18th May 2023. 8.59am

Regency View:

BUY Alumasc (ALU)

Regency View:

BUY Alumasc (ALU)

Alumasc offer attractive value and income

By 2025, new homes will be required to reduce carbon emissions by at least 75%.

They will also be expected to be ‘net zero ready’ through their use of lower-carbon heating and high fabric standards.

The rest of the UK’s housing stock, some 29m properties, will need to be brought up to net zero carbon standards by 2050 at an estimated retrofitting cost of some £250bn.

A business that is perfectly placed to play this ‘push to net zero’ theme is AIM-listed Alumasc (ALU).

Alumasc is a sustainable building products supplier with thriving export sales and a profitable UK business.

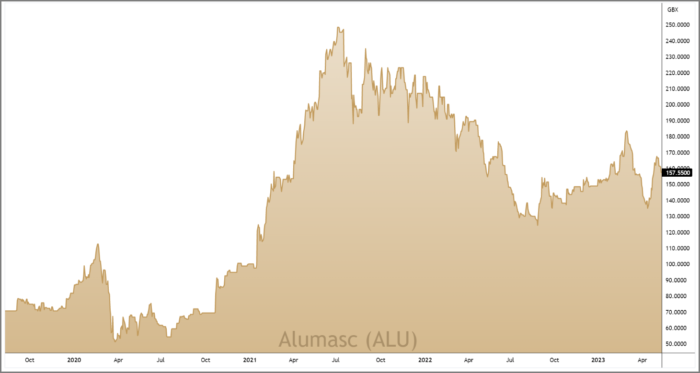

We’re no strangers to the stock and took a healthy 51% profit in July 2021 when the shares had run ahead of market expectations.

With the hot air of 2021 now dissipated, we believe the time is right to buy back into a stock offering attractive levels of value and income.

Strong and diverse product portfolio

Alumasc’s products are designed to be environmentally sustainable and energy-efficient, and they aim to support the construction of carbon zero homes.

The business delivered £89.4m total revenue last year (FY22) and operating profit of £12.6m on margins of 14.1%.

International exports account for 15% of total revenue (FY22) and this provides some geographical diversification which helps Alumasc to typically outperform the UK housebuilding market.

Alumasc’s sub-brands operate across three distinct business segments:

1. Water Management

Accounting for just over half group revenues, Water Management delivers the highest operating profits of the three segments.

Sub-brands include Wade, a leading manufacturer of drainage products, Gatic drainage covers and Skyline who manufacturer aluminium fascia and rainwater systems.

This division grew 24% in Alumasc’s last financial year (FY22), but growth has dropped back in the first half of FY23. This is predominantly due to the timing of several significant projects, including one at Chek Lap Kok airport in Hong Kong, which delivered £2.8m of sales to the prior period.

Alumasc said export sales are expected to recover in the second half of the financial year, as the next phase of the Chek Lap Kok development starts.

2. Building Envelope

Building Envelope accounts for a third of group revenues, but has the lowest margins of the three segments. Sub-brands include RoofPro and Blackdown Greenroofs.

This division is going from strength to strength, and after a solid FY22 which delivered revenue of £29.4m, momentum has continued during the first half of Alumasc’s current financial year (H1 FY23).

Half-year revenue jumped 29%, which Alumasc said was the result of investment in high quality employees and some new products, including a “very successful” flat pitch roofing system, along with increased promotion of its emissions reducing product, Olivine.

3. Housebuilding Products

This division accounts for just 14% of group revenues, but has the highest profit margins of the three segments.

Alumasc’s sole brand in this space is Timloc, a well-established UK-based manufacturer of construction accessories.

Timloc grew revenues by 12% to £12.4m last year and, like Alumasc’s Building Envelope division, growth this year has been strong with revenues jumping 24% in H1 FY23.

Alumasc said part of Timloc’s strong start to the year has been due to the “significant launch” of its new range of Tile Vents which have been “very well received by the marketplace for their quality”.

The below graphic shows Alumasc’s diverse collection of sub-brands in action:

Value & Income

Alumasc offers investors value and income in equal measure…

The stock trades on a forward price to earnings multiple of just 6.5. This looks attractive relative to its peer group and the wider market.

Alumasc also have a very reasonable Price to Sales ratio of 0.65 and an enterprise value relative to adjusted earnings (EV to EBITDA) of 4.33.

The stock also trades at a 32% discount to an estimated Fair Value of £2.34 per share.

Alumasc’s balance sheet does have some debt (£9.5m FY22), but this is counterbalanced with £8.28m in cash reserves.

In terms of income, Alumasc paid a 10p per share dividend last year, which was covered more than twice over by earnings.

The dividend is forecast to rise to 10.4p this year (FY23) and 10.8p the year after – putting Alumasc on a market-beating forward dividend yield of 6.8%.

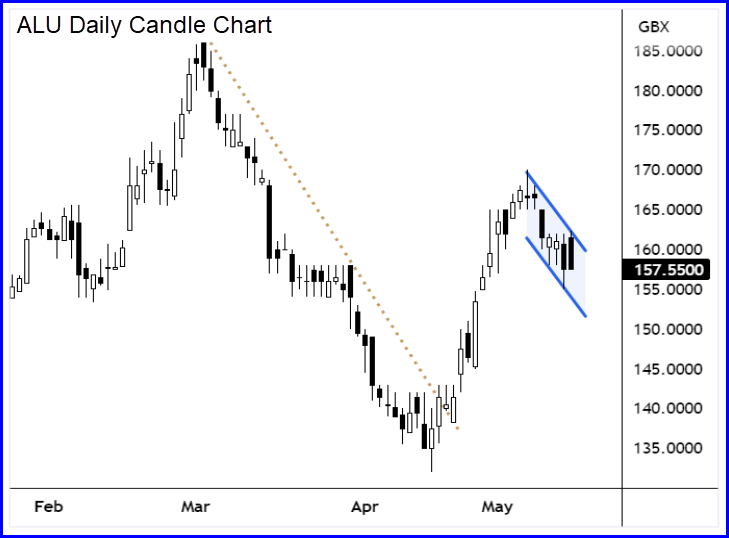

On the price chart, Alumasc’s share price has recently sprung back to life…

The shares rallied more than 30% last month, snapping the descending trendline which had been in place since February.

Recent price action has seen the shares coil within a small ‘bull flag’ formation and this has created a short-term technical catalyst for timing our entry.

This short-term catalyst compliments the long-term tailwinds, which centre around the move towards sustainable construction and green buildings. And we believe Alumasc represent a high-quality addition to our list of ‘green economy’ stocks.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.