6th Jun 2024. 8.58am

Regency View:

BUY Altitude (ALT)

Regency View:

BUY Altitude (ALT)

Altitude AIM high: The small business making waves in a $28 billion market

At its very core, our AIM Investor service seeks to unearth small stocks with big potential – businesses that can disrupt industries and create substantial value for investors.

One such stock that exemplifies this ethos is Altitude (ALT), a company with fast-growing earnings and a market cap of just north of £28m, operating in the promotional products industry worth an estimated $26 billion.

Powered by proprietary tech: Altitude’s products and services

Altitude offers a wide range of products and services designed to streamline the promotional products supply chain and enhance business operations:

- Product Search Engines: These advanced search engines allow businesses to find promotional products quickly and easily based on various criteria like product type, material, price range, and customization options.

- Order Management Tools: These tools automate the order fulfilment process, helping businesses manage customer orders, track inventory, and coordinate with suppliers in real-time.

- Design Applications: Intuitive design applications enable users to create customized artwork and branding materials for promotional products, making it easy to personalize items to match their brand identity.

- E-commerce Solutions: Altitude provides robust online storefronts and shopping portals for businesses to showcase and sell their promotional products, integrating seamlessly with their other platforms.

- AI integration: By leveraging AI technology, Altitude enhances the functionality of their platforms, optimising product recommendations and delivering personalised insights to users.

Diverse revenue streams fuelling growth

Altitude makes money through various channels, ensuring a steady and diverse stream of revenue. One primary source is subscription fees, which businesses pay to access Altitude’s comprehensive suite of services and technology platforms. These subscriptions offer benefits such as supplier relations, negotiated discounts, and marketing programs.

Additionally, Altitude generates revenue from software-as-a-service (SaaS) technology fees. Businesses pay to use Altitude’s proprietary technology platforms, which include product search engines, order management tools, design applications, and e-commerce solutions. This model ensures a recurring revenue stream from technology-driven services.

Altitude also earns gross transaction fees on orders processed through its supplier network and e-commerce platforms. These fees are based on the volume and value of purchase orders, making this a performance-driven revenue source that scales with the company’s growth. Procurement sales add another layer of revenue through long-term contracts requiring initial investment and specialist licensing for their technology and marketing solutions. Lastly, Altitude’s affiliate model, with independent sales agents known as Affiliated Consultant Specialists, drives additional revenue and market expansion through commissions based on sales performance.

Catalysts driving Altitude’s next growth phase

Altitude is poised for significant growth, driven by several key catalysts:

1. Market opportunity and fragmented industry: Operating in a $26 billion market, Altitude is well-positioned to capture market share in a highly fragmented industry with thousands of suppliers and distributors.

2. Strategic partnerships and pipeline expansion: By forging strategic partnerships and expanding their pipeline of opportunities, Altitude enhances its growth prospects and competitive position.

3. Affiliate model growth: The company’s network of Affiliated Consultant Specialists continues to expand, driving revenue growth and market penetration.

4. Technology innovation and platform enhancements: Continuous investment in technology innovation keeps Altitude at the forefront of the industry, providing efficient and scalable solutions for distributors and vendors.

5. Market expansion and international growth: Altitude’s ambition to expand beyond its core territories, such as its successful entry into the Canadian market, demonstrates its ability to adapt and capture a larger share of the global promotional products market.

Trading update sparks fresh momentum

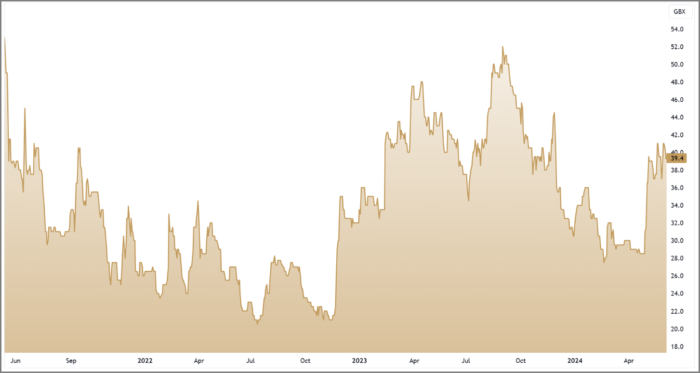

At the start of May, Altitude released a market-beating trading update, which caused the shares to surge higher, pushing them back above the key 50-day and 200-day moving averages – backed by strong volume.

The trading update detailed Altitude’s impressive financial performance, with revenue and adjusted EBITDA showing substantial growth. Key drivers included the company’s successful expansion into the collegiate market and the continued growth of its affiliate model. Altitude reported that new Gear Shop contracts awarded had an estimated gross revenue of $12 million, showcasing the company’s ability to secure lucrative deals and expand its customer base. Additionally, the 23% growth in Affiliate recruitment highlighted the effectiveness of their strategy to broaden market reach and drive sales through independent sales agents.

Altitude’s improved cash position and enhanced financial flexibility were also noted in the trading update. The company ended the year with £1.3 million in cash, and its US credit facilities increased from $1.7 million to $3.3 million. This strengthened liquidity should allow Altitude to pursue further growth initiatives, such as strategic acquisitions and international market expansion. The positive market sentiment following the trading update was evident as investors re-evaluated Altitude’s valuation, recognizing the company’s strong performance and potential for continued growth. This fresh momentum underscores the market’s belief in Altitude’s strategic direction and operational excellence.

Undervalued growth potential

Altitude’s forward P/E ratio of 16.5, coupled with an impressive, forecasted earnings per share (EPS) growth rate of 50.9%, suggests potential undervaluation. With a PEG ratio of 0.5, Altitude’s stock appears significantly undervalued relative to its strong earnings growth forecast.

These metrics indicate that Altitude’s current valuation does not fully reflect the company’s impressive earnings growth potential, making it an attractive investment opportunity for investors seeking exposure to the promotional products industry.

With its innovative technology platforms, diversified revenue streams, and strong growth prospects, we’re excited to add Altitude to our list of AIM Investor open positions.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.