Regency View:

BUY Argentex (AGFX)

High margins and strong financials make Argentex the real deal

The SME foreign exchange (FX) market represents a vast, rich, and fertile landscape from which tech-savvy small businesses can grow rapidly.

In the FX space, an SME has an annual FX turnover of around $5-$500 million. At this level, the high street banks, which dominate the market, are unable and unwilling to compete with smaller more dynamic specialists on price, service, and flexibility.

This has created a fragmented market from which successful SME-serving FX brokers can scale through digitization and consolidation.

One such broker is AIM-listed Argentex (AGFX).

Argentex adopt a private-bank style model to service a broadly sophisticated corporate client base offering advice and execution.

Importantly, they are a riskless principal broker and only cater for commercial transactions. This means they do not speculate in the market and generate revenue solely from the spread.

With annual revenue just shy of £35m (FY22), Argentex a relative tiddler in the SME FX ocean.

However, with high margins, strong financials, and a heavily invested management team, Argentex are more likely to act as a predator then prey.

Insiders with skin in the game

When investing in a small and growing business, you need the leaders of the business to act in the best interest of shareholders.

The best marker for this is insider ownership, and Argentex’s management team have plenty of skin in the game.

Harry Adam’s, group CEO and Co-Founder owns 12.2% of the company’s stock and in total, Argentex’s board and senior management hold 34%.

This considerable level of investment reduces the risk of shareholder dilution and should help drive long-term value in the business.

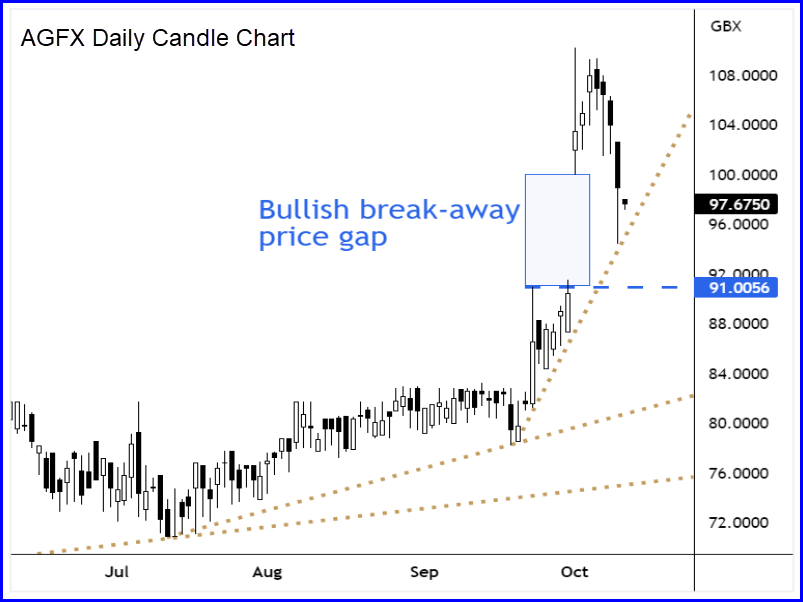

Bullish trading update creates break-away gap

Earlier this month, Argentex released a market-beating trading update…

Half-year revenues are expected to surge 75% to £27.4m with costs “remaining in line with management expectations”.

Argentex also said there has been “continued strong client demand” with the number of corporate clients trading growing to 1,393 versus 1,241 in the same period last year.

The impressive trading update caused the shares to gap more than 10% higher.

Price gaps that form on a genuine market beat like this are significant in two ways:

1. They create a burst of bullish momentum which should see prices drift higher in subsequent months as the market recalibrates its expectations.

2. The bottom of the gap creates a long-term layer of support.

With these two factors in mind, the pullback into the gap that we have seen during the last week makes Argentex’s price chart very easy on the eye.

Risk / reward near the bottom of the gap is attractive as the medium-term probabilities of higher prices are firmly in our favour.

And whilst it’s not essential, a bullish technical catalyst of this nature adds an extra level of comfort when putting your hard-earned money on the line.

High-quality financials

Argentex has many of the high-quality characteristics that we look for when selecting AIM stocks.

They have a strong track record of delivering profitable growth with a Return on Equity of 23.9% – one of the best in its peer group.

Sales are growing at a compound rate (CAGR) north of 25% over a five-year period and operating margin is high at 30% which has seen profitability keep pace with revenue growth.

These attractive margins also mean that Argentex is highly cash generative for its size, delivering £15.2m of operating cashflow on revenue of 34.5m in FY22.

And with such strong margins, over 90% of operating cashflow moves to free cashflow which in turn has created a rock-solid debt-free balance sheet which currently has £37.9m net cash.

What makes Argentex even more attractive is that investors are only being asked to pay 10x future earnings. This seem very reasonable given Argentex’s high-quality financials and growth trajectory.

Earnings per share (EPS) is forecast to grow at 26.9% over the next two years, putting Argentex on a modest Price to Earnings Growth (PEG) ratio of 0.5.

With momentum on the price chart and a set of high-quality financials, we’re excited by Argentex’s potential.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.