31st Jan 2019. 9.00am

Regency View:

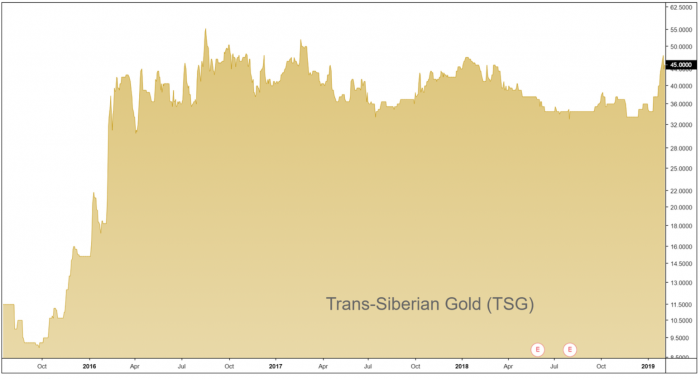

BUY Trans-Siberian Gold (TSG)

Regency View:

BUY Trans-Siberian Gold (TSG)

The little Russian miner paying big dividends

There’s a buzz of anticipation around the gold market the likes of which we’ve not witnessed in almost a decade. Barrick Gold’s merger with London listed Randgold at the end of 2018 was swiftly followed by Newmont’s proposed acquisition of Goldcorp in January. Should the $10bn Newmont deal go through it would create the world’s largest gold miner, capable of producing eight million ounces a year.

Early stages of a bull market

These high-profile mega-mergers look set to kick start a cycle of further acquisitions that will cascade down through the gold mining sector. As Pierre Lassonde, Chairman of Canadian gold miner Franco-Nevada puts it “reserves are going down and the most efficient way to solve this is to acquire someone”. Indeed, gold mining is a cyclical game that Pierre is all too familiar with “in the good times there’s always too much money chasing too few good names and at the bottom there’s never enough money, I think we’re more towards the bottom right now. Junior mining companies are finding it exceedingly difficult to raise money, my sense is that we’re in the early stage of a bull market”.

Of course, ‘gold mining Chairman bullish on gold stocks’ is hardly a stop the press moment but the fact that the market has rewarded Barrick and Newmont for their moves should not be ignored. There are also signs that the headwinds for gold over the last five years are turning to tailwinds. The fed rate hike cycle appears to be coming to an end and growing trade tensions between the US and China have seen a steady rise in risk aversion. Indeed, gold has rallied over 12% during the last six months and has the 2018 highs of 1360 in its sights.

Who says gold doesn’t pay dividends!

Trans-Siberian Gold, owner of the high-grade Asacha mine in Far East Russia has paid out over £14m to shareholders in the past two years alone. This is a £50m market cap stock making £46m in revenue and paying out £7m a year in dividends, so what’s the catch?

The gold at TSG’s Asacha mine occurs in two zones: The Main zone, currently being mined and the East zone, not yet mined. TSG’s December 2017 reserves estimate measured 57,000 ounces at the Main zone with a further 299,000 ounces indicated. 2018 gold production hit a record high of just over 42,000 ounces, that’s 73% of the 57,000 ounces measured at the Main zone. So the catch is that investors are now reliant on the conversion of the 299,000 ounces of ‘indicated’ reserves at the Main zone and 244,000 ounces ‘inferred’ reserves at the as yet untapped East zone.

TSG’s management are confident that this transition from mining measured (proved) to indicated (probable) resource will be smooth. Indeed, their January trading update indicated a robust forward production guidance of 40,000 to 44,000 ounces in 2019. Given management’s recent track record, shareholders will likely be well compensated.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.