Regency View:

BUY Alliance Pharma (APH)

Alliance Pharma’s global growth story

Did you know 1 in 20 Google searches relate to health?

Or that 60% of people tend to take an over-the-counter (OTC) medication before making an appointment with a doctor?

Given these stats, it’s no real surprise that the e-commerce consumer healthcare market is worth $260bn worldwide and is growing fast…

The e-commerce consumer healthcare market grew 30% in China last year and 23% in the US. A company with established brands in both regions and strong e-commerce channels is Alliance Pharma (APH).

Alliance is a globally diversified healthcare group…

Its core business is Consumer Healthcare which accounts for more than 70% of revenues and is the primary driver of top line growth. Alliance also have a well-established Prescription Medicines business, which operates from the same regulatory platform.

Standout brands within the group include:

Kelo-cote – a range of clinically proven scar prevention and treatment creams. Kelo-cote is very well established in China, with high brand awareness and usage. The brand generated £48.8m in revenue (FY21), that’s around 29% of the group’s £169.6m revenue (FY21).

Amberen – a clinically proven vitamin mineral supplement for the relief of menopause symptoms. It is the number one menopause supplement in the US. Amberen contributed £19.2m to group revenue in FY21.

Nizoral – medicated anti-dandruff shampoo – generating revenues of £20.6m FY21.

For completeness, Alliance’s other consumer brands contributed £33.2m to group revenue (FY21) and its Prescription Medicines business contributed £47.8m to group revenue (FY21).

Amberen transforms Alliance Pharma’s US offering

At the end of 2020, Alliance bought Amberen owner Biogix for $110m (£80m) …

The strategic acquisition is set to transform Alliance’s US offering – expanding its operating platform and brand positioning in the largest OTC consumer healthcare market in the world.

Amberen has strong e-commerce sales channels with Amazon sales in particular “experiencing strong year-on-year growth” in FY21.

With the acquisition now fully integrated, Alliance’s US revenue growth in FY21 surged 287% to £26m, and this rapid US growth is forecast to continue…

Alliance expect “Amberen revenue growth to accelerate in 2022, with a weighting towards H2”.

New distribution agreement to boost Chinese e-commerce growth

In 2021, Alliance signed a new distribution agreement for Kelo-cote based on China’s cross-border e-commerce regulation (CBEC) which allows enhanced access for the import of goods.

CBEC has been hugely successful in facilitating export sales from the EU to consumers in China and this is very exciting for Alliance because Kelo-cote is such a strong brand in the region.

Group Asia-Pacific (APAC) revenues jumped 41% to £48.8m (FY21) and this was driven purely by strong Chinese demand for Kelo-cote.

The new distribution deal moves Kelo-cote closer to its key growth market and provides Alliance with greater control over its distribution chain.

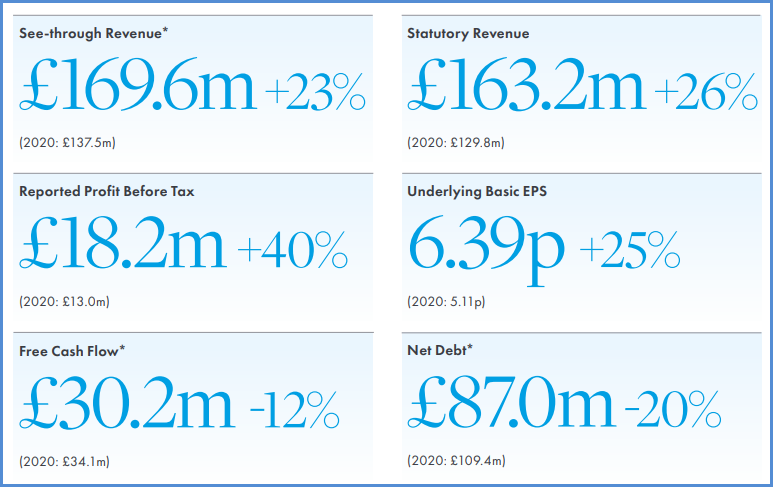

March earnings beat expectations

In March, Alliance released a stellar set of FY21 numbers – showing a strong bounce back from the impact of the pandemic…

Full year revenues to December 2021 grew 23% in constant currencies to £169.6m. While like-for-like revenues excluding Amberen grew 12%.

The group’s overall e-Commerce revenues now represent 25% of total sales and pre-tax margins remained stable at 25%.

Strong cash generation helped to reduce leverage with net debt to EBITDA (earnings before interest, taxes, depreciation and amortization) dropping from 2.43x following the acquisition of Amberen in December 2020, to 1.73x at 31 December 2021.

Alliance’s FY22 outlook was very upbeat, with the group well positioned to deliver on its medium- term ambition to grow revenues to between £225m – £250m (£169.6m FY21) and pre-tax profits of between £50m and £60m (£42.2m FY21).

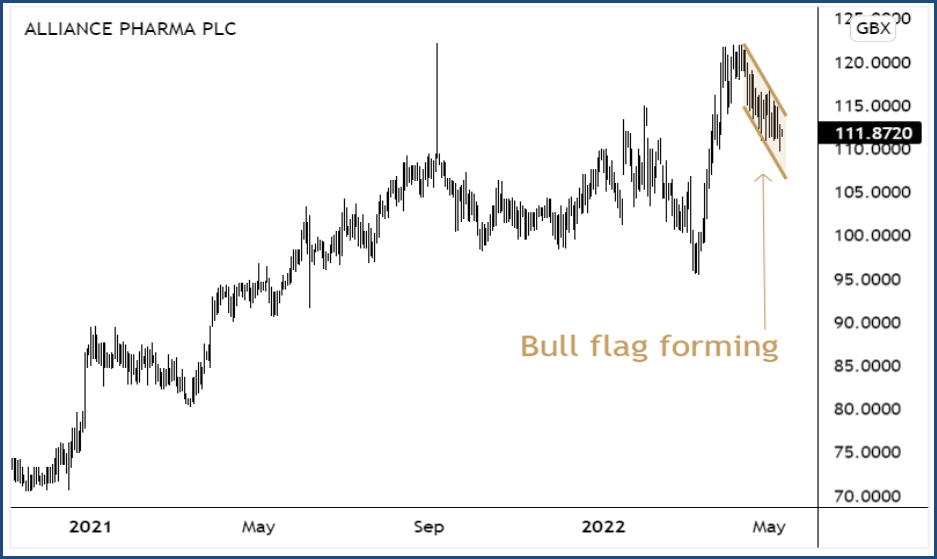

Bull flag forming

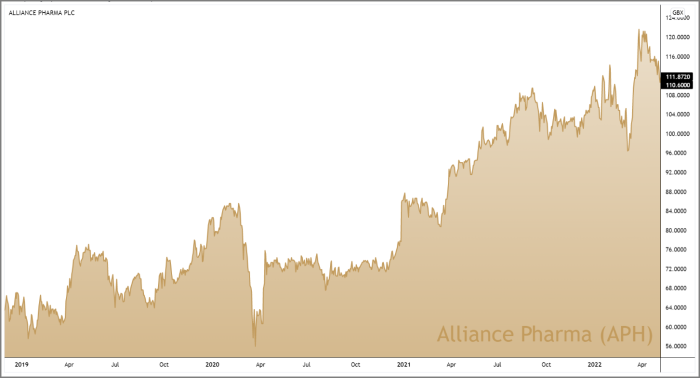

Alliance’s share price has carved out a powerful uptrend during the last two years.

After surging higher in March following their market-beating numbers, we’ve been patiently waiting for a pullback…

Our patience appears to have paid off, with prices undergoing an orderly pullback from highs – forming a small descending retracement channel or ‘bull flag’.

This bullish pattern indicates that we are likely to see continuation in-line with the dominant trend.

And although the share price is strong, Alliance’s forward valuation remains attractive…

The shares trade on a forward price to earnings (PE) ratio of 16.8, which looks more than reasonable give forecast earnings per share growth of 69.6%.

Should Alliance deliver on its “aggressive global growth strategy”, we expect shareholders to be well rewarded.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.