractive dividend of 2.72 pence per share last year (7.67%) which is forecast to remain at those levels into Full-Year 2023.

In summary, we believe Atalaya offers high-quality exposure to a strong sector at a very reasonable price. It may be more mature than many other AIM-listed miners, but with that maturity comes the prospect of stable shareholder returns.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.