20th Dec 2024. 12.03pm

Regency View:

TAKE PROFITS Alumasc (ALU)

Regency View:

TAKE PROFITS Alumasc (ALU)

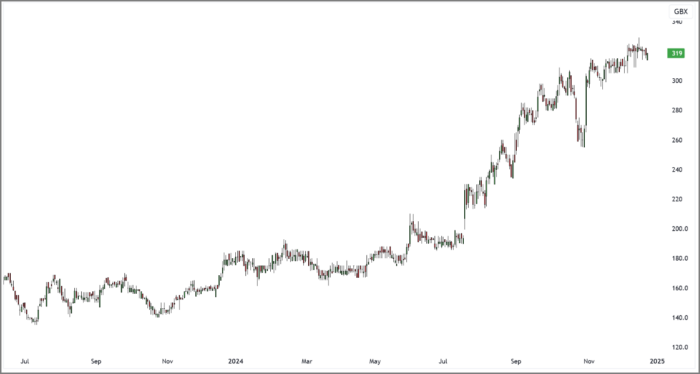

Close Alumasc (ALU) at market (319p)

Since our initial recommendation in 2023, Alumasc (ALU) has delivered an impressive 103% return, significantly outperforming the broader market. While the company’s growth prospects remain solid, with robust revenue and profitability, the recent share price rally has pushed the stock closer to its intrinsic value. Given its current high valuation and the fact that much of the good news appears to be priced in, we believe it’s a prudent time to lock in profits.

Alumasc’s most recent interim results showed healthy growth, with revenues up 13% and a strong 32.5% increase in EPS. However, with the stock trading at a relatively high PEG ratio of 1.9, the upside from here looks more limited. While the company continues to benefit from its position in the sustainable building products sector, we feel that the stock has run its course for now. Given the 103% return since our initial recommendation, we’re choosing to realise profits and shift focus to other opportunities with greater potential for growth.

Profit = +103%

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.