18th Aug 2022. 8.58am

Regency View:

BUY Alpha Financial Markets Consulting (AFM)

Regency View:

BUY Alpha Financial Markets Consulting (AFM)

Alpha scaling up its North American growth

‘Alpha’ – defined in the world of finance as ‘the excess return of an investment relative to the return of a benchmark index’.

Generating ‘alpha’ or ‘beating the benchmark’ is the goal of all active portfolio managers and it’s the reason why certain hedge funds can charge very high fees.

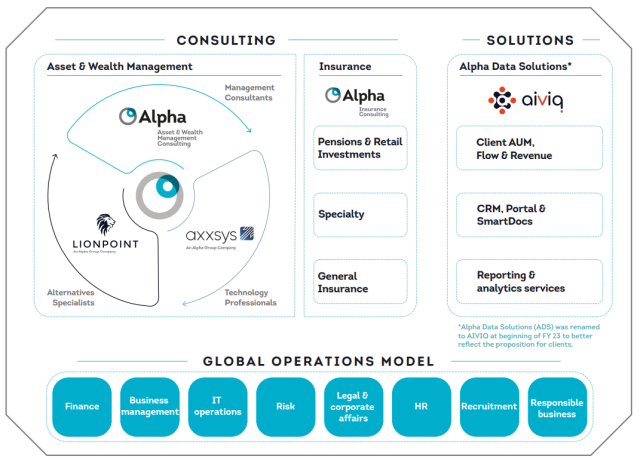

Alpha Financial Markets Consulting (AFM) was formed in London in 2003 to help wealth managers generate alpha and lower costs.

It is now a global consulting powerhouse operating across the asset management, wealth management and insurance industries with 760 consultants in 16 global offices.

Alpha is growing at breakneck speed and has rock solid financials, meaning shareholders should be well rewarded and undiluted.

Tailwinds driving Alpha’s growth

Alpha have managed to build and retain a strong team of consultants, allowing the business to offer a diverse range of specialist services.

There are several long-term trends across the asset management, wealth management and insurance markets which represent strong tailwinds for Alpha’s services, these include:

1. The drive for efficiency

2. Fee compression

3. Regulatory change

4. A growing focus on ESG and responsible investing

These tailwinds were evident in Alpha’s stellar set of Full Year 2022 numbers…

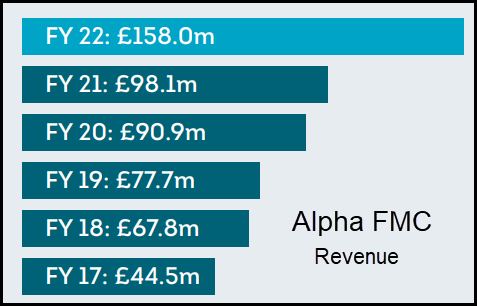

Organic net fee income jumped 31%, headline revenue grew 60% to £158m, adjusted earnings (EBITDA) increased 56% to £33.9m and adjusted cash conversion reached 112%.

“With a strong pipeline of potential new business and the structural tailwinds that underpin demand for Alpha’s services remaining robust, the Group is well positioned to balance the risks of these pressures and continue to deliver attractive growth and margins” commented Alpha’s long-term Chairman Ken Fry.

North America key for Alpha

Alpha is doing a great job of executing one of their key objectives, scaling its North American business…

North America is the world’s largest asset management market with assets under management around eight times greater than in the UK.

Alpha’s revenue in the region tripled in 2022 to £46.9m and now represents 30% of total turnover.

Organic net fee income growth in North America reached 62.2% year-on-year as Alpha won a string of new clients from the world’s top asset management companies.

Alongside the significant scope for organic growth in North America, Alpha acquired New York based boutique consultancy, Lionpoint last year…

Lionpoint, has focus on private-market asset managers and the acquisition has proved extremely complementary to the public-market focus of the rest of Alpha’s business.

Since the acquisition in May 2021, Lionpoint has added 75 people to its headcount and won 64 new clients. Many of the world’s largest public asset managers are expanding into alternative assets and the Lionpoint acquisition has transformed Alpha’s offering in these areas.

High quality financials

Alpha has the type of strong, high quality financials that you’d expect from a financial services consultancy operating at the peak of its powers…

The business is lean and mean, generating plenty of free cashflow (£27.9m FY22) which has grown at a pace of 38.1% (CAGR/Avg).

This healthy cash generation combined with tight cost control has created a rock-solid balance sheet with £63.5m of cash and no debt – making Alpha well placed to deliver acquisitive growth without excessive shareholder dilution.

And when you combine Alpha’s strong financial footing with its impressive track record of delivering profitable growth, its easy to see why the shares are trading on a forward price to earnings multiple of 21.3.

Beside the old adage of ‘you get what you pay for’, Alpha’s punchy forward multiple looks reasonable given its forecast earnings per share (EPS) growth of 70% – giving the stock a Price to Earnings growth (PEG) multiple of just 0.5 (where anything below 1 is attractive).

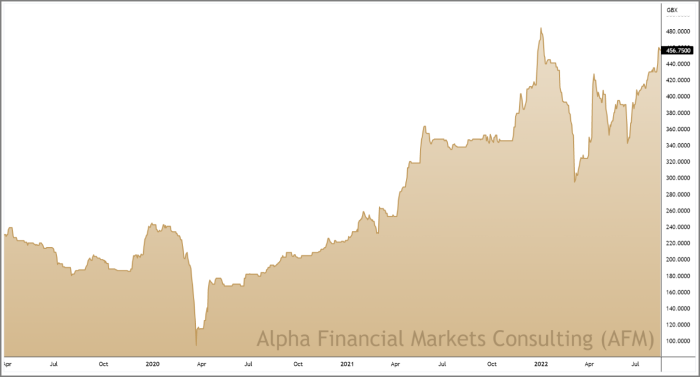

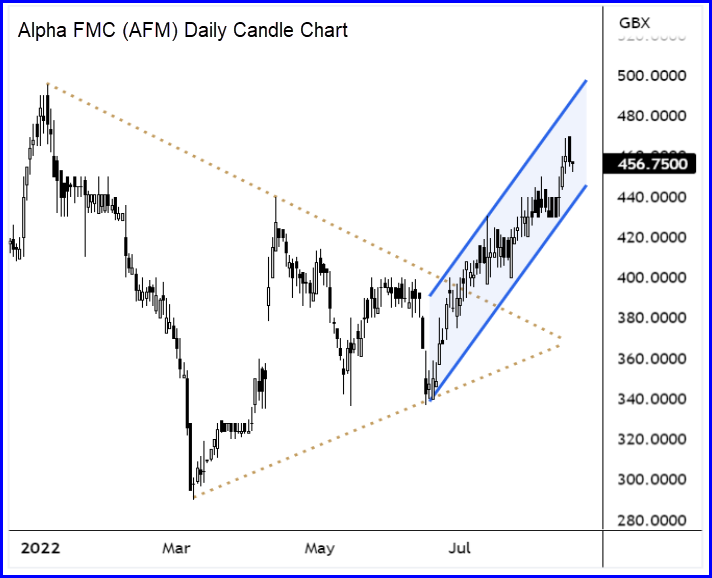

On the price chart, Alpha’s share price has plenty of bullish momentum…

The shares recently broke out of a medium-term ‘triangle’ or consolidation pattern and the shares long-term uptrend has kicked back in with prices forming a bullish ascending channel.

With short-term price momentum realigned with the long-term trend, we now have a technical catalyst in place for entry.

In summary, Alpha is a high-quality growth stock with bags of bullish momentum on and off the price chart and we’re more than happy to add them to our stable of AIM Investor stocks.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.